BP 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance

BP Annual Report and Form 20-F 2013 93

Further details

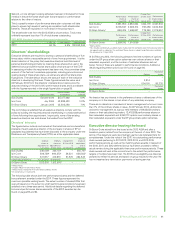

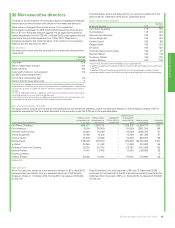

Deferred shares (audited)a

Deferred share element interests Interests vested in 2013 and 2014

Bonus year Type

Performance

period

Date of award of

deferred shares

Potential maximum deferred shares

Number of

ordinary

shares

vested Vesting date

Face value

of the award

at date of

grant £

At 1 Jan

2013

Awarded

2013

At 31 Dec

2013

Awarded

2014

Bob Dudleyb2011cComp 2012-2014 08 Mar 2012 109,206 –109,206 – – – 539,478

Vol 2012-2014 08 Mar 2012 109,206 –109,206 – – – 539,478

Mat 2012-2014 08 Mar 2012 218,412 –218,412 – – – 1,078,955

2012dComp 2013-2015 11 Feb 2013 –114 ,6 9 0 114 ,6 9 0 – – – 521,840

Vol 2013-2015 11 Feb 2013 –114 ,6 9 0 114 ,6 9 0 – – – 521,840

Mat 2013-2015 11 Feb 2013 –229,380 229,380 – – – 1,043,679

2013dComp 2014-2016 12 Feb 2014 – – – 149,628 – – 728,688

Mat 2014-2016 12 Feb 2014 – – – 149,628 – – 728,688

Iain Conn 2010 Comp 2011-2013 09 Mar 2011 21,384 –21,384 –24,670f12 Feb 2014 –

Mat 2011-2013 09 Mar 2011 21,38 4 –21,384 –24,670f12 Feb 2014 –

2011cComp 2012-2014 08 Mar 2012 80,652 –80,652 – – – 398,421

Vol 2012-2014 08 Mar 2012 80,652 –80,652 – – – 398,421

Mat 2012-2014 08 Mar 2012 161,304 –161,304 – – – 796,842

2012dComp 2013-2015 11 Feb 2013 –80,648 80,648 – – – 366,948

Vol 2013-2015 11 Feb 2013 –80,648 80,648 – – – 366,948

Mat 2013-2015 11 Feb 2013 –161,296 161,296 – – – 733,897

2013dComp 2014-2016 12 Feb 2014 – – – 100,563 – – 489,742

Mat 2014-2016 12 Feb 2014 – – – 100,563 – – 489,742

Dr Brian Gilvary 2009 DABe2010-2012 15 Mar 2010 8 7,3 9 4 – – – 95,279f15 Jan 2013 –

2010 DABe2011-2013 14 Mar 2011 44,971 –44,971 – 51,118f09 Jan 2014 –

2011hDABe2012-2014 15 Mar 2012 73,624 –73,624 – – – 362,966

2012dComp 2013-2015 11 Feb 2013 –78,815 78,815 – – – 358,608

Vol 2013-2015 11 Feb 2013 –78,815 78,815 – – – 358,608

Mat 2013-2015 11 Feb 2013 –157,6 30 15 7,6 3 0 – – – 717,217

2013dComp 2014-2016 12 Feb 2014 – – – 96,653 – – 470,700

Mat 2014-2016 12 Feb 2014 – – – 96,653 – – 470,700

Former executive director

Dr Byron Groteb2010 Comp 2011-2013 09 Mar 2011 26,604 –26,604 –30,174f12 Feb 2014 –

Vol 2011-2013 09 Mar 2011 26,604 –26,604 –3 0,174f12 Feb 2014 –

Mat 2011-2013 09 Mar 2011 53,208 –44,340i–50,292f12 Feb 2014 –

2011cComp 2012-2014 08 Mar 2012 91,638 –91,638 – – – 452,692

Vol 2012-2014 08 Mar 2012 91,638 –91,638 – – – 452,692

Mat 2012-2014 08 Mar 2012 183,276 –91,638i– – – 452,692

2012dComp 2013-2015 11 Feb 2013 –97,278 97,278 – – – 442,615

Vol 2013-2015 11 Feb 2013 –97,278 97,278 – – – 442,615

Mat 2013-2015 11 Feb 2013 –194,556 32,424i– – – 147,529

Comp = Compulsory.

Vol = Voluntary.

Mat = Matching.

DAB = Deferred annual bonus plan.

a Since 2010, vesting of the deferred shares has been subject to a safety and environmental sustainability hurdle, and this will continue. If the committee assesses that there has been a material

deterioration in safety and environmental performance, or there have been major incidents, either of which reveal underlying weaknesses in safety and environmental management, then it may

conclude that shares should vest only in part, or not at all. In reaching its conclusion, the committee will obtain advice from the SEEAC. There is no identified minimum vesting threshold level.

b Bob Dudley and Dr Byron Grote received awards in the form of ADSs. The above numbers reflect calculated equivalents in ordinary shares. One ADS is equivalent to six ordinary shares.

c The face value has been calculated using the market price of ordinary shares on 8 March 2012 of £4.94.

d The market price at closing of ordinary shares on 11 February 2013 was £4.55 and for ADSs was $43.01 and on 12 February 2014 was £4.87 and for ADSs was $48.38. The sterling value has been

used to calculate the face value.

e Dr Brian Gilvary was granted the shares under the DAB prior to his appointment as a director. The vesting of these shares is not subject to further performance conditions and he receives deferred

shares at each scrip payment date as part of his election choice.

f The market price of each share used to determine the total value at vesting on the vesting dates of 15 January 2013, 9 January 2014 and 12 February 2014 were £4.58, £4.97 and £4.90 respectively

and for ADSs on 12 February 2014 was $48.41.

h The face value has been calculated using the market price of ordinary shares on 15 March 2012 of £4.93.

i All deferred and matched shares have been prorated to reflect actual service during the performance period and these figures have been used to calculate the face value.