BP 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance

BP Annual Report and Form 20-F 2013 87

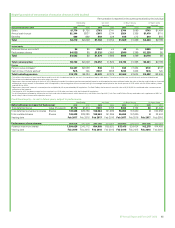

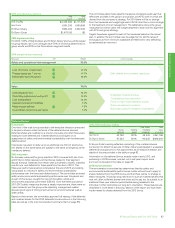

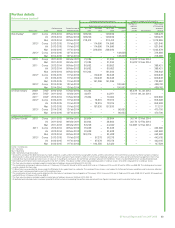

2013 overall bonus outcome

Paid

in cash

Total

deferred

Bob Dudley $2,343,660 $1,171,830

Iain Conn £961,380 £480,690

Dr Brian Gilvary £924,000 £462,000

Dr Byron Grote $1,470,150 $0

2014 implementation

For 2014, 100% of Bob Dudley’s and Dr Brian Gilvary’s bonus will be based

on group results. Iain Conn will again have 70% of his bonus determined on

group results and 30% on his Downstream segment results.

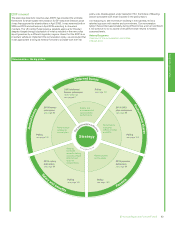

The committee determines specific measures and targets each year that

reflect the priorities in the group’s annual plan and KPIs, both of which are

derived from the company’s strategy. For 2014 there will be no change

from the measures and weightings used in 2013 other than a minor change

to the treatment of cost management. The table below shows the group

measures that will be used, the weight attached to each and the alignment

with KPIs and group strategy.

Targets have been agreed for each of the measures based on the annual

plan. In addition the committee uses its judgement to set the range of

bonus payouts from minimum acceptable at threshold to very stretching

but achievable at maximum.

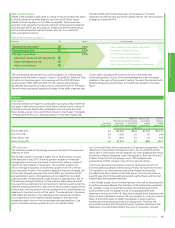

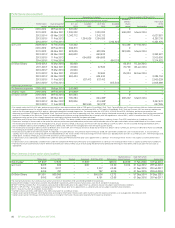

2014 annual bonus measures

Safety and operational risk management

Value

30.0%

70.0%

Measures KPI Weight Link to strategy

Loss of primary containment 10.0%

Process safety tier 1 events 10.0% Safe, reliable and compliant operations

Recordable injury frequency 10.0%

Operating cash flow 16.3%

Underlying replacement cost profit 16.3%

Cost management 16.3%

Upstream unplanned deferrals 7.0%

Major project delivery 7.0%

Downstream net income per barrel 7.0%

Disciplined financial choices

Competitive project execution

Focus on high-value Upstream assets

Grow our exploration position

Build high-quality Downstream businesses

Deferred bonus

Framework

One-third of the total bonus awarded to the executive directors is required

to be paid in shares under the terms of the deferred bonus element.

Deferred shares are matched on a one-for-one basis and, after three years,

vesting for both deferred and matched shares is contingent on an

assessment of safety and environmental sustainability over the three-year

deferral period.

Individuals may elect to defer up to an additional one-third of total bonus

into shares on the same basis and subject to the same contingency as the

mandatory deferral.

2013 outcomes

No bonuses were paid for group results in 2010, however both Iain Conn

and Dr Byron Grote received a limited bonus related to their segment

results that year. Deferrals from these were converted to shares, matched

one-for-one, and deferred for three years from the start of 2011. The

three-year performance period concluded at the end of 2013 and vesting

was subject to a review of safety and environmental sustainability

performance over the three-year deferral period. The committee reviewed

safety and environmental sustainability performance over this period and,

as part of this review, sought the input of the safety, ethics and

environment assurance committee (SEEAC). Over the three-year period

2011-2013 safety measures showed a steady improvement, there were no

major incidents, and the group-wide operating management system

showed good signs of driving improvement in environmental as well as

safety areas.

Based on their review, the committee approved full vesting of the deferred

and matched shares for the 2010 deferred bonus as shown in the following

table (as well as in the total remuneration summary chart on page 85).

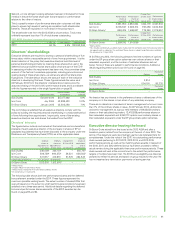

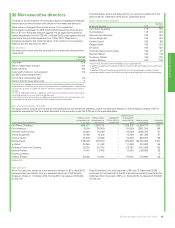

2010 deferred bonus vesting

Name

Shares

deferred

Vesting

agreed

Total shares

including

dividends

Total

value

at vesting

Iain Conn 42,768 100% 49,340 £241,766

Dr Byron Grote 97,548 100% 110,640 $892,680

Dr Byron Grote’s vesting reflected a prorating of the matched shares

component to reflect his service. Dr Brian Gilvary participated in a separate

deferred bonus plan prior to his appointment as an executive director and

details of this are provided in the table on page 93.

Information on the deferred bonus awards made in early 2013, and

pertaining to 2012 bonuses, was set out in last year’s report and a

summary is included in the table on page 85.

2014 implementation

The remuneration committee has determined that the safety and

environmental sustainability performance hurdle will continue to apply to

shares deferred from the 2013 bonus and that there will be no change to

these measures. It has also proposed that in future all matched shares that

vest will, after sufficient shares have been sold to pay tax, be subject to an

additional three-year retention period before being released to the

individual, further reinforcing our long-term orientation. These features are

described in more detail in the policy section of the report and have been

implemented for shares deferred from the 2013 bonus.