BP 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Building a stronger,

safer BP

Annual Report and

Form 20-F 2013

bp.com/annualreport

Table of contents

-

Page 1

Annual Report and Form 20-F 2013 bp.com/annualreport Building a stronger, safer BP -

Page 2

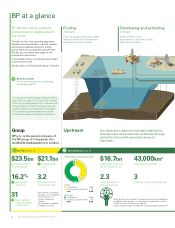

...nance, research and technology and other business functions. We have well-established operations in Europe, the US, Canada, Russia, South America, Australasia, Asia and parts of Africa. a On the basis of market capitalization, proved reserves and production. Annual Report and Form 20-F 2013 bp.com... -

Page 3

... Gulf of Mexico oil spill Corporate responsibility Our management of risk Risk factors Liquidity and capital resources Corporate governance 59 Corporate governance 60 66 69 71 72 73 74 Board of directors Executive team Governance overview How the board works Board effectiveness Shareholder... -

Page 4

...% of the assets and operations of the company and its subsidiaries that were consolidated at the date or for the periods indicated, including non-controlling interests. BP's primary share listing is the London Stock Exchange. Ordinary shares are also traded on the Frankfurt Stock Exchange in Germany... -

Page 5

... Strategic report 20 Our approach to executive directors' remuneration 22 Group performance 25 Upstream 31 Downstream 35 Rosneft 37 Other businesses and corporate 38 Gulf of Mexico oil spill 41 Corporate responsibility 41 44 47 Safety Environment and society Employees 49 Our management of risk... -

Page 6

...make ï¬nancial, strategic and operating decisions. Group BP p.l.c. is the parent company of the BP group of companies. Our worldwide headquarters is in London. See KPIs page 18. Upstream Our Upstream segment manages exploration, development and production activities through global functions with... -

Page 7

... in the year g Operating capital employed is total assets (excluding goodwill) less total liabilities, excluding ï¬nance debt and current and deferred taxation. h Includes 32MW of capacity in the Netherlands, which is managed by our Downstream segment. BP Annual Report and Form 20-F 2013 3 -

Page 8

... integrated fuels value chains, which include reï¬neries and fuels marketing businesses together with global oil supply and trading activities. We supply fuel and related convenience services to consumers at approximately 17,800 BP-branded retail sites and have operations in almost 50 countries... -

Page 9

... and onshore pipelines has made Azerbaijan a focal point of the global energy market. Rosneft Rosneft is Russia's largest oil company and the world's largest publicly traded oil company in terms of hydrocarbon production. BP's 19.75% share of Rosneft's proved reserves on an SEC basis is 5 billion... -

Page 10

...US. But the long-term supply challenge has not gone away. More energy is required to meet the needs and aspirations of a rising global population. The BP Energy Outlook projects an average increase in energy demand of 1.5% per year through to 2035. That's like adding the needs of a country twice the... -

Page 11

... shareholders, with executive pay policy now subject to a vote at the annual general meeting. BP has a record of ensuring there are clear links between strategy, performance and remuneration. This will continue. I believe diversity helps to strengthen the effectiveness of a board. We plan succession... -

Page 12

... in downstream averaged 95.3% - the highest level for 10 years. These numbers reinforce my view that safety and value have the same roots: systematic, disciplined operations, undertaken by people who respect each other and work as one team. In terms of capital discipline, in 2013 we invested $24... -

Page 13

...separate BP business to manage our onshore oil and gas assets, which we believe will help to unlock the signiï¬cant value associated with our extensive resource position there. Our reserves replacement ratio was 129% of production. When we include the net growth in our Russian portfolio as a result... -

Page 14

... late 2014. It is expected to bring total capacity at the site to more than 2.7 million tonnes per year. Thunder Horse in the Gulf of Mexico is one of the largest integrated offshore drilling and production platforms in the world. Population and economic growth are the main drivers of global energy... -

Page 15

... biofuels. Source: BP Energy Outlook 2035. Nuclear Coal Gas Oil Air BP is one of the world's largest aviation fuels suppliers, marketing aviation fuels and specialist products in more than 45 countries. It sells over seven billion gallons of fuel per year. BP Annual Report and Form 20-F 2013 11 -

Page 16

... success as a group is to act in the long-term interests of our shareholders, our partners and society. We aim to create value for our investors and beneï¬ts for the communities and societies in which we operate, with the responsible supply of energy playing a vital role in economic development... -

Page 17

... gas value chains. And, with our downstream businesses, we plan to leverage our newly upgraded assets, customer relationships and technology to grow free cash ï¬,ow. Our strategy in action See page 14 for more information on how we are going to measure our progress. 10-point plan 2011-2014 In... -

Page 18

... execution Delivering energy to the world Grow our exploration position Focus on high-value upstream assets Grow our exploration position Focus on high-value upstream assets Quality portfolio Build high-quality downstream businesses Build high-quality downstream businesses Advanced technology... -

Page 19

... events. Operating cash ï¬,ow, gearinga, total shareholder return, replacement cost proï¬t (loss) per ordinary share. Major project delivery. Strategy in action in 2013 A commitment to safe operations Toledo reï¬nery sets a safety record. See page 42. Maximizing value at Mad Dog Changing plans to... -

Page 20

... and research technology to government affairs, trading, marketing, legal and others. And our approach to professional development programmes and training helps build individual capabilities, reducing a potential skills gap. This is vital in a world where oil and gas companies face an increasing... -

Page 21

... needed to address complex issues, work effectively with our partners and help create shared value. Universities and research institutions National and international oil companies In t Banks and providers of ï¬nance er na l r e l a ti o n s ps hi Governments and regulators BP Industry bodies... -

Page 22

... are not investing or ï¬nancing activities. 2013 performance Higher operating cash ï¬,ow in 2013 reï¬,ected a lower cash outï¬,ow relating to the Gulf of Mexico oil spill, partly offset by higher cash outï¬,ows as a result of working capital build. Our gearing (net debt ratio) shows investors how... -

Page 23

... and sustainable dividend policy. 2013 performance TSR grew as a result of increases in both the BP share price and in the dividend, with the improvement for ordinary shares slightly offset by exchange rate effects. Proved reserves replacement ratio is the extent to which the year's production has... -

Page 24

... high calibre executives. The largest components are share based and vest over a number of years - further aligning executives' interests with those of our shareholders. Directors' remuneration report See bp.com/remuneration and page 81. Salary Reï¬,ects scale and dynamics of the business. Annual... -

Page 25

Strategic report 3 Long-term based The structure of pay is designed to reï¬,ect the long-term nature of BP's business and the signiï¬cance of safety and environmental risks. The largest components of total remuneration are share based and vest over the longest period. The deferred bonus plan ... -

Page 26

... water, gas value chains, giant ï¬elds and high-quality downstream businesses. Increasing overall operating cash ï¬,owe by 50% in 2014 compared with 2011.f We are on track to meet our goal of generating more than $30 billion of operating cash ï¬,ow in 2014. We expect to use around half of the extra... -

Page 27

... Segment RC proï¬t (loss) before interest and tax ($ billion) Downstream Upstream Other businesses Gulf of Mexico and corporate oil spill Group RC proï¬t (loss) before interest and tax 45 35 25 15 5 (5) (15) (25) (35) (45) TNK-BP Unrealized proï¬t in inventory Rosneft 2009 2010 2011 2012... -

Page 28

...Gulf of Mexico oil spill, net operating cash ï¬,ow in 2013 was $21.2 billion (2012 $22.9 billion, 2011 $29.0 billion). Shareholder distributions Total dividends paid in 2013 were 36.5 cents per share, up 11% compared with 2012 on a dollar basis and 12% in sterling terms. This equated to a total cash... -

Page 29

... global functions with specialist areas of expertise: technology, ï¬nance, procurement and supply chain, human resources and information technology. Technologies such as seismic imaging, enhanced oil recovery and real-time data support our upstream strategy by helping to gain new access, increasing... -

Page 30

... for oil consumption, by supply growth in North America, and OPEC production decisions. Risks to supply remain a key uncertainty. c d From Oil Market Report 21 January 2014 ©, OECD/IEA 2014, page 1. BP Statistical Review of World Energy June 2013. 26 BP Annual Report and Form 20-F 2013 -

Page 31

...Corridor so that gas can be moved directly from Azerbaijan to Europe for the ï¬rst time, helping to increase the energy security of European markets. With a total investment of more than $28 billion, this project will involve the construction and integration of activity related to 26 wells, two new... -

Page 32

...11 countries. Exploration expense Total exploration expense of $3,441 million (2012 $1,475 million, 2011 $1,520 million) included the write-off of expenses related to unsuccessful drilling activities in Brazil ($388 million), the UK North Sea ($262 million), Angola ($232 million), the Gulf of Mexico... -

Page 33

... in oil equivalent terms and includes changes resulting from revisions to previous estimates, improved recovery and extensions and discoveries. For 2013 the proved reserves replacement ratio for the Upstream segment, excluding acquisitions and disposals, was 93% for subsidiaries and equity-accounted... -

Page 34

... It also generates margins and fees from selling physical products and derivatives to third parties, together with income from asset optimization and trading. The integrated supply and trading function manages the group's trading activities in natural gas, power and NGLs. This means we have a single... -

Page 35

...fuels marketing businesses and global oil supply and trading activities. We sell reï¬ned petroleum products including gasoline, diesel, aviation fuel and LPG. • Lubricants - manufactures and markets lubricants and related products and services globally, adding value through brand, technology and... -

Page 36

... Margins in 2013 declined primarily due to increased product and gasoline supply, high gasoline inventories, competitor capacity additions and lower seasonal turnarounds. Financial performance 2013 2012 $ million 2011 Sale of crude oil through spot and term contracts Marketing, spot and term sales... -

Page 37

... weaker product margins resulting from over supply in certain markets partially offset by lower turnaround activity in the US and Europe. Our petrochemicals productiona of 13,943 thousand tonnes (kte) in 2013 was lower than the previous two years (2012 14,727kte, 2011 14,866kte) due to the sale of... -

Page 38

... normal course of business. Retail sites are primarily branded BP, ARCO and Aral. Excludes our interests in equity-accounted entities that are dual-branded. Supply and trading BP's integrated supply and trading function is responsible for delivering value across the overall crude and oil products... -

Page 39

... business continued to increase the proportion of total sales resulting from premium product sales; in 2013 the percentage of premium sales was 40% compared with 39% in 2012 and 37% in 2011. In January 2014, BP announced that it had agreed to sell its specialist global aviation turbine oils business... -

Page 40

... The Rosneft segment result includes equityaccounted earnings from Rosneft, representing BP's share in Rosneft and foreign currency effects on the dividends received in 2013. For more information on the sale and purchase agreements, see Financial statements - Note 6. $ million 2013a Production (net... -

Page 41

... value through optimizing and managing cash ï¬,ows and the short-term investment of operational cash balances. Trading activities are underpinned by the compliance, control and risk management infrastructure common to all BP trading activities. For further information, see Financial statements... -

Page 42

...and oil spill. Since May 2010, more than 240 initial and amended work plans have been developed by state and federal trustees and BP to study resources and habitat. The study data will inform an assessment of injury to natural resources in the Gulf of Mexico and the development of a restoration plan... -

Page 43

... volume of oil spilled and the application of statutory penalty factors. Civil claims BP p.l.c., BP Exploration & Production Inc. (BPXP - the BP group company that conducts exploration and production operations in the Gulf of Mexico) and various other BP entities have been among the companies named... -

Page 44

..., the total cumulative charges recognized to date amount to $42.7 billion. BP has provided for spill response costs, environmental expenditure, litigation and claims and Clean Water Act penalties that can be measured reliably. At 31 December 2013, provisions related to the Gulf of Mexico oil spill... -

Page 45

... of the business. In addition, the group operations risk committee (GORC) reviews safety and risk management across BP. The board's safety, ethics and environment assurance committee (SEEAC) receives updates from the group chief executive and the head of S&OR on management plans associated with the... -

Page 46

... outstanding recommendations relate to well control and well integrity, drilling and competence, the management of risk and change, and blowout preventers. The board's safety, ethics and environment assurance committee monitors BP's global implementation of the measures recommended in the Bly Report... -

Page 47

...2012, BP has retained a process safety monitor for a term of up to four years from February 2014. The process safety monitor will review and provide recommendations concerning BP Exploration & Production Inc's process safety and risk management procedures for deepwater drilling in the Gulf of Mexico... -

Page 48

... -0.2 49.2 50.0 2012 direct GHG Real sustainable reductions Acquisitions Operational changes Managing our impacts At a group level, we review our management of material issues such as GHG emissions, water, oil spill response, sensitive and protected areas and human rights annually. Using our... -

Page 49

...to help inform oil spill response planning. Sensitivity mapping helps us to identify the various types of habitats, resources and communities that could potentially be impacted by oil spills and develop appropriate response strategies. Sensitivity mapping is conducted around the world and in 2013 we... -

Page 50

... reach the standards needed to supply BP and other organizations through training and sharing of our standards in areas such as health and safety. BP's social investments, the contributions we make to social and community programmes in locations where we operate, support development activities that... -

Page 51

... functions - to be women by 2020. Workforce by gender Numbers as at 31 December Male Female Female % Strategic report Safety Respect Excellence Courage One Team BP headcount Number of employees at 31 December a US Non-US Total 2013 Upstream Downstream Other businesses and corporate Gulf Coast... -

Page 52

... 67%). Business leadership teams review the results of the survey and agree actions to address identiï¬ed issues. In 2013, safety scores remained strong and there was an increase in employees' understanding of the operating management system, an area of focus identiï¬ed in the previous year. While... -

Page 53

... strategy of meeting the world's energy needs responsibly while creating long-term shareholder value; these risks are described in the Risk factors on page 51. Our management systems, organizational structures, processes, standards, code of conduct and behaviours together form a system of internal... -

Page 54

...; management strategy and actions to restore the group's reputation in the US; and compliance with government settlement agreements arising out of the accident and oil spill. See Legal proceedings page 257 and Gulf of Mexico committee page 78 for further information. Safety and operational risks... -

Page 55

... 10-point plan. The risks are categorized against the following areas: strategic and commercial; compliance and control; and safety and operational. In addition, we have set out one separate risk for your attention - the risk resulting from the 2010 Gulf of Mexico oil spill. Prices and markets - BP... -

Page 56

...to loss of opportunity, loss of value and higher capital expenditure. Reserves progression - inability to progress upstream resources in a timely manner could adversely affect our long-term replacement of reserves and negatively impact our business. Successful execution of our group strategy depends... -

Page 57

... review and report to the probation ofï¬cer, the DoJ, and BP regarding BP Exploration & Production's (BPXP) compliance with the key terms of the settlement including the completion of safety and environmental management systems audits, operational oversight enhancements, oil spill response training... -

Page 58

... changes to our drilling operations, exploration, development and decommissioning plans, impact our ability to capitalize on our assets and limit our access to new exploration properties or operatorships, particularly in the deepwater Gulf of Mexico. We buy, sell and trade oil and gas products... -

Page 59

... Gulf of Mexico oil spill. The occurrence of any such risks could have a consequent material adverse impact on the group's business, competitive position, cash ï¬,ows, results of operations, ï¬nancial position, prospects, liquidity, shareholder returns and/or implementation of the group's strategic... -

Page 60

...'s long-term credit ratings are A (positive outlook) from Standard & Poor's, and A2 (stable outlook) from Moody's Investor Services, both remaining unchanged during 2013. We increased our ï¬nancial ï¬,exibility in 2013 with the completion of the sale of BP's 50% share in TNK-BP to Rosneft in return... -

Page 61

...expenditures relating to the Gulf of Mexico oil spill and the implications for future activities. See Risk factors on page 51 and Financial statements - Note 2 for further information. Cash ï¬,ow The following table summarizes the group's cash ï¬,ows. $ million 2013 2012 2011 Strategic report Off... -

Page 62

... years, $4 billion has been contributed to funded pension plans. This is reï¬,ected in net cash provided by operating activities in the table above. The Strategic report was approved by the board and signed on its behalf by David J Jackson, Company Secretary on 6 March 2014. 58 BP Annual Report... -

Page 63

... time commitment Independence and conï¬,icts of interest Succession Board activity Risk and assurance International advisory board Corporate governance 72 Board effectiveness 72 73 Induction and board learning Board evaluation 73 Shareholder engagement 73 73 73 73 Institutional investors Private... -

Page 64

Board of directorsa As at 6 March 2014 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Key to portraits 1 5 9 13 Carl-Henric ...Gilvary 4 Admiral Frank Bowman 8 George David 12 Brendan Nelson a The ages of the board are correct as at 31 December 2013. 60 BP Annual Report and Form 20-F 2013 -

Page 65

... executive on 1 October 2010. Bob joined Amoco Corporation in 1979, working in a variety of engineering and commercial posts. Between 1994 and 1997, he worked on corporate development in Russia. In 1997, he became general manager for strategy for Amoco and in 1999, following the merger between BP... -

Page 66

... global oil and gas industry and of the US business environment has beneï¬ted the board, the SEEAC and the Gulf of Mexico committee. He has actively supported the work of the BP Massachusetts Institute of Technology (MIT) academy. He has led the SEEAC on several visits to the company's operations... -

Page 67

... active member of the audit, remuneration and Gulf of Mexico committees, bringing a strong US and global view to their deliberations. Iain Conn Chief executive, Downstream Tenure Appointed to the board 1 July 2004 (9 years) Group responsibilities Manufacturing, logistics, marketing operations of BP... -

Page 68

... director of TNK-BP over two periods, from 2003 to 2005 and from 2010 until the sale of the business and acquisition of Rosneft equity in 2013. From 2005 until 2009 he was chief executive of the integrated supply and trading function, BP's commodity trading arm. In 2010 he was appointed deputy group... -

Page 69

...the audit committee in meeting the many challenges from increased changes to regulation. He stepped down as group chief executive of MTN Group at the end of March 2011. He was formerly a director of a number of listed South African companies, including Johnnic Holdings (formerly a subsidiary of the... -

Page 70

... and deepwater Gulf of Mexico including petroleum engineer, ï¬eld manager, operations manager, resource manager, and asset manager. In addition, he worked on the Vastar integration team. a The ages of the executive team are correct as at 31 December 2013. 66 BP Annual Report and Form 20-F 2013 -

Page 71

... Bernard Looney is responsible for production operations, drilling, engineering, procurement and supply-chain management, as well as health, safety and environment in the upstream. Bernard joined BP in 1991 as a drilling engineer, working in the North Sea, Vietnam and the Gulf of Mexico. In 2001... -

Page 72

... of positions. In 1993, he became general manager for the Arkoma Basin, and in 1997 moved into the role of business unit leader for the Gulf of Mexico Shelf. During 1998-2000, he worked on the BP-Amoco merger and served as head of strategy and planning for the worldwide exploration and production... -

Page 73

... and auditor review. The board's statement on the report is outlined on page 116. It has been another challenging year, but one where the board has continued to work well and learn. I look forward to 2014. Corporate governance Safety, strategy, project selection and project execution have been... -

Page 74

... number of meetings the director did attend. C Committee chairman. * Includes a joint Audit Committee-SEEAC meeting to review BP's system of internal control and risk management. 1 2 Paul Anderson was unable to attend the Gulf of Mexico committee meeting on 25 September 2013 due to a late change... -

Page 75

..., timely and clear information to enable the board to operate effectively. • Is responsible for the integrity and effectiveness of the BP board's system of governance. The group chief executive Bob Dudley • Is responsible for day-to-day management of the group. • Chairs the executive team... -

Page 76

...point plan and geopolitical risk associated with BP's operations around the world. The board's monitoring committees (audit, safety, ethics and environment assurance and Gulf of Mexico committees) were also allocated a number of group risks for review over the year: these are outlined in the reports... -

Page 77

... on the company's performance, governance and remuneration. An annual investor event was held in March 2013 with the chairman and chairs of the board committees. This meeting enables BP's largest shareholders to hear about the work of the board and its committees, and for non-executive directors to... -

Page 78

... held on the UK government programme on cyber-security, global trends in fraud and corruption and developments in oil and gas accounting. Financial disclosure The committee reviewed the quarterly, half-year and annual ï¬nancial statements with management, focusing on the integrity and clarity of... -

Page 79

... Gulf of Mexico oil spill with management and the external auditors, including as part of the review of BP's stock exchange announcement at each quarter end. The committee examined developments relating to the interpretation of the business economic loss claims element of the company's settlement... -

Page 80

... services related to ï¬nancial records. Financial information systems design and implementation. Appraisal, valuation, fairness opinions, contribution in-kind. Actuarial services. Internal audit outsourcing. Management functions. HR functions. Broker-dealer, investment advisor, banking services... -

Page 81

... and experience of the company is important. A two-tier system for approval of audit-related and non-audit work operates. For services relating to accounting, auditing and ï¬nancial reporting matters, internal accounting and risk management control reviews or non-statutory audit, the committee has... -

Page 82

... of legal and licence-to-operate risks arising out of the Deepwater Horizon accident and oil spill. The committee's work is integrated with that of the board, which retains ultimate accountability for oversight of the group's response to the accident. 78 BP Annual Report and Form 20-F 2013 -

Page 83

...including the strategy connected with settlements and claims. • Review the environmental work to remediate or mitigate the effects of the oil spill in the waters of the Gulf of Mexico and on the affected shorelines. • Oversee management strategy and actions to restore the group's reputation in... -

Page 84

... A number of issues relating to the company's strategy in the light of the views of shareholders and the market more generally. • The chief executive's succession plans for the executive team and senior leaders. The committee also considered the organization and operation of the executive team... -

Page 85

Directors' remuneration report 82 84 Chairman's annual statement 2013 annual report on remuneration 84 95 Executive directors Non-executive directors 96 Directors' remuneration policy 96 107 Executive directors Non-executive directors Corporate governance BP Annual Report and Form 20-F 2013 ... -

Page 86

.... Overall group performance exceeded annual plan levels and resulted in a score of 1.32 times target. Performance was assessed relative to metrics set at the start of the year and reï¬,ecting the company's strategy and key performance indicators. Safety and operational risk management accounted for... -

Page 87

.... Our remuneration system has worked appropriately during difï¬cult times, and I am conï¬dent it will continue to do so as and when performance returns to healthy sustained levels. Antony Burgmans Chairman of the remuneration committee 6 March 2014 Corporate governance Remuneration - the... -

Page 88

...30% on safety and operational risk (S&OR) management and 70% on restoring value. S&OR results were good both in terms of improvement and overall standard. Similarly, performance relative to value measures was overall better than the annual plan. Overall group outcome was 1.32 times target level. The... -

Page 89

... the plan and includes re-invested dividends on shares vested. In accordance with UK regulations, the vesting price of the assumed vesting is the average market price for the fourth quarter of 2013 which was £4.69 for ordinary shares and $45.52 for ADSs. d Represents the annual increase in accrued... -

Page 90

... 1.32 score for group purposes. In the Downstream segment, safety results were good with improvement in most areas of process and personal safety. Performance related to value measures was negatively impacted by compression of fuel margins and so operating cash ï¬,ow was below plan level, but other... -

Page 91

...will be based on group results. Iain Conn will again have 70% of his bonus determined on group results and 30% on his Downstream segment results. 2014 annual bonus measures Measures KPI Weight Link to strategy Corporate governance Safety and operational risk management Loss of primary containment... -

Page 92

...fourth or ï¬fth place of the peer group. 2011-2013 performance shares outcome Measures Weight Threshold Outcomes Max Result % of max Total shareholder return Reserves replacement Strategic imperatives Safety and operational risk management Rebuilding external reputation Staff alignment and morale... -

Page 93

... 2014-2016 performance share plan will be based on the same measures as used last year and remain aligned directly with the company's strategic priorities and KPIs. Link to strategy Total shareholder return Operating cash ï¬,ow Strategic imperatives Safety and operational risk management Reserves... -

Page 94

...operation Salary review Executive directors Executive team and group leaders Annual bonus Assess performance Determine bonus for 2012 Review measures for 2014 Agree measures and targets for 2014 Long-term equity plans Assess performance Determine vesting of 2010-2012 plans Agree awards for 2013-2015... -

Page 95

... plan prior to his appointment as a director. The vesting of these shares is subject to performance conditions. c On retirement at 11 April 2013. Corporate governance At 24 February 2014, the following directors held the numbers of options under the BP group share option schemes over ordinary... -

Page 96

...See Financial statements - Note 31 for further information. d Capital investment reï¬,ects organic capital expenditure. See footnote d on page 236 for further information. 2008 2009 2010 2011 2012 2013 This graph shows the growth in value of a hypothetical £100 holding in BP p.l.c. ordinary shares... -

Page 97

...received awards in the form of ADSs. The above numbers reï¬,ect calculated equivalents in ordinary shares. One ADS is equivalent to six ordinary shares. c The face value has been calculated using the market price of ordinary shares on 8 March 2012 of £4.94. d The market price at closing of ordinary... -

Page 98

... as a director and are not subject to performance conditions. SAYE = Save As You Earn all employee share scheme. a Numbers shown are ADSs under option. One ADS is equivalent to six ordinary shares. b Options exercised on 6 February 2013. Market price at closing for information. Shares were sold... -

Page 99

...' annual report on remuneration with details for non-executive directors. There were no changes following the review of non-executive remuneration undertaken in 2012 which benchmarked the structure and fees of BP non-executive directors against the 10 largest companies by market capitalization in... -

Page 100

... executive director remuneration is linked to success in implementing the company's strategy. Performance related: The major part of total remuneration varies with performance, with the largest elements being share based, further aligning with shareholders' interests. Long term: The structure of pay... -

Page 101

... group chief executive. Employees are not consulted directly by the committee when making policy decisions although feedback from employee surveys provide views on a wide range of points including pay which are regularly reported to the board. The committee has a long-standing and active programme... -

Page 102

... the largest part of remuneration to long-term performance. The level varies according to performance relative to measures linked directly to strategic priorities. See page 102. • Shares up to a maximum value of five and a half times salary for the group chief executive and four times salary... -

Page 103

... salary increases. Changes to policy No change to policy. Corporate governance • S pecific measures and targets are determined each year by the remuneration committee. • A proportion will be based on safety and operational risk management and is likely to include measures such as loss... -

Page 104

...an on-target level for executive directors. 100 BP Annual Report and Form 20-F 2013 Performance measures The measures used to determine bonus results will derive from the annual plan and support the strategic priorities of safety and operational risk (S&OR) management and reinforcing value creation... -

Page 105

... and environmental standards over the long term is a good qualitative reï¬,ection of the sustainability of the business. • This non-ï¬nancial hurdle complements the ï¬nancial and operational performance conditions applicable to performance share awards. BP Annual Report and Form 20-F 2013 101 -

Page 106

...-12 2011-13 Performance measures Performance measures will be aligned to BP's strategy that focuses on value creation and reinforcing safety and operational risk management. Vesting of a portion of shares will be based on our total shareholder return (TSR) compared to other oil majors, reï¬,ecting... -

Page 107

... all other BP (US) qualiï¬ed and non-qualiï¬ed pension arrangements. The beneï¬t payable under SERB is unreduced at age 60 but reduced by 5% per year if separation occurs before age 60. Beneï¬ts payable under this plan are unfunded and therefore paid from corporate assets. UK executive directors... -

Page 108

.... Bob Dudley ($ thousand) Fixed $20,000 Annual Long term 76% Calculation assumptions Minimum Fixed components only • Current salary and taxable beneï¬ts. • Pension value of one year's service using current salary for US and cash in lieu for UK. - UK 35% x salary. - US 1.3% x salary x 20. 12... -

Page 109

... following contractual beneï¬ts: • A company car and chauffeur for business and private use, on terms that the company bear all normal servicing, insurance and running costs. Alternatively, the executive director is entitled to a car allowance in lieu. BP Annual Report and Form 20-F 2013 105 -

Page 110

...director and chairman of the ethics committee Unilever Audit committee member 0 £82,000 Unilever PLC £19,375 Unilever NV e22,990 a b Bob Dudley holds this appointment as a result of the company's shareholding in Rosneft. On retirement at 11 April 2013. 106 BP Annual Report and Form 20-F 2013 -

Page 111

... report describes the separate policies of the BP board for the remuneration of the chairman and the non-executive directors (NEDs). to £5 million if resolution 20 at the 2014 AGM is duly passed. • NEDs should not receive share options, bonuses or retirement beneï¬ts from the company... -

Page 112

...matters. The maximum remuneration for non-executive directors is set in accordance with the Articles of Association. This directors' remuneration report was approved by the board and signed on its behalf by David J Jackson, company secretary on 6 March 2014. 108 BP Annual Report and Form 20-F 2013 -

Page 113

... information 110 Internal Control Revised Guidance for Directors (Turnbull) 110 Corporate governance practices 111 Code of ethics 111 Controls and procedures 111 Principal accountants' fees and services Corporate governance 112 Memorandum and Articles of Association BP Annual Report and Form... -

Page 114

... audit, Gulf of Mexico and safety, ethics and environment assurance committees requested, received and reviewed reports from executive management, including management of the business segments, corporate activities and functions, at their regular meetings. In considering the systems, the board noted... -

Page 115

... registered public accounting ï¬rm, as stated in their report appearing on page 121 of BP Annual Report and Form 20-F 2013. Corporate governance Code of ethics The company has adopted a code of ethics for its group chief executive, chief ï¬nancial ofï¬cer, group controller, general auditor... -

Page 116

...nancial reporting matters; internal accounting and risk management control reviews (excluding any services relating to information systems design and implementation); non-statutory audit; project assurance and advice on business and accounting process improvement (excluding any services relating to... -

Page 117

... general meeting is 14 days subject to the company obtaining annual shareholder approval, failing which, a 21-day notice period will apply. Corporate governance Liquidation rights; redemption provisions In the event of a liquidation of BP, after payment of all liabilities and applicable deductions... -

Page 118

... or the company's Memorandum or Articles of Association on the right of non-residents or foreign persons to hold or vote the company's ordinary shares or BP ADSs, other than limitations that would generally apply to all of the shareholders and limitations applicable to certain countries and persons... -

Page 119

... and production activities Movements in estimated net proved reserves 201 207 Standardized measure of discounted future net cash flows and changes therein relating to proved oil and gas reserves Operational and statistical information 219 222 224 Parent company financial statements of BP... -

Page 120

... generally accepted accounting practice, give a true and fair view of the assets, liabilities, financial position, performance and cash flows of the company; and • the management report, which is incorporated in the strategic report and directors' report, includes a fair review of the development... -

Page 121

... statements of BP p.l.c for the year ended 31 December 2013 comprise the group income statement, the group statement of comprehensive income, the group statement of changes in equity, the group balance sheet, the group cash flow statement and the related notes 1 to 38. The financial reporting... -

Page 122

... to address the risks of material misstatement identified above. Together with the group functions, which are also subject to audit, these locations represent the principal business units of the group and account for 75% (2012 72%) of the group's total assets and 84% (2012 72%) of the group's profit... -

Page 123

... relating to the company's compliance with the nine provisions of the UK Corporate Governance Code specified for our review. Other matter We have reported separately on the parent company financial statements of BP p.l.c. for the year ended 31 December 2013 and on the information in the Directors... -

Page 124

... Public Accounting Firm on the Annual Report on Form 20-F The Board of Directors and Shareholders of BP p.l.c. We have audited the accompanying group balance sheets of BP p.l.c. as of 31 December 2013, 31 December 2012 and 1 January 2012, and the related group income statement, group statement... -

Page 125

... the standards of the Public Company Accounting Oversight Board (United States), the group balance sheets of BP p.l.c. as of 31 December 2013 and 2012, and the related group income statement, group statement of comprehensive income, group statement of changes in equity and group cash flow statement... -

Page 126

... on the restatement of comparative amounts as a result of the adoption of IFRS 11 'Joint Arrangements' and the amended IAS 19 'Employee Benefits'. See Note 2 for information on the impact of the Gulf of Mexico oil spill on these income statement line items. 122 BP Annual Report and Form 20-F 2013 -

Page 127

... value payment reserve reserve Profit and loss account NonBP shareholders' controlling interests equity Total equity At 1 January 2013 Profit for the year Other comprehensive income Total comprehensive income Dividends Repurchases of ordinary share capital Share-based payments, net of tax Share... -

Page 128

... 1,105 130,407 See Note 1 for information on the restatement of comparative amounts as a result of the adoption of IFRS 11 'Joint Arrangements' and the amended IAS 19 'Employee Benefits'. C-H Svanberg Chairman R W Dudley Group Chief Executive 6 March 2014 124 BP Annual Report and Form 20-F 2013 -

Page 129

...) loss on sale of businesses and fixed assets Earnings from joint ventures and associates Dividends received from joint ventures and associates Interest receivable Interest received Finance costs Interest paid Net finance expense relating to pensions and other post-retirement benefits Share-based... -

Page 130

... contingencies related to the Gulf of Mexico oil spill, pensions and other post-retirement benefits and taxation. Basis of consolidation The group financial statements consolidate the financial statements of BP p.l.c. and the entities it controls (its subsidiaries) drawn up to 31 December each year... -

Page 131

... by the relevant accounting standard, and the investment is therefore accounted for as an associate. BP's share of Rosneft's oil and natural gas reserves is included in the estimated net proved reserves of equity-accounted entities. Financial statements BP Annual Report and Form 20-F 2013 127 -

Page 132

... information. BP's investment in Rosneft is reported as a separate operating segment since that date, reflecting the way in which the investment is managed. A separate organization within the group deals with the ongoing response to the Gulf of Mexico oil spill. This organization reports directly... -

Page 133

... to have exploration wells and exploratory-type stratigraphic test wells remaining suspended on the balance sheet for several years while additional appraisal drilling and seismic work on the potential oil and natural gas field is performed or while the optimum development plans and timing are... -

Page 134

... flows are adjusted for the risks specific to the asset group and are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money. Fair value less costs to sell is identified as the price that would be received to sell the asset... -

Page 135

... management's best estimate of future oil and natural gas prices and reserves volumes. Prices for oil and natural gas used for future cash flow calculations are based on market prices for the first five years and the group's long-term price assumptions thereafter. As at 31 December 2013, the group... -

Page 136

... losses, foreign exchange gains or losses and any changes in fair value arising from revised estimates of future cash flows, which are recognized in profit or loss. Impairment of financial assets The group assesses at each balance sheet date whether a financial asset or group of financial assets... -

Page 137

... debt-related derivatives in the normal course of business. In addition, the financial statements reflect the application of cash flow hedge accounting to certain of the contracts signed in October 2012 for BP to sell its investment in TNK-BP and obtain an additional shareholding in Rosneft, which... -

Page 138

...amount of the associated restoration, environmental or other provision and the group's share of the fair value of the net assets of the fund available to contributors. Significant estimate or judgement Detailed information on the Gulf of Mexico oil spill, including the financial impacts, is provided... -

Page 139

... information), and we now apply the same rate of return on plan assets as we use to discount our pension liabilities. The impact of this change on key financial statement line items is shown at the end of this note. The pension and other post-retirement benefit assumptions at 31 December 2013, 2012... -

Page 140

..., sale, issue or cancellation of equity shares. Shares repurchased under the share buy-back programme which are immediately cancelled are not shown as treasury shares or own shares, but are shown as a deduction from the profit and loss reserve in the group statement of changes in equity. Revenue... -

Page 141

...) relating to pensions and other post-retirement benefits Profit for the year Earnings per share - cents Profit for the year attributable to BP shareholders Basic Diluted Balance sheet Property, plant and equipment Intangible assets Investments in joint ventures Net assets Cash flow statement Profit... -

Page 142

...is shown in BP Financial and Operating Information 2008-2012 available on bp.com/investors. Other standards A number of other new or amended standards have been adopted by the group with effect from 1 January 2013 but do not have a significant impact on the financial statements. These include: IFRS... -

Page 143

... BP considers are not possible, at this time, to measure reliably. For further information, including developments in relation to the interpretation of business economic loss claims under the Plaintiffs' Steering Committee (PSC) settlement, see Provisions and contingent liabilities below. The total... -

Page 144

... - Gulf of Mexico oil spill - continued reimbursement asset during the period to 31 December 2013. The net increase in the provision of $1,542 million for the full year relates principally to business economic loss claims processed by the DHCSSP subsequent to finalization of the BP Annual Report and... -

Page 145

...issuance of final determination notices and payments of business economic loss claims will be lifted when the matter is transferred back to the District Court; the timing of this would be affected by the status of any such petition by BP. BP Annual Report and Form 20-F 2013 141 Financial statements -

Page 146

...-quarter 2010 interim financial statements. At the time that charge was taken, the latest estimate from the intra-agency Flow Rate Technical Group created by the National Incident Commander in charge of the spill response was between 35,000 and 60,000 barrels per day. The mid-point of that range... -

Page 147

.... In January 2013, the States of Alabama, Mississippi and Florida submitted or asserted claims to BP under OPA 90 for alleged losses including economic losses and property damage as a result of the Gulf of Mexico oil spill. BP is evaluating these claims. The States of Louisiana and Texas have also... -

Page 148

...in relation to the Gulf of Mexico oil spill. The costs charged in 2013 relate primarily to the ongoing costs of operating the Gulf Coast Restoration Organization (GCRO) and increases in legal costs. Finance costs of $39 million (2012 $19 million) reflect the unwinding of the discount on payables and... -

Page 149

... central North Sea were classified as held for sale. In the Downstream segment, the Texas City refinery and related assets, and the southern part of the US West Coast fuels value chain, including the Carson refinery, were classified as held for sale at 31 December 2012. BP's investment in TNK-BP was... -

Page 150

... number of interests in the Gulf of Mexico to Marubeni Group. Downstream In 2013, gains resulted from the disposal of our global LPG business and closing adjustments on the sales of the Texas City and Carson refineries with their associated marketing and logistics assets. Losses principally resulted... -

Page 151

...-retirement benefit plan curtailment gains of $109 million. In 2011 a $278-million gain was not recognized in the income statement as it represented an unrealized gain on the sale of business assets in Vietnam to our former associate TNK-BP. Consideration received from prior year business disposals... -

Page 152

... Rosneft directly rather than receiving and immediately paying $8.3 billion in cash; however, the net result was the same. BP accounts for its investment in Rosneft as an associate, and so equity accounts for its share of Rosneft's earnings, production and reserves. See Note 18 for more information... -

Page 153

... of pension and other post-retirement benefit plans are allocated to Other businesses and corporate. However, the periodic expense relating to these plans is allocated to the other operating segments based upon the business in which the employees work. Certain financial information is provided... -

Page 154

...million 2013 Other businesses and corporate Gulf of Mexico oil spill response Consolidation adjustment and eliminations By segment Upstream Downstream Rosneft TNK-BP Total group Segment revenues Sales and other operating revenues Less: sales and other operating revenues between segments Third... -

Page 155

... 2012 Other businesses and corporate Gulf of Mexico oil spill response Consolidation adjustment and eliminations By segment Upstream Downstream TNK-BP Total group Segment revenues Sales and other operating revenues Less: sales and other operating revenues between segments Third party sales... -

Page 156

... corporate Gulf of Mexico oil spill response Consolidation adjustment and eliminations By segment Upstream Downstream TNK-BP Total group Segment revenues Sales and other operating revenues Less: sales and other operating revenues between segments Third party sales and other operating revenues... -

Page 157

... tax assets and defined benefit pension plan surpluses. $ million 2012 Financial statements By geographical area US Non-US Total Revenues Third party sales and other operating revenuesa Other income statement items Production and similar taxes Results Replacement cost profit before interest... -

Page 158

... of discount on other payables relating to the Gulf of Mexico oil spill was $38 million (2012 $12 million and 2011 $52 million). See Note 2 for further information on the financial impacts of the Gulf of Mexico oil spill. 9. Operating leases In the case of an operating lease entered into by BP as... -

Page 159

...the Upstream segment. At 31 December 2013, the future minimum lease payments relating to drilling rigs amounted to $8,776 million (2012 $8,527 million). Financial statements Commercial vehicles hired under operating leases are primarily railcars. Retail service station sites and office accommodation... -

Page 160

... or lower ratesa Tax reported in equity-accounted entities Adjustments in respect of prior years Movement in deferred tax not recognized Tax incentives for investment Gulf of Mexico oil spill non-deductible costs Permanent differences relating to disposalsb Foreign exchange Other Effective tax rate... -

Page 161

...the period 2015-2021. Other deductible temporary differences of $0.7 billion are expected to expire in the period 2014-2020, the remainder do not have an expiry date. $ billion Benefit of previously unrecognized deferred tax on current year tax charge 2013 2012 2011 Current tax benefit relating... -

Page 162

... 2013 and 18 February 2014, the latest practicable date before the completion of these financial statements, there was a net decrease of 171,061,543 in the number of ordinary shares outstanding as a result of share issues in relation to employee share-based payment plans. During the same period... -

Page 163

...are ordinary share equivalents (one ADS is equivalent to six ordinary shares). There has been a net decrease of 32,378,757 in the number of potential ordinary shares in relation to employee share-based payment plans between 31 December 2013 and 18 February 2014. BP Annual Report and Form 20-F 2013... -

Page 164

...service stations Land and land improvements Buildings Oil and gas properties Transportation Total Cost At 1 January 2013 Exchange adjustments Additions Acquisitions Transfers Deletions At 31 December 2013 Depreciation At 1 January 2013 Exchange adjustments Charge for the year Impairment losses... -

Page 165

... account any specific risks relating to the country where the cash-generating unit is located. The rate to be applied to each country is reassessed each year. Discount rates of 12% and 14% have been used for goodwill impairment calculations performed in 2013 (2012 12% and 14%). The business segment... -

Page 166

... in 2013 given the passage of time since 2009. There was no significant change in the outcome of this test compared to that in 2009. The key assumptions to which the calculation of the value in use for the Lubricants unit is most sensitive are operating margins, sales volumes, and discount rate... -

Page 167

... summarized financial information relating to the group's share of joint ventures. $ million 2013 2012 2011 Sales and other operating revenues Profit before interest and taxation Finance costs Profit before taxation Taxation Profit for the year Other comprehensive income Total comprehensive... -

Page 168

... financial information for the group's associates as it relates to the amounts recognized in the group income statement and on the group balance sheet. $ million Earnings from associates - after interest and tax 2013 2012 2011 2013 2012 Investments in associates 2011 Rosneft TNK-BP Other associates... -

Page 169

18. Investments in associates - continued The following table provides summarized financial information at 100% share relating to each of the group's material associates. $ million Gross amount 2013 Rosneft 2012 TNK-BPa 2011 TNK-BP Sales and other operating revenues Profit before interest and ... -

Page 170

... financial risks arising from natural business exposures as well as its use of financial instruments including: market risks relating to commodity prices, foreign currency exchange rates, interest rates and equity prices; credit risk; and liquidity risk. 166 BP Annual Report and Form 20-F 2013 -

Page 171

... teams are subject to close financial and management control. The integrated supply and trading function maintains formal governance processes that provide oversight of market risk associated with trading activity. A policy and risk committee monitors and validates limits and risk exposures, reviews... -

Page 172

... $312 million (2012 $311 million increase in 2013). (iv) Equity price risk The group holds equity investments, typically for strategic purposes, that are classified as non-current available-for-sale financial assets and are measured initially at fair value with changes in fair value recognized in... -

Page 173

... million (2012 A$500 million). The group's long-term credit ratings are A (positive outlook) from Standard & Poor's, and A2 (stable outlook) from Moody's Investor Services, both remaining unchanged during 2013. During 2013, $8.6 billion of long-term taxable bonds were issued with terms ranging from... -

Page 174

... is in level 3 of the fair value hierarchy. Fair value losses of $4 million were recognized in the income statement (2012 $70 million gain and 2011 $21 million gain). 21. Inventories $ million 2013 2012 Crude oil Natural gas Refined petroleum and petrochemical products Supplies Trading inventories... -

Page 175

... quarter of 2013. See Note 6 for further information. The remaining restricted cash balances relate largely to amounts required to cover initial margin on trading exchanges. 24. Valuation and qualifying accounts $ million 2013 Accounts receivable Fixed asset investments Accounts receivable 2012... -

Page 176

...their original business objective, and are recognized at fair value with changes in fair value recognized in the income statement. Trading activities are undertaken by using a range of contract types in combination to create incremental gains by arbitraging prices between markets, locations and time... -

Page 177

...transaction with Rosneft - see Cash flow hedges below for further information. Derivative liabilities held for trading have the following fair values and maturities. $ million 2013 Less than 1 year 1-2 years 2-3 years 3-4 years 4-5 years Over 5 years Total Currency derivatives Oil price derivatives... -

Page 178

... held for trading purposes within level 3 of the fair value hierarchy. $ million Oil price Natural gas price Power price Other Total Net fair value of contracts at 1 January 2013 Gains (losses) recognized in the income statement Purchases New contracts Settlements Transfers out of level 3 Exchange... -

Page 179

...net decrease (increase) in profit before tax of $4 million. Derivative gains and losses Gains and losses relating to derivative contracts are included within sales and other operating revenues and within purchases in the income statement depending upon the nature of the activity and type of contract... -

Page 180

... in the income statement if the investment in Rosneft were either sold or impaired. The cash flow hedge derivatives were valued using the quoted Rosneft share price at the time the deal completed, of $7.60 per share. Fair value hedges At 31 December 2013, the group held interest rate and cross... -

Page 181

... lease obligations is estimated using discounted cash flow analyses based on the group's current incremental borrowing rates for similar types and maturities of borrowing. $ million 2013 Fair value Carrying amount Fair value 2012 Carrying amount Financial statements Short-term borrowings Long-term... -

Page 182

... discount rate of 3.25% (2012 2.5%) or a real discount rate of 1% (2012 0.5%), as appropriate. 30. Pensions and other post-retirement benefits Most group companies have pension plans, the forms and benefits of which vary with conditions and practices in the countries concerned. Pension benefits... -

Page 183

... joiners. Retired US employees typically take their pension benefit in the form of a lump sum payment. The plan's assets are overseen by a fiduciary investment committee composed of seven company employees appointed by the appointing officer, who is the president of BP Corporation North America Inc... -

Page 184

... level of return over the long term with an acceptable level of risk. In order to provide reasonable assurance that no single security or type of security has an unwarranted impact on the total portfolio, the investment portfolios are highly diversified. The current long-term asset allocation... -

Page 185

... postretirement benefit plans UK pension plansa US pension plansb Other plans Total Fair value of pension plan assets At 31 December 2013 Listed equities - developed markets - emerging markets Private equity Government issued nominal bonds Index-linked bonds Corporate bonds Property Cash Other... -

Page 186

... post-retirement benefits - continued $ million 2013 US other postretirement benefit plans UK pension plans US pension plans Other plans Total Analysis of the amount charged to profit before interest and taxation Current service costa Past service costb Settlement Operating charge relating to... -

Page 187

... post-retirement benefits - continued $ million 2012 US other postretirement benefit plans UK pension plans US pension plans Other plans Total Analysis of the amount charged to profit before interest and taxation Current service costa Past service costb Settlement Operating charge relating to... -

Page 188

...UK pension plans US pension plans German pension plans One additional year's longevity Effect on pension and other post-retirement benefit expense in 2014 Effect on pension and other post-retirement benefit obligation at 31 December 2013 52 927 5 95 3 46 9 213 184 BP Annual Report and Form... -

Page 189

... market price of such shares on the London Stock Exchange during the previous six months over par value. During 2013 the company repurchased 753 million ordinary shares at a cost of $5,463 million as part of the share repurchase programme announced on 22 March 2013. The number of shares in issue... -

Page 190

...-for-sale investments (including recycling) Cash flow hedges (including recycling) Share of items relating to equity-accounted entities, net of tax Items that will not be reclassified to profit or loss Remeasurements of the net pension and other post-retirement benefit liability or asset Total... -

Page 191

$ million Total own shares and treasury shares Foreign currency translation reserve Availablefor-sale investments Total fair value reserves Sharebased payment reserve Profit and loss account BP shareholders' equity Noncontrolling interests Own shares Treasury shares Cash flow hedges Total equity... -

Page 192

... to profit in respect of employee share-based payment plans where the scheme has not yet been settled by means of an award of shares to an individual. Profit and loss account The balance held on this reserve is the accumulated retained profits of the group. 188 BP Annual Report and Form 20-F 2013 -

Page 193

...-for-sale investments (including recycling) Cash flow hedges (including recycling) Share of items relating to equity-accounted entities, net of tax Other Items that will not be reclassified to profit or loss Remeasurements of the net pension and other post-retirement benefit liability or asset Share... -

Page 194

..., for executive directors and senior managers, salary and benefits earned during the year, plus cash bonuses awarded for the year. Deferred annual bonus awards, to be settled in shares, are included in share-based payments. Short-term employee benefits includes compensation for loss of office of... -

Page 195

...not related to the Gulf of Mexico oil spill There were contingent liabilities at 31 December 2013 in respect of guarantees and indemnities entered into as part of the ordinary course of the group's business. No material losses are likely to arise from such contingent liabilities. Further information... -

Page 196

...of the audit of the accounts of BP p.l.c. including the group's consolidated financial statements. Includes interim reviews and reporting on internal financial controls and non-statutory audit services. The pension plan services include tax compliance services of $240,000 (2012 $50,000 and 2011 $108... -

Page 197

... and production Marketing Exploration and production Finance Investment holding Exploration and production, refining and marketing pipelines and petrochemicals Finance Associates % Principal activities Russia Rosneft 20 Russia Integrated oil operations BP Annual Report and Form 20-F 2013... -

Page 198

...BP group Sales and other operating revenues Earnings from joint ventures - after interest and tax Earnings from associates - after interest and tax Equity-accounted income of subsidiaries - after interest and tax Interest and other income Gains on sale of businesses and fixed assets Total revenues... -

Page 199

...BP group Sales and other operating revenues Earnings from joint ventures - after interest and tax Earnings from associates - after interest and tax Equity-accounted income of subsidiaries - after interest and tax Interest and other income Gains on sale of businesses and fixed assets Total revenues... -

Page 200

...BP group Sales and other operating revenues Earnings from joint ventures - after interest and tax Earnings from associates - after interest and tax Equity-accounted income of subsidiaries - after interest and tax Interest and other income Gains on sale of businesses and fixed assets Total revenues... -

Page 201

... associates Other investments Subsidiaries - equity-accounted basis Fixed assets Loans Trade and other receivables Derivative financial instruments Prepayments Deferred tax assets Defined benefit pension plan surpluses Current assets Loans Inventories Trade and other receivables Derivative financial... -

Page 202

... associates Other investments Subsidiaries - equity-accounted basis Fixed assets Loans Trade and other receivables Derivative financial instruments Prepayments Deferred tax assets Defined benefit pension plan surpluses Current assets Loans Inventories Trade and other receivables Derivative financial... -

Page 203

... Other subsidiaries Eliminations and reclassifications 2012 BP p.l.c. BP group Net cash provided by operating activities Net cash used in investing activities Net cash used in financing activities Currency translation differences relating to cash and cash equivalents Increase in cash and cash... -

Page 204

... (unaudited) 2013 reserves and production information for equity-accounted entities includes BP's share of TNK-BP from 1 January to 20 March, and Rosneft for the period 21 March to 31 December. For the period 22 October 2012 to 31 December 2012, and throughout all of 2013, financial information for... -

Page 205

Oil and natural gas exploration and production activities $ million 2013 Europe North America Rest of North America South America Africa Asia Australasia Total UK Rest of Europe US Russia Rest of Asia Subsidiariesa Capitalized costs at 31 Decemberb Gross capitalized costs Proved properties ... -

Page 206

Oil and natural gas exploration and production activities - continued $ million 2013 Europe North America Rest of North America South America Africa Asia Australasia Total UK Rest of Europe US Russiaa Rest of Asia Equity-accounted entities (BP share)b Capitalized costs at 31 Decemberc Gross ... -

Page 207

Oil and natural gas exploration and production activities - continued $ million 2012 Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia Rest of Asia Subsidiariesa Capitalized costs at 31 Decemberb j Gross capitalized costs Proved ... -

Page 208

... BP's share of costs incurred and results of operations for the period 22 October to 31 December 2012. These tables contain information relating to oil and natural gas exploration and production activities of equity-accounted entities. They do not include amounts relating to assets held for sale... -

Page 209

.... Midstream activities exclude inventory holding gains and losses. The profits of equity-accounted entities are included after interest and tax. Excludes balances associated with assets held for sale. Excludes goodwill associated with business combinations. BP Annual Report and Form 20-F 2013 205 -

Page 210

Oil and natural gas exploration and production activities - continued $ million 2011 Europe North America Rest of North America South America Africa Asia Australasia Total UK Rest of Europe US Russia Rest of Asia Equity-accounted entities (BP share)a Capitalized costs at 31 Decemberb Gross ... -

Page 211

Movements in estimated net proved reserves million barrels Crude oila Europe North America Rest of North America South America Africa Asia Australasia 2013 Total UK Rest of Europe USb Russia Rest of Asia Subsidiaries At 1 January 2013 Developed Undeveloped Changes attributable to Revisions of ... -

Page 212

... estimated net proved reserves - continued billion cubic feet Natural gasa Europe North America Rest of North America South America Africa Asia Australasia 2013 Total UK Rest of Europe US Russia Rest of Asia Subsidiaries At 1 January 2013 Developed Undeveloped Changes attributable to Revisions... -

Page 213

... million barrels Bitumena Rest of North America 2013 Total Subsidiaries At 1 January 2013 Developed Undeveloped Changes attributable to Revisions of previous estimates Improved recovery Purchases of reserves-in-place Discoveries and extensions Production Sales of reserves-in-place At 31 December... -

Page 214

...net proved reserves - continued million barrels of oil equivalentb Total hydrocarbonsa Europe North America Rest of North America South America Africa Asia Australasia 2013 Total UK Rest of Europe USc Russia Rest of Asia Subsidiaries At 1 January 2013 Developed Undeveloped Changes attributable... -

Page 215

... in estimated net proved reserves - continued million barrels Crude oila Europe North America Rest of North America South America Africa Asia Australasia 2012 Total UK Rest of Europe USb Russia Rest of Asia Subsidiaries At 1 January 2012 Developed Undeveloped Changes attributable to Revisions... -

Page 216

... estimated net proved reserves - continued billion cubic feet Natural gasa Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia 2012 Total UK US Russia Rest of Asia Subsidiaries At 1 January 2012 Developed Undeveloped Changes attributable to Revisions... -

Page 217

... million barrels Bitumena Rest of North America 2012 Total Subsidiaries At 1 January 2012 Developed Undeveloped Changes attributable to Revisions of previous estimates Improved recovery Purchases of reserves-in-place Discoveries and extensions Production Sales of reserves-in-place At 31 December... -

Page 218

... net proved reserves - continued million barrels of oil equivalentb Total hydrocarbonsa Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia 2012 Total UK USc Russia Rest of Asia Subsidiaries At 1 January 2012 Developed Undeveloped Changes attributable... -

Page 219

...in estimated net proved reserves - continued million barrels Crude oila Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia 2011 Total UK USb Russia Rest of Asia Subsidiaries At 1 January 2011 Developed Undeveloped Changes attributable to Revisions of... -

Page 220

... estimated net proved reserves - continued billion cubic feet Natural gasa Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia 2011 Total UK US Russia Rest of Asia Subsidiaries At 1 January 2011 Developed Undeveloped Changes attributable to Revisions... -

Page 221

... million barrels Bitumena Rest of North America 2011 Total Subsidiaries At 1 January 2011 Developed Undeveloped Changes attributable to Revisions of previous estimates Improved recovery Purchases of reserves-in-place Discoveries and extensions Production Sales of reserves-in-place At 31 December... -

Page 222

... net proved reserves - continued million barrels of oil equivalentb Total hydrocarbonsa Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia 2011 Total UK USc Russia Rest of Asia Subsidiaries At 1 January 2011 Developed Undeveloped Changes attributable... -

Page 223

... Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia Rest of Asia At 31 December 2013 Subsidiaries Future cash inflowsa Future production costb Future development costb Future taxationc Future net cash flows 10% annual discountd Standardized measure of... -

Page 224

... Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia Rest of Asia At 31 December 2012 Subsidiaries Future cash inflowsa Future production costb Future development costb Future taxationc Future net cash flows 10% annual discountd Standardized measure of... -

Page 225

... Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia Rest of Asia At 31 December 2011 Subsidiaries Future cash inflowsa Future production costb Future development costb Future taxationc Future net cash flows 10% annual discountd Standardized measure of... -

Page 226

... 2013, 2012 and 2011. Production for the yeara Europe North America Rest of North America South America Africa Asia Australasia Total UK Rest of Europe US Russia Rest of Asia Subsidiaries Crude oilb 2013 2012 2011 Natural gasc 2013 2012 2011 Equity-accounted entities(BP share) Crude oilb 2013... -

Page 227

... 6.3 Information for 2011 and 2012 includes BP's share of TNK-BP which was sold to Rosneft on 21 March 2013. Drilling and production activities in progress The following table shows the number of exploratory and development oil and natural gas wells in the process of being drilled by the group and... -

Page 228

...audited the parent company financial statements of BP p.l.c. for the year ended 31 December 2013 which comprise the company balance sheet, the company cash flow statement, the company statement of total recognized gains and losses and the related notes 1 to 13. The financial reporting framework that... -

Page 229

... on 6 March 2014 having been duly authorized to do so by the board of directors: R W Dudley Group Chief Executive The parent company financial statements of BP p.l.c. on pages 224-234 do not form part of BP's Annual Report on Form 20-F as filed with the SEC. BP Annual Report and Form 20-F 2013 225 -

Page 230

Company cash flow statement For the year ended 31 December Note 2013 $ million 2012 Net cash outflow from operating activities Servicing of finance and returns on investments Interest received Interest paid Dividends received Net cash inflow from servicing of finance and returns on investments Tax ... -

Page 231

... of time, and is determined by applying the discount rate to the opening present value of the benefit obligation, taking into account material changes in the obligation during the year. The expected return on plan assets is based on an assessment made at the beginning of the year of long-term market... -

Page 232

...list of investments in subsidiary undertakings, joint ventures and associated undertakings will be attached to the company's annual return made to the Registrar of Companies. The parent company financial statements of BP p.l.c. on pages 224-234 do not form part of BP's Annual Report on Form 20-F as... -

Page 233

3. Fixed assets - investments - continued Subsidiary undertakings % Country of incorporation Principal activities International BP Corporate Holdings BP Global Investments BP International BP Shipping Burmah Castrol South Africa BP Southern Africa US BP Holdings North America 100 100 100 100 100 ... -

Page 234

...rate of return % 2012 Expected long-term rate of return % 2011 Market value $ million Market value $ million Market value $ million Listed equity - developed - emerging Private equity Government issued nominal bondsa Index-linked bondsa Corporate bondsa Propertyb Cash Other Present value of plan... -

Page 235

... held in the BP Global Pension Trust (2012 $94 million), with $40 million representing the company's share of Merchant Navy Officers Pension Fund (2012 $32 million). The parent company financial statements of BP p.l.c. on pages 224-234 do not form part of BP's Annual Report on Form 20-F as filed... -

Page 236

... market price of such shares on the London Stock Exchange during the previous six months over par value. During 2013 the company repurchased 753 million ordinary shares at a cost of $5,463 million as part of the share repurchase programme announced on 22 March 2013. The number of shares in issue... -

Page 237

...Share capital Share premium account Capital redemption reserve Merger reserve Own shares Treasury shares Share-based payment reserve Profit and loss account Total At 1 January 2013 Currency translation differences Actuarial gain on pensions (net of tax) Share-based payments Repurchases of ordinary... -

Page 238

... Gulf of Mexico oil spill (see Note 2 to the consolidated financial statements), and in relation to potential losses arising from environmental incidents involving ships leased and operated by a subsidiary. 11. Share-based payments Effect of share-based payment transactions on the company's result... -

Page 239

... proceedings 267 Further note on certain activities 268 Material contracts 268 Property, plant and equipment 268 Related-party transactions 269 Exhibits 269 Certain definitions 271 Directors' report information 271 Cautionary statement Additional disclosures BP Annual Report and Form 20-F 2013 235 -

Page 240

... are not recognized GAAP measures. We believe these numbers are useful information to investors. Further information on net debt is given in Financial statements - Note 28. The number of ordinary shares shown has been used to calculate the per share amounts. 236 BP Annual Report and Form 20-F 2013 -

Page 241

...tax rate (adjusted for the items noted above, equity-accounted earnings and certain deferred tax adjustments relating to changes in UK taxation). Non-operating items reported within the equity-accounted earnings of TNK-BP and Rosneft are reported net of tax. BP Annual Report and Form 20-F 2013 237 -

Page 242

... Gulf of Mexico oil spill, equity-accounted earnings, certain impairment losses, disposal gains and fair value gains and losses on embedded derivatives and certain deferred tax adjustments relating to changes in UK taxation). Reconciliation of non-GAAP information $ million 2013 2012 2011 Upstream... -

Page 243

... Our upstream activities in North America take place in four main areas: deepwater Gulf of Mexico, Lower 48 states, Alaska and Canada. For further information on BP's activities in connection with its responsibilities following the Deepwater Horizon oil spill, see page 38. BP has around 620 lease... -

Page 244

...in late 2012, continued to increase as planned, reaching a maximum rate of just over 150mb/d in 2013. • In October we had an oil and gas discovery in the pre-salt play of Angola in Block 20 (BP 30%), operated by Cobalt International Energy, Inc. This was followed by a successful drill-stem test in... -

Page 245

... supplied under a long-term contract with Australia's North West Shelf venture described below. In Azerbaijan, BP invests more than any other foreign investor, operates two PSAs, Azeri-Chirag-Gunashli (ACG) (BP 35.8%) and Shah Deniz (BP 25.5%), and also holds other exploration leases. • In 2012... -

Page 246