BP 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance

BP Annual Report and Form 20-F 2013 91

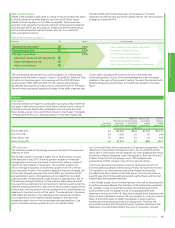

Second, a more stringent vesting schedule has been introduced for those

metrics in the performance share plan that are based on performance

relative to the other oil majors.

Third, a specific review of performance share plan outcomes will take

place to ensure high levels of vesting are consistent with shareholder

benefits. These are explained in more detail in the policy report.

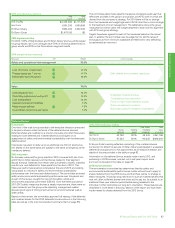

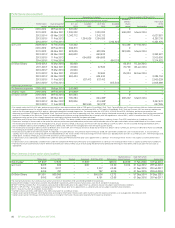

The shareholder vote from the 2013 AGM is shown below. Total votes

withheld represent less than 1% of total shares outstanding.

2013 AGM directors’ remuneration report vote results

Year % vote ‘for’ % vote ‘against’ Votes withheld

2013 94.1% 5.9% 108,843,360

Directors’ shareholdings

Executive directors are required to develop a personal shareholding of five

times salary within a reasonable period of time from appointment. It is the

stated intention of the policy that executive directors build this level of

personal shareholding primarily by retaining those shares that vest in the

deferred bonus and performance share plans which are part of the EDIP.

In assessing whether the requirement has been met, the committee takes

account of the factors it considers appropriate, including promotions and

vesting levels of these share plans, as well as any abnormal share price

fluctuations. The table below shows the status of each of the executive

directors in developing this level. These figures include the value as at

24 February 2014 from the directors’ interests shown below plus the

assumed vesting of the 2011-2013 performance shares and is consistent

with the figures reported in the single figure table on page 85.

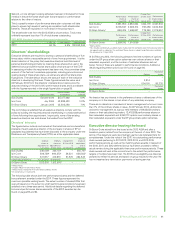

Appointment date

Value of current

shareholding

% of policy

achieved

Bob Dudley October 2010 $5,477,092 61%

Iain Conn July 2004 £3,888,423 101%

Dr Brian Gilvary January 2012 £2,502,388 71%

The committee is satisfied that all executive directors comply with the

policy by building the required personal shareholding in a reasonable period

of time following their appointment. Importantly, none of the existing

executive directors has sold shares that vested from the EDIP.

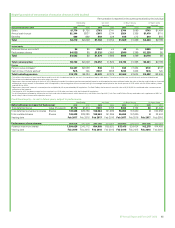

Directors’ interests

The figures below indicate and include all the beneficial and non-beneficial

interests of each executive director of the company in shares of BP (or

calculated equivalents) that have been disclosed to the company under the

Disclosure and Transparency Rules (DTRs) as at the applicable dates.

Ordinary

shares or

equivalents at

1 Jan 2013

Ordinary

shares or

equivalents at

31 Dec 2013

Change from

31 Dec 2013

to

24 Feb 2014

Ordinary

shares or

equivalents

total at

24 Feb 2014

Bob Dudley 346,008a355,707a–355,707a

Iain Conn 509,729b600,272b26,231 626,503b

Dr Brian Gilvary 331,977 412,973 81,570 494,543

Former executive director At 1 Jan 2013 At retirement

Dr Byron Grote 1,512,616c1,512,616d– –

a

Held as ADSs.

b

Includes 48,024 shares held as ADSs.

c

Held as ADSs, except for 94 shares held as ordinary shares.

d

On retirement at 11 April 2013.

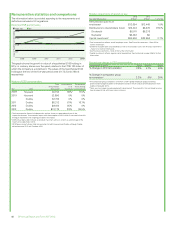

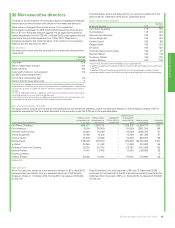

The following table shows both the performance shares and the deferred

bonus element awarded under the EDIP. These figures represent the

maximum possible vesting levels. The actual number of shares/ADSs that

vest will depend on the extent to which performance conditions have been

satisfied over a three-year period. Additional details regarding the deferred

bonus and performance shares elements of the EDIP awarded can be

found on pages 93 and 94.

Performance

shares at

1 Jan 2013

Performance

shares at

31 Dec 2013

Change from

31 Dec 2013

to

24 Feb 2014

Performance

shares total at

24 Feb 2014

Bob Dudleya3,691,950 4,953,654 1,604,178 6,557,832

Iain Conn 2,305,847 2,666,314 818,486 3,484,800

Dr Brian Gilvaryb669,434 1,599,607 776,350 2,375,957

Former executive director

Performance

shares at

1 Jan 2013

Performance

shares at

31 Dec 2013

Change from

31 Dec 2013

to

24 Feb 2014

Performance

shares total at

24 Feb 2014

Dr Byron Grotea2,889,192 1,810,686c– –

a

Held as ADSs.

b

This includes conditionally awarded shares made under the competitive performance plan prior to

his appointment as a director. The vesting of these shares is subject to performance conditions.

c On retirement at 11 April 2013.

At 24 February 2014, the following directors held the numbers of options

under the BP group share option schemes over ordinary shares or their

calculated equivalent, and the number of restricted shares as set out

below. None of these are subject to performance conditions. Additional

details regarding these options can be found on page 94.

Options

Restricted

shares

Bob Dudley – –

Iain Conn 3,814 –

Dr Brian Gilvary 504,191 80,335

Former executive director Options

Restricted

shares

Dr Byron Grote – –

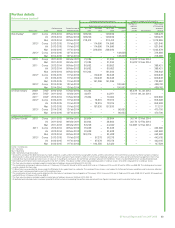

No director has any interest in the preference shares or debentures of the

company or in the shares or loan stock of any subsidiary company.

There are no directors or members of senior management who own more

than 1% of the ordinary shares in issue. At 24 February 2014, all directors

and senior management as a group held interests of 9,632,638 ordinary

shares or their calculated equivalent, 12,418,589 performance shares or

their calculated equivalent and 6,058,172 options over ordinary shares or

their calculated equivalent under the BP group share option schemes.

Executive director leaving the board

Dr Byron Grote retired from the board at the 2013 AGM and after a

transition period, retired from the company at the end of June 2013. The

terms of his departure were reported last year but are reiterated here for

completeness. Under the rules of the EDIP, his outstanding performance

share awards pertaining to 2011-2013, 2012-2014, and 2013-2015

performance periods, as well as the matching share awards in respect of

the 2010, 2011 and 2012 deferred bonus have been prorated to reflect

actual service during the applicable three-year performance periods. These

share awards will vest at the normal time to the extent the performance

targets or hurdles have been met. His 2013 bonus eligibility was likewise

prorated to reflect his service and based on group results for the year. He

has not received any termination payments on leaving service.