BP 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance

BP Annual Report and Form 20-F 2013 105

Recruitment

The committee expects any new executive directors to be engaged on

terms that are consistent with the policy as described on the preceding

pages. The committee recognizes that it cannot always predict accurately

the circumstances in which any new directors may be recruited. The

committee may determine that it is in the interests of the company and

shareholders to secure the services of a particular individual which may

require the committee to take account of the terms of that individual’s

existing employment and/or their personal circumstances. Accordingly, the

committee will ensure that:

• Salary level of any new director is competitive relative to the peer group.

• Variable remuneration will be awarded within the parameters outlined on

pages 98-99, save that the committee may provide that an initial award

under the EDIP (within the salary multiple limits on page 98) is subject to

a requirement of continued service over a specified period, rather than a

corporate performance condition.

• Where an existing employee of BP is promoted to the board, the

company will honour all existing contractual commitments including any

outstanding share awards or pension entitlements.

• Where an individual is relocating in order to take up the role, the

company may provide certain one-off benefits such as reasonable

relocation expenses, accommodation for a period following appointment

and assistance with visa applications or other immigration issues and

ongoing arrangements such as tax equalization, annual flights home, and

housing allowance.

• Where an individual would be forfeiting valuable remuneration in

order to join the company, the committee may award appropriate

compensation. The committee would require reasonable evidence of

the nature and value of any forfeited award and would,

to the extent practicable, ensure any compensation was no more

valuable than the forfeited award and that it was paid in the form of

shares in the company.

The committee would expect any new recruit to participate in the

company pension and benefit schemes that are open to senior employees

in his home country but would have due regard to the recruit’s existing

arrangements and market norms.

In making any decision on any aspect of the remuneration package for a

new recruit, the committee would balance shareholder expectations,

current best practice and the requirements of any new recruit and would

strive not to pay more than is necessary to achieve the recruitment. The

committee would give full details of the terms of the package of any new

recruit in the next remuneration report.

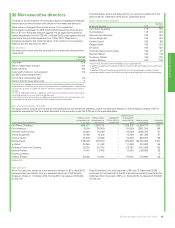

Service contracts

Summary details of each executive director’s service agreement are as

follows:

Service

agreement date

Salary as at

1 Jan 2014

Bob Dudley 6 Apr 2009 $1,800,000

Iain Conn 22 Jul 2004 £774,000

Dr Brian Gilvary 22 Feb 2012 £710,000

Bob Dudley’s contract is with BP Corporation North America Inc. He is

seconded to BP p.l.c. under a secondment agreement dated 15 April 2009,

which has been further extended to 15 April 2019. His secondment can be

terminated with one month’s notice by either party and terminates

automatically on the termination of his service agreement. Iain Conn’s and

Dr Brian Gilvary’s service agreements are with BP p.l.c.

Each executive director is entitled to pension provision, details of which are

summarized on page 103.

Each executive director is entitled to the following contractual benefits:

• A company car and chauffeur for business and private use, on terms that

the company bear all normal servicing, insurance and running costs.

Alternatively, the executive director is entitled to a car allowance in lieu.

• Medical and dental benefits, sick pay during periods of absence and tax

preparation assistance.

• Indemnification in accordance with applicable law.

• Each executive director participates in bonus or incentive arrangements

at the committee’s sole discretion. Currently, each participates in the

discretionary bonus scheme and the deferred bonus and performance

share plans as described on pages 100, 101 and 102 respectively.

Each executive director may terminate his employment by giving his

employer 12 months’ written notice. In this event, for business reasons,

the employer would not necessarily hold the executive director to his full

notice period.

Other than in the case of Dr Brian Gilvary (who became a director on

1 January 2012), the service agreements are expressed to expire at a

normal retirement age of 60; however, such executive directors could not,

under UK law, be required to retire at this (or any other) age following

abolition of the default retirement age.

The employer may lawfully terminate the executive director’s employment

in the following ways:

• By giving the director 12 months’ written notice.

• Without compensation, in circumstances where the employer is entitled

to terminate for cause, as defined for the purposes of his service

agreement.

Additionally, in the case of Iain Conn and Dr Brian Gilvary, the company

may lawfully terminate employment by making a lump sum payment in lieu

of notice equal to 12 months’ base salary. The company may elect to pay

this sum in monthly instalments rather than as a lump sum.

The lawful termination mechanisms described above are without prejudice

to the employer’s ability in appropriate circumstances to terminate in

breach of the notice period referred to above, and thereby to be liable for

damages to the executive director.

In the event of termination by the company, each executive director may

have an entitlement to compensation in respect of his statutory rights under

employment protection legislation in the UK and potentially elsewhere.

Where appropriate the company may also meet a director’s reasonable

legal expenses in connection with either his appointment or termination of

his appointment.

The committee considers that its policy on termination payments arising

from the contractual provisions summarized above provides an appropriate

degree of protection to the director in the event of termination and is

consistent with UK market practice.

Exit payments

Should it become necessary to terminate an executive director’s

employment, and therefore to determine a termination payment, the

committee’s policy would be as follows:

• The director’s primary entitlement would be to a termination payment in

respect of his service agreement, as set out above. The committee will

consider mitigation to reduce the termination payment to a leaving

director when appropriate to do so, taking into account the

circumstances and the law governing the agreement. Mitigation would

not be applicable where a contractual payment in lieu of notice is made.

In addition, the director may be entitled to a payment in respect of his

statutory rights. Other potential elements are as follows:

– First, the committee would consider whether the director should be

entitled to an annual bonus in respect of the financial year in which the

termination occurs. Normally, any such bonus would be restricted to

the director’s actual period of service in that financial year.

– Second, the committee would consider whether conditional share

awards held by the director under the EDIP should lapse on leaving or

should, at the committee’s discretion, be preserved (in which event

the award would normally continue until the normal vesting date and

be treated in the manner described on pages 101-102 of this report).

Any such determination will be made in accordance with the rules of

the EDIP, as approved by shareholders.