BP 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Form 20-F 201390

Remuneration committee

The committee was made up of the following independent non-executive

directors:

Members

Antony Burgmans (chairman)

George David

Ian Davis

Professor Dame Ann Dowling

Carl-Henric Svanberg normally attends the meetings

Committee role

The committee’s tasks are formally set out in the board governance

principles as follows:

• To determine, on behalf of the board, the terms of engagement and

remuneration of the group chief executive and the executive directors

and to report on these to shareholders.

• To determine, on behalf of the board, matters of policy over which the

company has authority regarding the establishment or operation of the

company’s pension schemes of which the executive directors are

members.

• To nominate, on behalf of the board, any trustees (or directors of

corporate trustees) of such schemes.

• To review and approve the policies and actions being applied by the

group chief executive in remunerating senior executives other than

executive directors to ensure alignment and proportionality.

• To recommend to the board the quantum and structure of remuneration

for the chairman of the board.

Committee activities

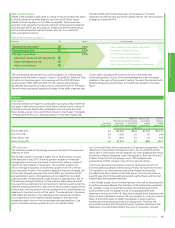

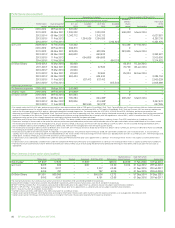

During the year, the committee met six times. Key discussions and

decision items are shown in the table below.

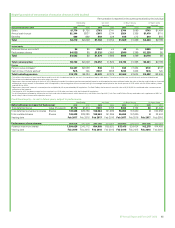

Remuneration committee 2013 meetings

Jan Mar May Jul Sept Dec

Strategy and policy

Review and approve DRR for 2013 AGM

Consider DRR vote from 2013 AGM

Review impact of new UK regulations

Review policy

Review committee operation

Salary review

Executive directors

Executive team and group leaders

Annual bonus

Assess performance

Determine bonus for 2012

Review measures for 2014

Agree measures and targets for 2014

Long-term equity plans

Assess performance

Determine vesting of 2010-2012 plans

Agree awards for 2013-2015 plans

Review measures for 2014-2016 plans

Agree measures and targets for

2014-2016 plans

Other items

Review chairman's fees

Review major pension programmes

Other issues as required

The board’s overall evaluation process included a separate questionnaire

on the work of the remuneration committee. The results were analyzed by

an external consultant and discussed at the committee’s meeting in

January 2014. Processes continued to be rated as good to excellent and a

number of topics for more in-depth discussion were identified.

Independence and advice

Independence

The committee operates with a high level of independence. The board

considers all committee members to be independent with no personal

financial interest, other than as shareholders, in the committee’s decisions.

Consultation

The group chief executive is consulted on the remuneration of the other

executive directors and senior executives and on matters relating to the

performance of the company; neither he nor the chairman of the board

participate in decisions on their own remuneration. Both the group human

resources director and head of group reward may attend relevant sections

of meetings to ensure appropriate input on matters related to executives

below board level.

The committee consults other relevant committees of the board, for

example the SEEAC, on issues relating to the exercise of its judgement or

discretion.

Advice

Gerrit Aronson, an independent consultant, is the committee’s

independent adviser. He is engaged directly by the committee. Mr

Aronson acts as the secretary to the remuneration committee and advises

the chairman, the board and the nomination committee on a variety of

governance issues.

During 2013, advice to the committee was received from David Jackson,

the company secretary, who is employed by the company and who reports

to the chairman of the board. The company secretary periodically reviews

the independence of the advisers. Advice and services on particular

remuneration matters was received from other external advisers appointed

by the committee.

Towers Watson provided information on the global remuneration

market, principally for benchmarking purposes. Freshfields Bruckhaus

Deringer LLP provided legal advice on specific compliance matters to the

committee. Both firms provide other advice in their respective areas to the

group.

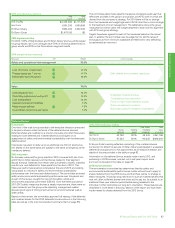

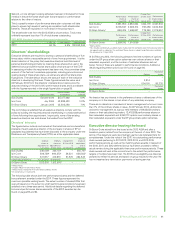

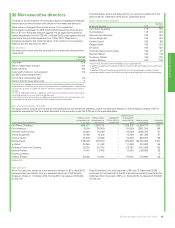

Total fees or other charges (based on an hourly rate) paid in 2013 to the

above advisers for the provision of remuneration advice to the committee

as set out above (save in respect of legal advice) is as follows:

Gerrit Aronson £150,000

Towers Watson £85,000

Shareholder engagement

The committee values its dialogue with major shareholders on

remuneration matters. During the year the committee’s chairman and the

committee’s independent adviser held individual meetings with

shareholders holding in aggregate more than 20% of the company’s shares

to ascertain their views and discuss important aspects of the committee’s

policy. They also met key proxy advisers. These meetings supplemented a

group meeting of shareholders with all committee chairs and the chairman,

as well as an investor relations programme including a regular ongoing

dialogue between the chairman and shareholders. This engagement

provides the committee with an important and direct perspective of

shareholder interests and, together with the voting results on the Directors’

remuneration report at the AGM, is considered when making decisions.

The committee reviewed remuneration policy during 2013 and, following

dialogue with shareholders, made three adjustments to further reinforce

our bias towards the long term and sustained performance.

First, a three-year retention period has been introduced to the matched

shares that vest in the deferred bonus element.