Cincinnati Bell 2013 Annual Report Download - page 126

Download and view the complete annual report

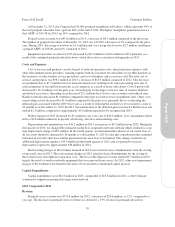

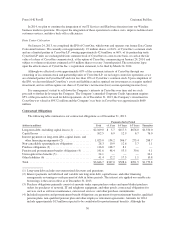

Please find page 126 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company believes that its cash on hand, cash generated from operations and available funding under its

credit facilities will be adequate to meet its cash requirements for the next 12 months.

Long-term view, including debt covenants

As of December 31, 2013, the Company had $2.3 billion of outstanding indebtedness and an accumulated

deficit of $3.3 billion. A significant amount of indebtedness was previously incurred from the purchase and

operation of a national broadband business, which was sold in 2003. In addition to the uses of cash described in

the Short-term view section above, the Company has to satisfy the above-mentioned long-term debt obligations.

The Company has no significant debt maturities until 2018. Contractual debt maturities, including capital leases,

are $12.6 million in 2014, $11.9 million in 2015, $118.3 million in 2016, $49.4 million in 2017, $633.3 million

in 2018 and $1,446.0 million thereafter. In addition, we have ongoing obligations to fund our qualified pension

plans. Based on current legislation and current actuarial assumptions, we estimate these contributions will

approximate $108 million over the period from 2014 to 2021. It is also possible that we will use a portion of our

cash flows generated from operations for de-leveraging in the future, including discretionary, opportunistic

repurchases of debt prior to the scheduled maturities.

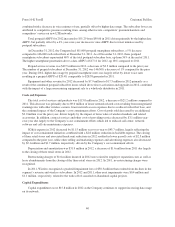

On January 24, 2013, we completed the IPO of CyrusOne, our former data center colocation business. As of

December 31, 2013, the fair value of our ownership interest in CyrusOne was $993.2 million. We intend to sell

down the Company’s ownership interest in CyrusOne and use the proceeds to primarily repay long-term debt to

achieve leverage ratios more comparable to other telecommunication companies and for other general corporate

purposes. Our amended Corporate Credit Agreement obligates us to use 85% of the proceeds towards debt

repayments.

During the fourth quarter of 2012, the Company’s $210 million revolving credit facility, previously expiring

in June 2014, was replaced with a new $200 million Corporate Credit Agreement that expires in July 2017.

Proceeds from this new facility may be used for ongoing working capital and for other general corporate

purposes. The amount available under this facility will be reduced to $150 million by December 31, 2014 and

further reduced to $125 million on December 31, 2015, subject to the amount of cash proceeds received by the

Company from any sales of its ownership in CyrusOne’s common stock or partnership units. This new Corporate

Credit Agreement contains financial covenants that require us to maintain certain leverage and interest coverage

ratios and limits our capital expenditures on an annual basis. Capital expenditures are permitted subject to

predetermined annual thresholds which are not to exceed $955 million in the aggregate over the five year

agreement. In 2013, capital expenditures were $189.2 million excluding CyrusOne, leaving $765.8 million

permitted capital expenditures over the next four years. The facility also has certain covenants, which, among

other things, limit our ability to incur additional debt or liens, pay dividends, sell, transfer, lease, or dispose of

assets, and make certain investments or merge with another company. If the Company were to violate any of its

covenants and were unable to obtain a waiver, it would be considered in default. If the Company were in default

under its Corporate Credit Agreement, no additional borrowings under the credit facility would be available until

the default was waived or cured. As of December 31, 2013, the Company was in compliance with the Corporate

Credit Agreement covenants.

In the third quarter of 2013, the Company amended and restated its Corporate Credit Agreement, originally

dated as of November 20, 2012, to include a $540 million Tranche B Term Loan facility that matures on

September 10, 2020.

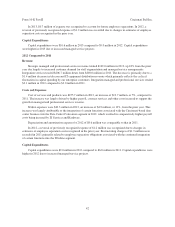

The Company’s public debt, which include the 8 3/4% Senior Subordinated Notes due 2018 and the 8 3/8%

Senior Notes due 2020 contain covenants that, among other things, limit the Company’s ability to incur

additional debt or liens, pay dividends or make other restricted payments, sell, transfer, lease, or dispose of assets

and make investments or merge with another company. As of December 31, 2013, the Company was in

compliance with these covenants.

46

Form 10-K Part II Cincinnati Bell Inc.