BP 2013 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

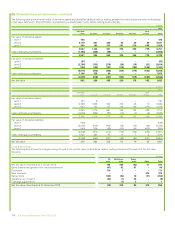

30. Pensions and other post-retirement benefits – continued

$ million

2011

UK

pension

plans

US pension

plans

US other

post-

retirement

benefit

plans

Other

plans Total

Analysis of the amount charged to profit before interest and taxation

Current service costa383 280 53 135 851

Past service cost 3 184 – 43 230

Settlement –––44

Operating charge relating to defined benefit plans 386 464 53 182 1,085

Payments to defined contribution plans 5 199 – 41 245

Total operating charge 391 663 53 223 1,330

Analysis of the amount credited (charged) to other finance expense

Interest income on plan assets (1,361) (304) – (178) (1,843)

Interest on plan liabilities 1,263 369 163 448 2,243

Other finance (income) expense (98) 65 163 270 400

Analysis of the amount recognized in other comprehensive income

Actual asset return less interest income on plan assetsa(1,552) 224 (1) (54) (1,383)

Change in financial assumptions underlying the present value of the plan liabilities (2,251) (468) (63) (636) (3,418)

Change in demographic assumptions underlying the present value of the plan

liabilities (429) (44) 102 (6) (377)

Experience gains and losses arising on the plan liabilities (84) (102) 89 (26) (123)

Remeasurements recognized in other comprehensive income (4,316) (390) 127 (722) (5,301)

aThe costs of managing the plan’s investments are treated as being part of the return on plan assets, the costs of administering our pension plan benefits are generally included in current service cost

and the costs of administering our other post-retirement benefit plans are included in the benefit obligation.

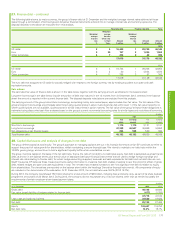

At 31 December 2013, reimbursement balances due from or to other companies in respect of pensions amounted to $399 million reimbursement

assets (2012 $381 million) and $15 million reimbursement liabilities (2012 $15 million). These balances are not included as part of the pension

surpluses and deficits, but are reflected within other receivables and other payables in the group balance sheet.

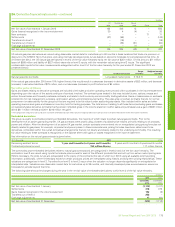

Sensitivity analysis

The discount rate, inflation, salary growth, US healthcare cost trend rate and the mortality assumptions all have a significant effect on the amounts

reported. A one-percentage point change, in isolation, in certain assumptions as at 31 December 2013 for the group’s plans would have had the effects

shown in the table below. The effects shown for the expense in 2014 comprise the total of current service cost and net finance income or expense.

$ million

One percentage point

Increase Decrease

Discount ratea

Effect on pension and other post-retirement benefit expense in 2014 (474) 481

Effect on pension and other post-retirement benefit obligation at 31 December 2013 (6,918) 9,059

Inflation rate

Effect on pension and other post-retirement benefit expense in 2014 521 (397)

Effect on pension and other post-retirement benefit obligation at 31 December 2013 7,120 (5,658)

Salary growth

Effect on pension and other post-retirement benefit expense in 2014 142 (123)

Effect on pension and other post-retirement benefit obligation at 31 December 2013 1,300 (1,158)

US healthcare cost trend rate

Effect on US other post-retirement benefit expense in 2014 16 (13)

Effect on US other post-retirement obligation at 31 December 2013 278 (233)

aThe amounts presented reflect that the discount rate is used to determine the asset interest income as well as the interest cost on the obligation.

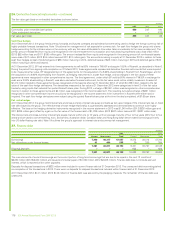

One additional year of longevity in the mortality assumptions would have the effects shown in the table below. The effect shown for the expense in

2014 comprises the total of current service cost and net finance income or expense.

$ million

UK

pension

plans

US

pension

plans

US other

post-

retirement

benefit

plans

German

pension

plans

One additional year’s longevity

Effect on pension and other post-retirement benefit expense in 2014 52539

Effect on pension and other post-retirement benefit obligation at 31 December 2013 927 95 46 213

184 BP Annual Report and Form 20-F 2013