AT&T Wireless 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

90 | AT&T Inc.

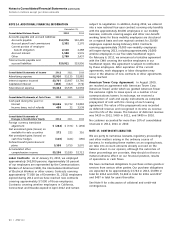

subject to negotiation. In addition, during 2012, we entered

into a new national four-year contract covering only benefits

with the approximately 40,000 employees in our mobility

business; contracts covering wages and other non-benefit

working terms for these mobility employees are structured

on a regional basis and one regional contract for 20,000

employees expired during February 2013. Contracts

covering approximately 30,000 non-mobility employees

will expire during 2013, including approximately 20,000

wireline employees in our five-state Southwest region.

On February 6, 2013, we announced a tentative agreement

with the CWA covering the wireline employees in our

Southwest region; this agreement is subject to ratification

by these employees. After expiration of the current

agreements, work stoppages or labor disruptions may

occur in the absence of new contracts or other agreements

being reached.

American Tower Corp. Agreement In August 2000,

we reached an agreement with American Tower Corp.

(American Tower) under which we granted American Tower

the exclusive rights to lease space on a number of our

communications towers. In exchange, we received a

combination of cash and equity instruments as complete

prepayment of rent with the closing of each leasing

agreement. The value of the prepayments was recorded

as deferred revenue and recognized in income as revenue

over the life of the leases. The balance of deferred revenue

was $420 in 2012, $450 in 2011, and $480 in 2010.

No customer accounted for more than 10% of consolidated

revenues in 2012, 2011 or 2010.

NOTE 15. CONTINGENT LIABILITIES

We are party to numerous lawsuits, regulatory proceedings

and other matters arising in the ordinary course of

business. In evaluating these matters on an ongoing basis,

we take into account amounts already accrued on the

balance sheet. In our opinion, although the outcomes of

these proceedings are uncertain, they should not have a

material adverse effect on our financial position, results

of operations or cash flows.

We have contractual obligations to purchase certain goods or

services from various other parties. Our purchase obligations

are expected to be approximately $3,744 in 2013, $3,890 in

total for 2014 and 2015, $1,469 in total for 2016 and 2017

and $457 in total for years thereafter.

See Note 9 for a discussion of collateral and credit-risk

contingencies.

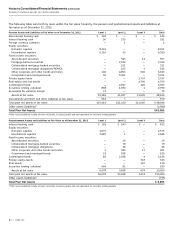

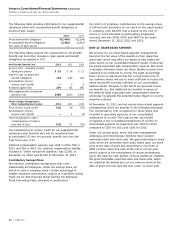

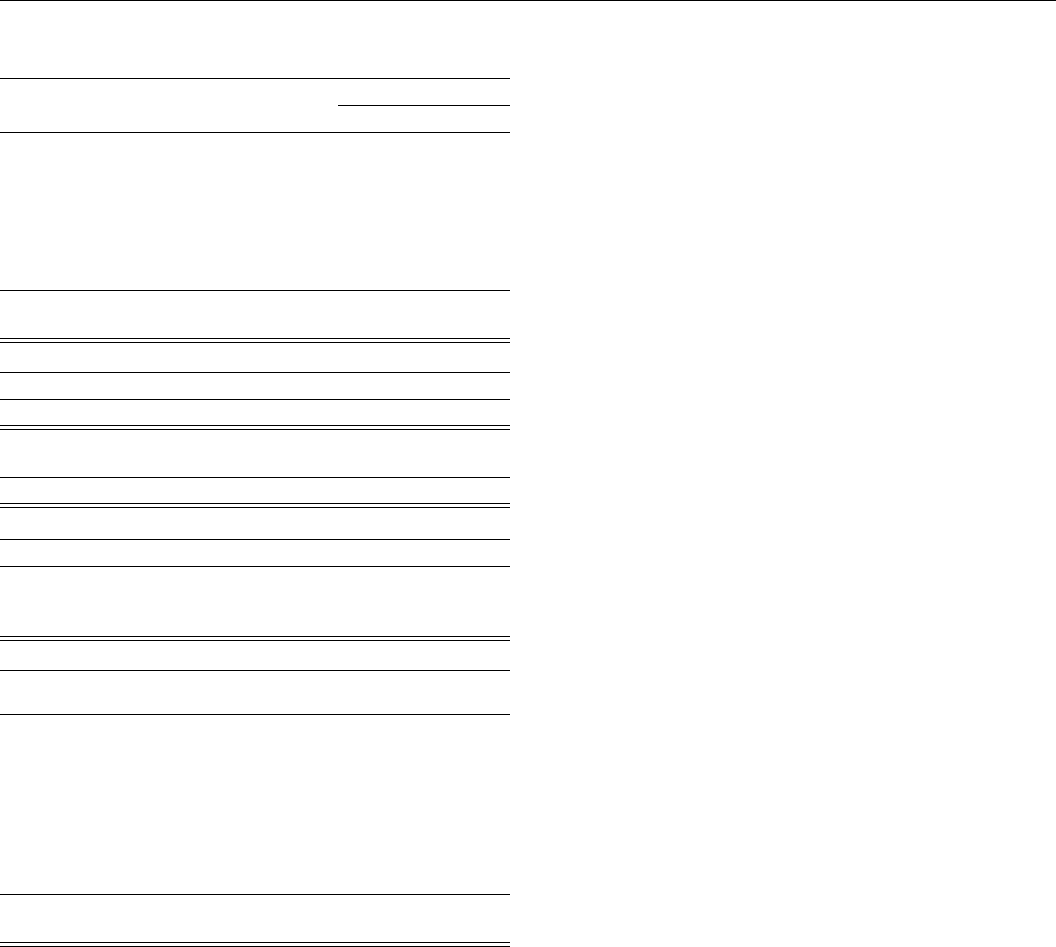

NOTE 14. ADDITIONAL FINANCIAL INFORMATION

December 31,

Consolidated Balance Sheets 2012 2011

Accounts payable and accrued liabilities:

Accounts payable $12,076 $10,485

Accrued payroll and commissions 2,332 2,170

Current portion of employee

benefit obligation 2,116 2,288

Accrued interest 1,588 1,576

Other 2,799 3,437

Total accounts payable and

accrued liabilities $20,911 $19,956

Consolidated Statements of Income 2012 2011 2010

Advertising expense $2,910 $3,135 $2,982

Interest expense incurred $3,707 $3,697 $3,766

Capitalized interest (263) (162) (772)

Total interest expense $3,444 $3,535 $2,994

Consolidated Statements of Cash Flows 2012 2011 2010

Cash paid during the year for:

Interest $3,696 $3,722 $3,882

Income taxes, net of refunds 458 32 3,538

Consolidated Statements of

Changes in Stockholders’ Equity 2012 2011 2010

Foreign currency translation

adjustment $ (284) $ (371) $ (494)

Net unrealized gains (losses) on

available-for-sale securities 272 222 316

Net unrealized gains (losses) on

cash flow hedges (110) (421) (180)

Defined benefit postretirement

plans 5,358 3,750 3,070

Accumulated other

comprehensive income $5,236 $3,180 $2,712

Labor Contracts As of January 31, 2013, we employed

approximately 242,000 persons. Approximately 55 percent

of our employees are represented by the Communications

Workers of America (CWA), the International Brotherhood

of Electrical Workers or other unions. Contracts covering

approximately 77,000 (as of December 31, 2012) employees

expired during 2012 and we have reached new contracts

covering approximately 57,000 of those employees.

Contracts covering wireline employees in California,

Connecticut and Nevada expired in April 2012 and remain