BP 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

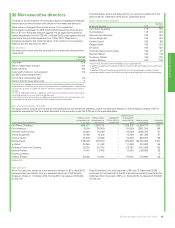

Corporate governance

BP Annual Report and Form 20-F 2013 89

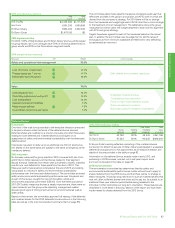

2014 implementation

Shares were awarded in early 2014 to a value of five and a half times salary

to Bob Dudley and four times salary to Iain Conn and Dr Brian Gilvary

(details of which are shown in the table on page 85). These have been

awarded under the performance share element of the executive directors’

incentive plan (EDIP) and are subject to a three-year performance period,

and for those shares that vest are subject, after tax, to an additional

three-year retention period.

The 2014-2016 performance share plan will be based on the same

measures as used last year and remain aligned directly with the company’s

strategic priorities and KPIs.

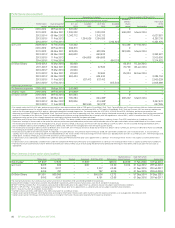

2014-2016 performance shares

Measures KPI Weight Link to strategy

Safe, reliable and compliant operations

Disciplined financial choices

Competitive project execution

Focus on high-value Upstream assets

Grow our exploration position

Build high-quality Downstream businesses

Total shareholder return 1/3rd

Operating cash flow 1/3rd

Strategic imperatives 1/3rd

Safety and operational risk management

Reserves replacement ratio

Major project delivery

TSR and reserves replacement ratio will be assessed on a relative basis

compared with the other oil majors – Chevron, ExxonMobil, Shell and Total.

As set out in the policy report, commencing with the 2014-2016 plan,

vesting will be 100%, 80% and 25% for first, second and third place

respectively amongst the oil majors and no vesting for fourth or fifth place.

The committee has agreed targets and ranges for the other measures that

will be used to assess performance at the end of the three-year

performance period. As part of its overall assessment it also considers

whether, in the event of high levels of vesting, the result is consistent with

benefits achieved by shareholders. Full details are included in the policy

report. Pensions

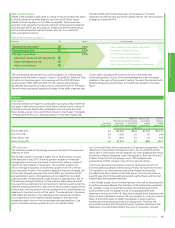

Pension

Framework

Executive directors are eligible to participate in company pension schemes

that apply in their home countries which follow national norms in terms of

structure and levels. Bob Dudley participates in the US plans (as did Dr

Byron Grote), and Iain Conn and Dr Brian Gilvary in the UK plan. Full details

on these plans are set out in the policy section of this report (page 103).

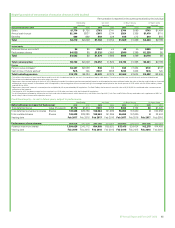

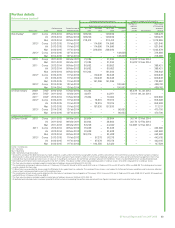

Service at

31 Dec 2013

Total accrued

pension at

31 Dec 2013

Additional

pension earned

during 2013

(net of inflation)

Actuarial value

of increase

earned

during 2013

20 times

increase

earned

during 2013

(thousand)

Bob Dudley (US) 34 $2,050 $222 $1,319 $4,447

Iain Conn (UK) 28 £326 £2 £0 £46

Brian Gilvary (UK) 27 £326 £2 £0 £44

Byron Grote (US) n/a $1,416 $7 -$93 $141

2013 outcomes

The table above sets out the change in pension for each of the executive

directors for 2013.

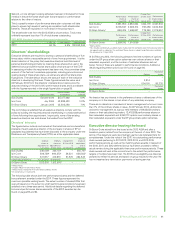

Bob Dudley’s pension increase is largely due to his promotion to group

chief executive in late 2010. Since his pension is based on three-year

average salary and bonus, the impact of a promotion takes a number of

years to be fully reflected in his pension. He is entitled, as all former

Amoco heritage employees, to receive the greater of the BP or Amoco

plans that apply. As part of the transition agreed at the time of merger, the

Amoco plan stopped accruing at the end of 2012, and therefore the BP

plan applicable to senior US executives will now determine his overall

accrued benefit. His total benefit under this plan is calculated as 1.3% of

final average earnings (including, for this purpose, base salary plus cash

bonus and bonus deferred into a compulsory or voluntary award under the

deferred matching element) for each year of service (without regard for tax

limits) which may be paid from various qualified and non-qualified plans as

described in the policy section of this report. The calculations in the above

table reflect this transition. The calculations also incorporate the latest

bonus reported on when determining the average of the best three

successive years’ bonus in the final average earnings calculation. Last

year’s numbers have been updated to be on a consistent basis.

Iain Conn and Dr Brian Gilvary participate in UK pension arrangements. The

disclosure of total pension includes any cash in lieu of additional accrual

that is paid to individuals in the UK scheme who have exceeded the annual

allowance or lifetime allowance under UK regulations. Both Iain Conn and

Dr Brian Gilvary fall into this category and in 2013 received cash

supplements of 35% of salary in lieu of future service accrual.

In terms of calculating the increase in pension value both a column on

20 times additional pension earned during the year as required by the new

UK regulations, as well as the actuarial value increase as previously

stipulated have been included in the table above. The summary table on

page 85 uses the 20 times additional pension earned figure and the cash

supplements are separately identified.

In Bob Dudley’s case, the committee has been informed by the company’s

consulting actuaries, Mercer, that the factor of 20 substantially overstates

the increase in value of his pension benefits primarily because his US

pension benefits are not subject to cost of living adjustments after

retirement, as they are in the UK. They have indicated that a typical annuity

factor for such US benefits is around 12, as compared to a UK plan where a

factor of 20 is often taken to reflect the increase in value of pension

benefits (as well as being required by UK regulations). Therefore the

committee considers that the actuarial value of increase identified in the

table above more accurately reflects the value of his pension increase.