BP 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The measures taken to secure

and reshape the group are

taking hold. BP is stronger and

safer as a result.

Carl-Henric Svanberg

Chairman’s letter

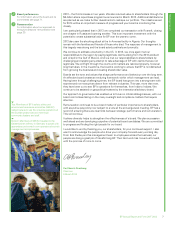

10-year dividend history

UK (pence per ordinary share)

20

10

30

40

04 05 06 07 08 09 10 11 12 13

15.25

19.15 21.10 21.00

29.39

36.42

8.68

17.40

20.85 23.40

US (cents per ADS)

One ADS represents six 25 cent ordinary shares.

100

200

300

400

04 05 06 07 08 09 10 11 12

13

166

209 230 254

330 336

84

168

219

198

Dear fellow shareholder,

In 2013 BP continued the programme of renewal we began following the crisis of 2010.

The measures taken to secure and reshape the group are taking hold. As this report

shows, BP is stronger and safer as a result.

Change within the group has taken place against the backdrop of a rapidly evolving world.

The energy landscape is developing at pace, for example, the growth of shale gas in the

US. But the long-term supply challenge has not gone away. More energy is required to

meet the needs and aspirations of a rising global population. The BP Energy Outlook

projects an average increase in energy demand of 1.5% per year through to 2035. That’s

like adding the needs of a country twice the size of the US over the next twenty years.

We are also seeing that society has ever higher expectations of business. This is reflected

in the increasing scrutiny placed on the commercial sector, particularly by politicians and

the media. Companies must work hard to maintain people’s trust and respect.

Shareholders’ expectations are shifting too, particularly in the extractive industries sector.

Some investors feel that international oil companies have spent too much for too little

return. A decade of mergers and acquisitions in our industry has generated little production

growth. Capital expenditure has increased but profit margins have been squeezed. Rightly,

shareholders expect better returns.

The board recognizes this changing world and the importance of our response. Throughout

2013 we gave close attention to strategy, project appraisal and capital discipline, working

with Bob Dudley and his team to ensure the group spends its money wisely. BP’s strategy

is rooted in three imperatives: clear priorities, a quality portfolio and distinctive capabilities.

Our first clear priority is to run safe and reliable operations. We must also make disciplined

financial choices, selecting the smart options that can help meet demand and generate

value. Furthermore, we must be competitive in how we execute our projects.

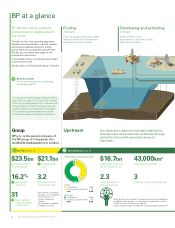

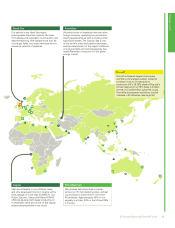

Our quality portfolio, which is at the core of our strategy, is the result of the choices we

make. It contains assets that enable us to play to our areas of greatest strength, from

exploration to high-value upstream projects – particularly deepwater operations, giant

fields and gas value chains – and high-quality downstream businesses.

To these assets and activities we apply our distinctive capabilities – the expertise of our

people, advanced technology and the ability to build the strong relationships required to

access resources and deliver complex projects.

In all of this, we are focused on value before volume. In other words we don’t simply chase

production for the sake of it, rather we choose projects where we can generate the most

value through our production.

We know we must be disciplined, sticking to clear limits on capital expenditure, and

balancing rewards for shareholders today with the long-term capital investment required

for tomorrow. Safety and strong governance must underpin everything we do.

2013 was a busy and successful year for BP, with progress in our underlying operations.

Our growing confidence was reflected in the dividend increase announced in October

BP Annual Report and Form 20-F 20136