Cincinnati Bell 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2014, we plan to continue the integration of our IT Services and Hardware functions into our Wireline

business markets operations. We expect the integration of these operations to reduce costs, improve technical and

customer services, and drive back-office efficiencies.

Data Center Colocation

On January 24, 2013, we completed the IPO of CyrusOne, which owns and operates our former Data Center

Colocation business. We currently own approximately 1.9 million shares, or 8.6%, of CyrusOne’s common stock

and are a limited partner in CyrusOne LP, owning approximately 42.6 million, or 66%, of its partnership units.

CyrusOne LP units are exchangeable into common stock of CyrusOne on a one-to-one basis, or cash at the fair

value of a share of CyrusOne common stock, at the option of CyrusOne, commencing on January 24, 2014, and

subject to volume restrictions estimated at 0.9 million shares over any 3 month period. The restrictions lapse

upon the effectiveness of CyrusOne Inc.’s registration statement, to be filed by March 24, 2014.

Although we effectively own approximately 69% of the economic interests of CyrusOne through our

ownership of its common stock and partnership units of CyrusOne LP, we no longer control its operations as we

are a limited partner in CyrusOne LP and own less than 10% of CyrusOne’s common stock. Upon completion of

the IPO, we deconsolidated CyrusOne’s assets and liabilities and recognized our investment as an equity method

investment, and we will recognize our share of CyrusOne’s net income (loss) as non-operating income (loss).

It is management’s intent to sell down the Company’s interests in CyrusOne over time and use such

proceeds to further de-leverage the Company. The Company’s amended Corporate Credit Agreement requires

85% of the proceeds to be used for debt repayments. As of December 31, 2013, the Company’s investment in

CyrusOne was valued at $993.2 million and the Company’s tax basis in CyrusOne was approximately $600

million.

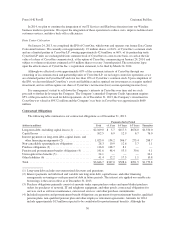

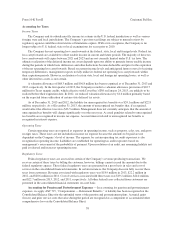

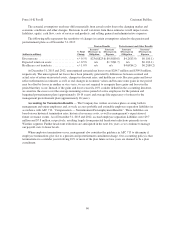

Contractual Obligations

The following table summarizes our contractual obligations as of December 31, 2013.

Payments due by Period

(dollars in millions) Total < 1 Year 1-3 Years 3-5 Years Thereafter

Long-term debt, excluding capital leases (1) ............ $2,169.0 $ 5.7 $117.3 $676.0 $1,370.0

Capital leases .................................... 102.5 6.9 12.9 6.7 76.0

Interest payments on long-term debt, capital leases, and

other financing arrangements (2) ................... 1,023.0 154.2 306.7 273.4 288.7

Non-cancellable operating lease obligations ............ 28.3 10.9 12.6 3.7 1.1

Purchase obligations (3) ............................ 116.8 108.7 8.1 — —

Pension and postretirement benefits obligations (4) ...... 141.6 48.4 53.5 30.6 9.1

Unrecognized tax benefits (5) ........................ 24.1 — — — 24.1

Other liabilities (6) ................................ 41.4 12.2 17.3 1.1 10.8

Total ........................................... $3,646.7 $347.0 $528.4 $991.5 $1,779.8

(1) Long-term debt excludes net unamortized discounts and premiums.

(2) Interest payments on both fixed and variable rate long-term debt, capital leases, and other financing

arrangements assuming no early payment of debt in future periods. The interest rate applied on variable rate

borrowings is the rate in effect as of December 31, 2013.

(3) Purchase obligations primarily consist of amounts under open purchase orders and open blanket purchase

orders for purchases of network, IT and telephony equipment, and other goods; contractual obligations for

services such as software maintenance, outsourced services; and other purchase commitments.

(4) Included in pension and postretirement benefit obligations are payments for postretirement benefits, qualified

pension plans, non-qualified pension plan and other employee retirement agreements. Amounts for 2014

include approximately $13 million expected to be contributed for postretirement benefits. Although the

50

Form 10-K Part II Cincinnati Bell Inc.