BP 2013 Annual Report Download - page 278

Download and view the complete annual report

Please find page 278 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Called-up share capital

Details of the allotted, called-up and fully-paid share capital at

31 December 2013 are set out in Financial statements – Note 31.

At the AGM on 11 April 2013, authorization was given to the directors to

allot shares up to an aggregate nominal amount equal to $3,194 million.

Authority was also given to the directors to allot shares for cash and to

dispose of treasury shares, other than by way of rights issue, up to a

maximum of $240 million, without having to offer such shares to existing

shareholders. These authorities were given for the period until the next

AGM in 2014 or 11 July 2014, whichever is the earlier. These authorities

are renewed annually at the AGM.

Share prices and listings

Markets and market prices

The primary market for BP’s ordinary shares is the London Stock

Exchange (LSE). BP’s ordinary shares are a constituent element of the

Financial Times Stock Exchange 100 Index. BP’s ordinary shares are also

traded on the Frankfurt Stock Exchange in Germany.

Trading of BP’s shares on the LSE is primarily through the use of the

Stock Exchange Electronic Trading Service (SETS), introduced in 1997 for

the largest companies in terms of market capitalization whose primary

listing is the LSE. Under SETS, buy and sell orders at specific prices may

be sent electronically to the exchange by any firm that is a member of the

LSE, on behalf of a client or on behalf of itself acting as a principal. The

orders are then anonymously displayed in the order book. When there is a

match on a buy and a sell order, the trade is executed and automatically

reported to the LSE. Trading is continuous from 8.00 a.m. to 4.30 p.m. UK

time but, in the event of a 20% movement in the share price either way,

the LSE may impose a temporary halt in the trading of that company’s

shares in the order book to allow the market to re-establish equilibrium.

Dealings in ordinary shares may also take place between an investor and

a market-maker, via a member firm, outside the electronic order book.

In the US, BP’s securities are traded on the New York Stock Exchange

(NYSE) in the form of ADSs, for which JPMorgan Chase Bank, N.A. is the

depositary (the Depositary) and transfer agent. The Depositary’s principal

office is 1 Chase Manhattan Plaza, N.A., Floor 58, New York, NY 10005-

1401, US. Each ADS represents six ordinary shares. ADSs are listed on

the NYSE. ADSs are evidenced by American depositary receipts (ADRs),

which may be issued in either certificated or book entry form.

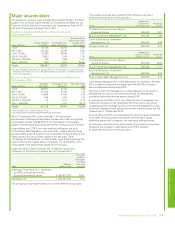

The following table sets forth, for the periods indicated, the highest and

lowest middle market quotations for BP’s ordinary shares and ADSs for

the periods shown. These are derived from the highest and lowest intra-

day sales prices as reported on the LSE and NYSE, respectively.

Pence Dollars

Ordinary shares American depositary sharesa

High Low High Low

Year ended 31 December

2009 613.40 400.00 60.00 33.70

2010 658.20 296.00 62.38 26.75

2011 514.90 361.25 49.50 33.62

2012 512.00 388.56 48.34 36.25

2013 494.20 426.50 48.65 39.99

Year ended 31 December

2012: First quarter 512.00 455.05 48.34 42.53

Second quarter 475.47 388.56 45.60 36.25

Third quarter 456.00 415.60 44.16 39.13

Fourth quarter 464.71 416.35 43.90 39.58

2013: First quarter 482.33 426.50 45.45 39.99

Second quarter 485.43 437.25 44.27 40.12

Third quarter 477.53 430.30 43.75 40.51

Fourth quarter 494.20 426.55 48.65 41.30

2014: First quarter (to 18 February) 499.90 463.80 49.63 45.83

Month of

September 2013 458.28 430.85 42.86 41.08

October 2013 491.27 426.55 46.65 41.30

November 2013 494.20 474.10 48.03 45.72

December 2013 491.26 464.15 48.65 45.30

January 2014 499.90 470.15 49.20 46.62

February 2014 (to 18 February) 495.85 463.80 49.63 45.83

aOne ADS is equivalent to six 25 cent ordinary shares.

Source: Thomson Reuters Datastream.

Market prices for the ordinary shares on the LSE and in after-hours

trading off the LSE, in each case while the NYSE is open, and the market

prices for ADSs on the NYSE, are closely related due to arbitrage among

the various markets, although differences may exist from time to time.

On 18 February 2014, 876,828,675.5 ADSs (equivalent to approximately

5,260,972,053 ordinary shares or some 28.51% of the total issued share

capital, excluding shares held in treasury) were outstanding and were

held by approximately 100,614 ADS holders. Of these, about 99,394 had

registered addresses in the US at that date. One of the registered holders

of ADSs represents some 868,478 underlying holders.

On 18 February 2014, there were approximately 279,391 ordinary

shareholders. Of these shareholders, around 1,574 had registered

addresses in the US and held a total of some 4,286,769 ordinary shares.

Since a number of the ordinary shares and ADSs were held by brokers

and other nominees, the number of holders in the US may not be

representative of the number of beneficial holders of their respective

country of residence.

Dividends

BP’s current policy is to pay interim dividends on a quarterly basis on its

ordinary shares.

BP’s current policy is also to announce dividends for ordinary shares in

US dollars and state an equivalent sterling dividend. Dividends on BP

ordinary shares will be paid in sterling and on BP ADSs in US dollars. The

rate of exchange used to determine the sterling amount equivalent is the

average of the market exchange rates in London over the four business

days prior to the sterling equivalent announcement date. The directors may

choose to declare dividends in any currency provided that a sterling

equivalent is announced, but it is not the company’s intention to change its

current policy of announcing dividends on ordinary shares in US dollars.

Information regarding dividends announced and paid by the company on

ordinary shares and preference shares is provided in Financial statements

– Note 12.

274 BP Annual Report and Form 20-F 2013