AT&T Wireless 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 77

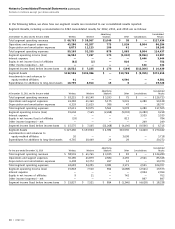

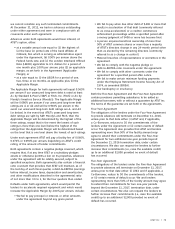

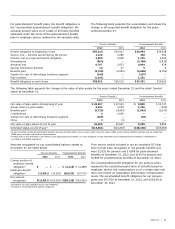

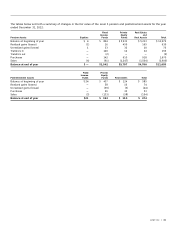

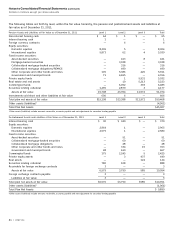

A reconciliation of the change in our UTB balance from

January 1 to December 31 for 2012 and 2011 is as follows:

Federal, State and Foreign Tax 2012 2011

Balance at beginning of year $ 4,541 $ 4,360

Increases for tax positions

related to the current year 791 217

Increases for tax positions

related to prior years 991 848

Decreases for tax positions

related to prior years (1,426) (1,066)

Lapse of statute of limitations (29) —

Settlements (75) 182

Balance at end of year 4,793 4,541

Accrued interest and penalties 977 1,312

Gross unrecognized income tax benefits 5,770 5,853

Less: Deferred federal and state

income tax benefits (610) (797)

Less: Tax attributable to timing

items included above (2,448) (2,331)

Total UTB that, if recognized, would

impact the effective income tax

rate as of the end of the year $ 2,712 $ 2,725

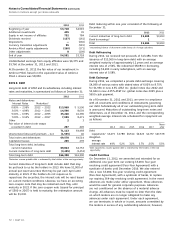

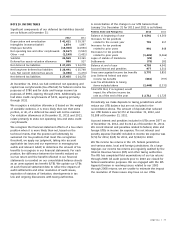

Periodically we make deposits to taxing jurisdictions which

reduce our UTB balance but are not included in the

reconciliation above. The amount of deposits that reduced

our UTB balance was $2,372 at December 31, 2012, and

$2,508 at December 31, 2011.

Accrued interest and penalties included in UTBs were $977 as

of December 31, 2012, and $1,312 as of December 31, 2011.

We record interest and penalties related to federal, state and

foreign UTBs in income tax expense. The net interest and

penalty expense (benefit) included in income tax expense was

$(74) for 2012, $(65) for 2011, and $(194) for 2010.

We file income tax returns in the U.S. federal jurisdiction

and various state, local and foreign jurisdictions. As a large

taxpayer, our income tax returns are regularly audited by the

Internal Revenue Service (IRS) and other taxing authorities.

The IRS has completed field examinations of our tax returns

through 2008. All audit periods prior to 2003 are closed for

federal examination purposes. We are engaged with the IRS

Appeals Division in resolving issues related to our 2003

through 2008 returns; we are unable to estimate the impact

the resolution of these issues may have on our UTBs.

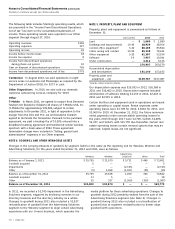

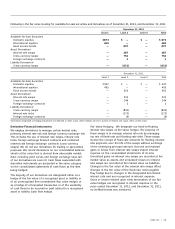

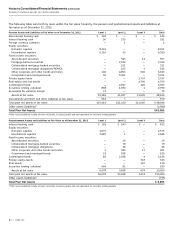

NOTE 10. INCOME TAXES

Significant components of our deferred tax liabilities (assets)

are as follows at December 31:

2012 2011

Depreciation and amortization $ 41,411 $ 39,367

Intangibles (nonamortizable) 1,874 1,897

Employee benefits (13,350) (14,950)

Net operating loss and other carryforwards (2,167) (1,502)

Other – net (1,199) (1,451)

Subtotal 26,569 23,361

Deferred tax assets valuation allowance 886 917

Net deferred tax liabilities $ 27,455 $ 24,278

Net long-term deferred tax liabilities $ 28,491 $ 25,748

Less: Net current deferred tax assets (1,036) (1,470)

Net deferred tax liabilities $ 27,455 $ 24,278

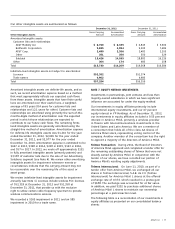

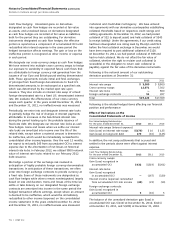

At December 31, 2012, we had combined net operating and

capital loss carryforwards (tax effected) for federal income tax

purposes of $780 and for state and foreign income tax

purposes of $956, expiring through 2031. Additionally, we

had state credit carryforwards of $431, expiring primarily

through 2032.

We recognize a valuation allowance if, based on the weight

of available evidence, it is more likely than not that some

portion, or all, of a deferred tax asset will not be realized.

Our valuation allowances at December 31, 2012 and 2011,

relate primarily to state net operating loss and state credit

carryforwards.

We recognize the financial statement effects of a tax return

position when it is more likely than not, based on the

technical merits, that the position will ultimately be

sustained. For tax positions that meet this recognition

threshold, we apply our judgment, taking into account

applicable tax laws and our experience in managing tax

audits and relevant GAAP, to determine the amount of tax

benefits to recognize in our financial statements. For each

position, the difference between the benefit realized on

our tax return and the benefit reflected in our financial

statements is recorded on our consolidated balance sheets

as an unrecognized tax benefit (UTB). We update our UTBs

at each financial statement date to reflect the impacts of

audit settlements and other resolution of audit issues,

expiration of statutes of limitation, developments in tax

law and ongoing discussions with taxing authorities.