BP 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Form 20-F 201382

Dear shareholder

BP continued the disciplined and systematic execution of its strategy

during 2013, focusing on safety and operational risk management, and on

restoring value. As in 2012, there were many positive steps in the recovery

journey during 2013 including improved safety, a strengthened portfolio

and a new future in Russia. I encourage you to read about these in more

detail elsewhere in this annual report.

Remuneration for executive directors continues to be tied closely to this

overall recovery of the group. The vast majority of potential remuneration is

based on outcomes relative to measures related directly to the company’s

strategy and key performance indicators. In addition to a direct link to

strategy, our remuneration system has a strong bias towards sustained

long-term performance, and our decisions regarding remuneration are

guided by key principles of informed judgement, fair treatment and

alignment with shareholders. My meetings with shareholders this year

have again been helpful in understanding perspectives and have led to a

few modifications to our policy.

Our report this year reflects the new UK regulations on directors’

remuneration and so is divided into an annual report on remuneration and a

separate policy report. The annual report on remuneration sets out and

explains the outcomes of the various elements that make up 2013 total

remuneration. The policy report explains our proposed remuneration policy

for the next three years which, subject to approval by shareholders, will

come into effect from the AGM. For both sections the information relating

to executive directors (whose remuneration is determined by the

remuneration committee) is presented separately from that relating to

non-executive directors (whose remuneration is determined by the full

board).

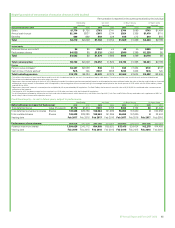

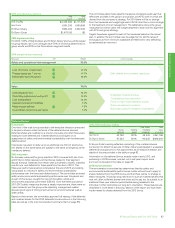

2013 outcomes

I am pleased to report that remuneration for 2013, as summarized on

page 85, increased after several years where pay was significantly

depressed by the aftermath of the Deepwater Horizon incident. It is

particularly encouraging that a moderate portion of shares in the long-term

performance share plan has vested this year. These outcomes reflect

strong and sustained performance with safety steadily improving,

operations performing well and a portfolio of assets growing through

capital discipline and strong project management. The significant

divestments of the last few years have made the company smaller but

stronger, with improved potential to grow value.

Annual bonus

It was a good year for BP with improved safety, new discoveries and

operations, a strengthened portfolio and benefits already accruing from the

company’s new relationship in Russia. Overall group performance

exceeded annual plan levels and resulted in a score of 1.32 times target.

Performance was assessed relative to metrics set at the start of the year

and reflecting the company’s strategy and key performance indicators.

Safety and operational risk management accounted for 30% of annual

bonus. Led strongly from the top, this continued to show encouraging

progress with particularly significant reductions in tier 1 process safety

events and loss of primary containment – both important measures of

process safety. Results this year confirm that it remains a constant priority

throughout the business.

The company also made good gains in restoring value, which accounted

for 70% of annual bonus. Underlying replacement cost profit and total cash

costs were both better than plan targets, while operating cash flow

achieved target levels. Key operating performance was also positive with

important major projects commissioned and a significant improvement in

unplanned Upstream deferrals. Downstream operations demonstrated

high availability and good safety results but profitability was impacted by a

difficult business environment affecting refinery margins.

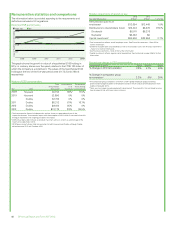

Deferred bonus

The first of the deferred bonus share awards, implemented in 2010,

became eligible for vesting at the end of 2013. Vesting was dependent on

safety and environmental sustainability performance over the period from

2011 through 2013. Our review confirmed very positive results during this

period with consistent improvements in key metrics and no major

incidents. Based on this positive result, the deferred and matched shares

for this period vested fully.

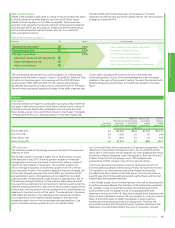

Performance shares

The 2011-2013 performance share plan, the first plan commencing after

the Deepwater Horizon incident, focused on value creation, reinforcing

safety and risk management and rebuilding trust. 50% of the award was

dependent on total shareholder return which failed to make the threshold

required for vesting. Reserves replacement, accounting for 20% of the

award, is expected to be very positive and progress relative to the strategic

imperatives, accounting for the remaining 30%, was very encouraging.

Overall, we expect nearly 40% of shares will vest, the highest in over

10 years.

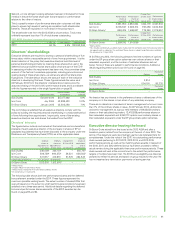

Other elements

Salaries were increased by just under 3% for Bob Dudley, Iain Conn and

Dr Brian Gilvary mid-year. Pension increases reflect normal plan rules and

valuation according to UK regulations. The increased value reported for

Bob Dudley reflects his promotion to group chief executive in 2010 which,

because his defined benefit pension is based on three-year average

remuneration, takes a number of years to reach a steady state. In addition,

the reported value is calculated according to UK regulations and the

committee has been informed by the company’s consulting actuaries that

these significantly overstate the value of his US pension increase.

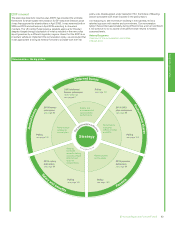

Remuneration policy

Attracting and retaining top talent is a key objective of our approach to

remuneration. Our proposed policy, as summarized on page 98, remains

largely unchanged from that which has applied for a number of years and

its continuity has been a stabilizing force during a period of company

turbulence. The core elements of salary, annual bonus, deferred bonus,

performance shares and pension continue to provide an effective, relatively

simple, performance-based system that fits well with the long-term nature

of BP’s business and strategy.

Three modifications have been included in our proposed policy as a result

of our dialogue with investors. First, we have added a three-year retention

period in the deferred bonus element for those matched shares that vest in

the plan. Second, we have made the vesting of performance shares more

stringent for those metrics based on performance relative to other oil

majors. Finally, we have added a specific review of performance share

vesting to ensure that high levels of vesting are consistent with

shareholder benefits.

All of the above are explained in more detail in the policy report.

Our remuneration system has worked

appropriately during difficult times, and I am

confident it will continue to do so as

performance returns to healthy sustained levels.

Chairman’s annual statement