BP 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6. Disposal of TNK-BP and investment in Rosneft

Disposal of TNK-BP

BP announced on 22 November 2012 that it, Rosneft and Rosneftegaz – the Russian state-owned parent company of Rosneft – had signed definitive

and binding sale and purchase agreements (SPAs) for the sale of BP’s 50% interest in TNK-BP to Rosneft, and for BP’s further investment in Rosneft.

The transaction would consist of three tranches:

• BP to sell its 50% shareholding in TNK-BP to Rosneft for cash consideration of $25.4 billion (which included a dividend of $0.7 billion received from

TNK-BP in December 2012) and Rosneft shares representing a 3.04% stake in Rosneft.

• BP would use $4.8 billion of the cash consideration to acquire a further 5.66% stake in Rosneft from the Russian government at a price of $8 per

share (representing a premium of 12% to the Rosneft share price on the bid date of 18 October 2012).

• BP would use $8.3 billion of the cash consideration to acquire a further 9.8% stake in Rosneft from a Rosneft subsidiary at a price of $8 per share.

The net result of the overall transaction was that BP would receive $12.3 billion in cash (including $0.7 billion of TNK-BP dividends received by BP in

December 2012) and acquire an 18.5% shareholding in Rosneft. Combined with BP’s existing 1.25% shareholding, this would result in BP owning

19.75% of Rosneft.

On completion, the transactions between BP, Rosneft and the Rosneft subsidiary were instead settled on a net basis, so that BP received the 9.80%

stake in Rosneft directly rather than receiving and immediately paying $8.3 billion in cash; however, the net result was the same.

BP accounts for its investment in Rosneft as an associate, and so equity accounts for its share of Rosneft’s earnings, production and reserves. See

Note 18 for more information on BP’s investment in Rosneft.

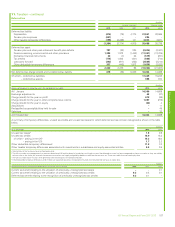

The gain on disposal of BP’s investment in TNK-BP, recognized in the TNK-BP segment in 2013, was $12.5 billion as shown in the table below.

$ million

Agreed cash disposal proceeds 25,425

Amount settled net in Rosneft shares (9.80% stake) (8,309)

TNK-BP dividend received by BP in December 2012 (709)

Interest on cash proceeds 239

Disposal proceeds received in cash 16,646

Shares in Rosneft received (9.80% and 3.04% stake) 10,755

Consideration received 27,401

Less: carrying value of investment in TNK-BP (12,393)

15,008

Deferral of gain (2,959)

Gain on existing 1.25% investment in Rosneft 523

Other (72)

Gain on disposal of investment in TNK-BP 12,500

Disposal proceeds of $4.9 billion were used to purchase the 5.66% stake in Rosneft from Rosneftegaz ($4.8 billion described above plus $0.1 billion of

interest). The net cash inflow relating to the transaction included in net cash flow from investing activities in the cash flow statement was $11.8 billion.

Part of the gain arising on the disposal, amounting to $3.0 billion, was deferred due to BP selling its investment in TNK-BP to Rosneft, which in turn is

now accounted for by BP as an associate. The deferred gain will be released to BP’s income statement over time as the TNK-BP assets are

depreciated or amortized.

Investment in Rosneft

BP’s investment in Rosneft is included in the group balance sheet within investments in associates, as described in Note 1. The investment is

measured at cost less the deferred gain described above, plus post-acquisition changes in BP’s share of Rosneft’s net assets. The amount recognized

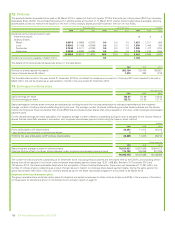

as BP’s initial investment in Rosneft was determined as shown in the table below.

$ million

Shares in Rosneft received 10,755

Shares purchased from Rosneftegaz 4,871

Value of agreements to purchase Rosneft shares accounted for as derivatives (see Note 26) (726)

Deferred gain (2,959)

Amount included in capital expenditure 11,941

Value of existing 1.25% investment in Rosneft 1,006

Investment in Rosneft on completion 12,947

The exercise to determine BP’s share of the fair value of Rosneft’s identifiable net assets and the consequent impact recognized via equity accounting

in BP’s income statement has been completed and the results are reflected in these financial statements.

148 BP Annual Report and Form 20-F 2013