BP 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Form 20-F 2013100

Remuneration policy in more depth

Salary and benefits

At 1 January 2014, the annual salaries for executive directors were as follows:

Bob Dudley $1,800,000, Iain Conn £774,000 and Dr Brian Gilvary £710,000.

Most components of total remuneration are determined as multiples of

salary and so the committee reviews salaries, normally annually.

These reviews consider both external competitiveness and internal

consistency when determining if any increases should be applied.

Salaries are compared against other oil majors, but the committee also

monitors market practice among European and US companies of a similar

size, geographic spread and business dynamic to BP.

Salaries are normally set in the home currency of the executive director.

The levels of increase for all our employees in relevant countries, as well as

the profile of increases for group leaders, are reviewed and considered

when assessing executive director salary increases.

The committee would expect annual increases to be in line with all

employee increases in the UK and US, unless there are promotions or

significant changes in responsibilities, in which case they would retain the

flexibility to recognize these with appropriate salary increases but will be

limited to within 2% of average increase for the group leaders.

Annual bonus

Operation

Highlights

150% of salary on target, 225% maximum.

Metrics focused on safety and operational risk,

and on value creation.

Details on performance measures will be explained each

year in annual report on remuneration.

Executive directors are eligible for an annual bonus (before any deferral) of

150% of salary at target and 225% at maximum. Bonuses for the group

chief executive and the chief financial officer will be based entirely on

group measures. Executive directors with large operating responsibilities

may have up to 50% of their bonus based on their respective business

segment, with the balance based on group measures.

The strategy provides the overall context for the company’s key

performance indicators and the focus for the annual plan. From this,

measures and targets to reflect the key priorities of the business are

selected at the start of the year for senior managers, including executive

directors. Measures typically include a range of financial and operating

ones as well as those relating to safety and the environment.

Where possible, the committee uses quantifiable, hard targets that can be

factually measured and objectively assessed. Where it is appropriate to

use qualitative measures, the information used to make assessments will

be established at the start of or early in the year. Targets are set so that

achieving plan levels of performance results in on-target bonus. For

maximum levels, targets reflect performance levels that the committee

judges are very stretching but nonetheless achievable.

At the end of each year, performance is assessed relative to the measures

and targets established at the start of the year, adjusted for any material

changes in the market environment (predominantly oil prices).

In addition to the specific bonus metrics, the committee also reviews the

underlying performance of the group in light of the annual plan,

competitors’ results and analysts’ reports, and seeks input from other

committees on relevant aspects. When appropriate, the committee may

make adjustments, up or down, to a straight formulaic result based on this

fuller information. The committee considers that this informed judgement

is important to establishing a fair overall assessment.

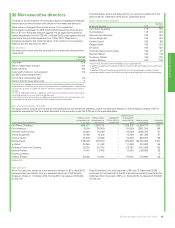

The rigorous process followed by the committee has resulted in bonus

levels varying considerably over a number of years, reflecting the changing

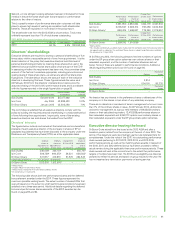

circumstances of the company during the period. The following chart

shows the average annual bonus result (before any deferral) relative to an

on-target level for executive directors.

History of annual bonus results

2008 2009 2010 2011 2012 2013

200

150

100

50

On-target Average actual result

% of target

Performance measures

The measures used to determine bonus results will derive from the annual

plan and support the strategic priorities of safety and operational risk

(S&OR) management and reinforcing value creation.

The committee determines specific measures, weightings and targets

each year to reflect the group’s strategy, key performance indicators (KPIs)

and the priorities in the annual plan. These measures will be reported each

year in the annual report on remuneration.

For safety and operational risk management the measures may include

established ones such as loss of primary containment, tier 1 process

safety events, recordable injury frequency, and/or days away from work

frequency. The measures selected will typically track both process and

personal safety and give an overall perspective on performance. The

committee will also seek the input of the safety, ethics and environmental

assurance committee (SEEAC) to determine if there are any other factors

or metrics that should be considered in arriving at a final assessment at

year end.

Value creation will form the principal measures and include both financial

and operating metrics that track performance relative to value creation.

Financial measures for value creation may include operating cash flow,

underlying replacement cost profit, and cost management or other similar

measures tracking the financial outcome of the company’s pursuit of

strategic goals. Additional operating metrics may include major project

delivery, Upstream unplanned deferrals, and Downstream net income per

barrel or other similar measures that track key operating aspects of the

strategy.

Where segment metrics are applied, they will typically include specific

safety metrics for the segment as well as value metrics such as availability,

efficiency, profitability and major project delivery.

The committee will make a balanced judgement of what, if any, increase

should be applied to each executive director’s salary. These decisions, and

the reasons for them, form part of the annual report of remuneration.

Benefits and other emoluments

Executive directors are entitled to receive those benefits which are made

available to employees generally in accordance with their applicable terms,

for example sharesave plans, sickness policy, relocation assistance and

maternity pay. Benefits are not pensionable.

In addition, executive directors may receive other benefits that are judged to

be cost effective and prudent in terms of the individual’s time and/or

security. These include car-related benefits, security assistance, tax

preparation assistance, insurance and medical benefits. The costs of these

are treated as taxable benefits to the individuals and are included in the

single figure table of the annual report on remuneration. The company would

meet any tax charges arising in respect of benefits provided to directors that

it considers relate to its business (for example security assistance).

The committee expects to maintain benefits at their current level for the

duration of this policy but notes that the taxable value may fluctuate

depending on, amongst other things, insurance premiums, and a director’s

personal circumstances.