BP 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Form 20-F 201384

2013 annual report on remuneration

This section reports on the remuneration outcomes

for 2013 and is divided into separate sections for

executive and non-executive directors.

The remuneration of the executive directors is set by

the remuneration committee (the committee) under

delegated powers from the board. The committee

makes a recommendation to the board for the

remuneration of the chairman. The remuneration of

the non-executive directors is set by the board

based on a recommendation from the chairman, the

group chief executive and the company secretary.

(a) Executive directors

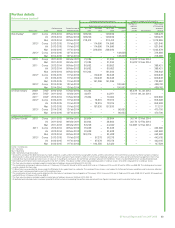

Total remuneration summary

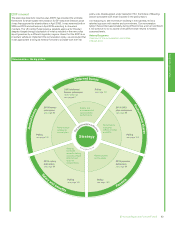

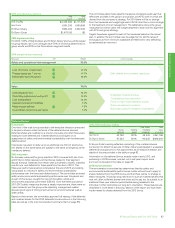

Strategy > Key performance indicators > Performance > Pay

The clear link from strategy through to pay continues. For several years the

company’s strategy has centred on enhancing safety and risk

management, rebuilding trust and restoring value. This strategy has

provided focus for key performance indicators (KPIs) and in turn the

measures for annual bonus, deferred bonus and performance share plans.

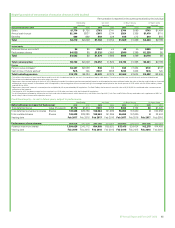

2013 summary of outcomes

These are shown in the table opposite and represent the following:

• Salary – reviewed mid-year and increased just under 3% for all except

Dr Byron Grote who retired mid-year.

• Annual bonus – overall group bonus was based 30% on safety and

operational risk (S&OR) management and 70% on restoring value.

S&OR results were good both in terms of improvement and overall

standard. Similarly, performance relative to value measures was overall

better than the annual plan. Overall group outcome was 1.32 times

target level.

The resulting cash bonuses are shown in the table opposite with total

deferred bonuses reflected in the ‘Conditional equity’ table as required

by UK regulations. Dr Byron Grote, given his retirement, was not eligible

for any deferral, and his bonus (prorated to reflect his service) was paid

in cash.

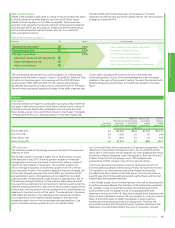

• Deferred bonus – the 2010 deferred bonus was contingent on safety

and environmental sustainability performance over the period 2011

through 2013. Overall assessment was very positive based on

continually improving safety and risk management performance and

strong evidence of ingrained safety culture and systems throughout the

organization. Based on this, 2010 deferred and matched shares

vested.

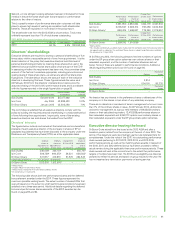

• Performance shares – the 2011-2013 plan was based 50% on total

shareholder return (TSR) and 20% on reserves replacement, both

relative to the other oil majors, and reflecting the key strategic focus on

restoring value. The final 30% was based on strategic imperatives made

up equally of safety and risk management, external reputation and staff

alignment and morale – all key strategic priorities in the period after the

Deepwater Horizon incident in 2010. 39.5% of shares in the plan are

expected to vest based on strong reserves replacement performance

and good progress against all three strategic imperatives. TSR

performance did not achieve the minimum level required for any vesting.

• Pension – pension figures reflect the UK requirements to show 20

times the increase in pension value for defined benefit schemes, as well

as any cash paid in lieu. In the case of Bob Dudley’s reported figures,

this UK requirement overstates the increase in the actuarial value of his

US pension by several million dollars.

84 (a) Executive directors

84 Total remuneration summary

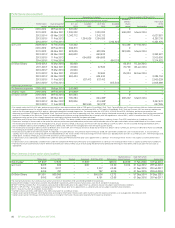

86 Total remuneration in more depth (including 2014

implementation of policy)

86 Salary and benefits

86 Annual bonus

87 Deferred bonus

88 Performance shares

89 Pension

90 Remuneration committee

91 Directors shareholdings

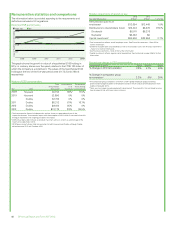

92 Remuneration statistics and comparisons

93 Further details

95 (b) Non-executive directors