Cincinnati Bell 2013 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Form 10-K/A Part IV Cincinnati Bell Inc.

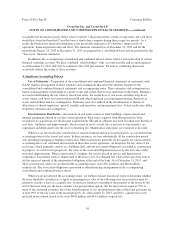

CyrusOne Inc. and CyrusOne LP

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(continued)

Restructuring Charges—Restructuring charges are a result of programs planned and controlled by

management that materially changes either the scope of business undertaken or the manner in which that business

is conducted. The 2013 restructuring charges were incurred as a result of moving certain administrative functions

to the Company’s corporate office. There were no such charges in 2012 or 2011.

Transaction-Related Compensation—During the period ended January 23, 2013, the Company received

an allocated compensation charge from CBI of $20.0 million for the settlement of its long-term incentive plan

associated with the completion of the IPO. The amount was determined by CBI and allocated to CyrusOne Inc.

on January 23, 2013, and reflected as expense and contributed capital in the respective period.

Operating and Transactional Taxes—Certain operating taxes, such as property, sales, use and value

added taxes, are reported as expenses in operating income. These taxes are not included in income tax expense

because the amounts to be paid are not dependent on the level of income generated. We also record operating

expenses for the establishment of liabilities related to certain operating tax audit exposures. These liabilities are

established based on our assessment of the probability of payment. Upon resolution of an audit, any remaining

liability not paid is released and increases operating income.

Income Taxes—The Company was included in CBI’s consolidated Texas tax return for all Predecessor

periods. In the accompanying financial statements, the Predecessor periods reflect income taxes as if the

Company was a separate stand-alone company. The income tax provision consists of an amount for taxes

currently payable and an amount for tax consequences deferred to future periods. CyrusOne Inc. will elect to be

taxed as a REIT under the Code, as amended, by making our REIT election upon the filing of our 2013 REIT

federal income tax return. Provided we qualify for taxation as a REIT and continue to meet the various

qualification tests mandated under the Code, we are generally not subject to corporate level federal income tax on

the earnings distributed currently to our shareholders. If we fail to qualify as a REIT in any taxable year, our

taxable income will be subject to federal income tax at regular corporate rates and any applicable alternative

minimum tax.

While CyrusOne Inc. and the Operating Partnership do not pay federal income taxes, we are still subject to

foreign, state and local income taxes in the locations in which we conduct business. Our taxable REIT

subsidiaries (each a “TRS”) are also subject to federal and state income taxes to the extent there is taxable

income.

Deferred income taxes are recognized in certain entities. Deferred income taxes are provided for temporary

differences in the bases between financial statement and income tax assets and liabilities. Deferred income taxes

are recalculated annually at rates then in effect. Valuation allowances are recorded to reduce deferred tax assets

to amounts that are more likely than not to be realized. The ultimate realization of the deferred tax assets depends

upon our ability to generate future taxable income during the periods in which basis differences and other

deductions become deductible and prior to the expiration of the net operating loss carryforwards.

The Company and its subsidiaries file income tax returns in the U.S. federal jurisdiction as well as various

foreign, state and local jurisdictions. The Company’s previous tax filings are subject to normal reviews by

regulatory agencies until the related statute of limitations expires. With a few exceptions, the Company is no

longer subject to U. S. federal, state or local examinations for years prior to 2010 and we have no liabilities for

uncertain tax positions as of December 31, 2013.

Foreign Currency Translation and Transactions—The financial position of foreign subsidiaries is

translated at the exchange rates in effect at the end of the period, while revenues and expenses are translated at

average rates of exchange during the period. Gains or losses from translation of foreign operations where the

local currency is the functional currency are included as components of other comprehensive (loss) income.

Gains or losses from foreign currency transactions are included in determining net income.

20