AT&T Wireless 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

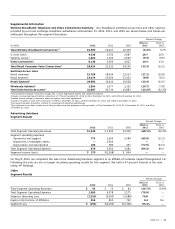

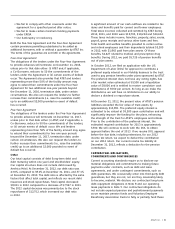

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

42 | AT&T Inc.

existing or new right-of-ways to deploy or activate our

U-verse-related equipment, services and products, resulting in

litigation. Petitions have been filed at the FCC alleging that

the manner in which we provision “public, educational and

governmental” (PEG) programming over our U-verse TV

service conflicts with federal law, and a lawsuit has been filed

in a California state superior court raising similar allegations

under California law. If courts having jurisdiction where we

have significant deployments of our U-verse services were

to decide that federal, state and/or local cable regulation

were applicable to our U-verse services, or if the FCC, state

agencies or the courts were to rule that we must deliver PEG

programming in a manner substantially different from the

way we do today or in ways that are inconsistent with our

current network architecture, it could have a material adverse

effect on the cost and extent of our U-verse offerings.

REGULATORY DEVELOPMENTS

Set forth below is a summary of the most significant

regulatory proceedings that directly affected our operations

during 2012. Industry-wide regulatory developments are

discussed above in Operating Environment Overview.

While these issues may apply only to certain subsidiaries,

the words “we,” “AT&T” and “our” are used to simplify the

discussion. The following discussions are intended as a

condensed summary of the issues rather than as a

comprehensive legal analysis and description of all of

these specific issues.

International Regulation Our subsidiaries operating

outside the United States are subject to the jurisdiction of

regulatory authorities in the market where service is provided.

Our licensing, compliance and advocacy initiatives in foreign

countries primarily enable the provision of enterprise (i.e.,

large-business) services. AT&T is engaged in multiple efforts

with foreign regulators to open markets to competition,

reduce network costs and increase our scope of fully

authorized network services and products.

Federal Regulation A summary of significant 2012 federal

regulatory developments follows.

Intercarrier Compensation/Universal Service In October

2011, the FCC adopted an order fundamentally overhauling

its high-cost universal service program, through which it

disburses approximately $4,500 per year to carriers providing

telephone service in high-cost areas, and its existing

intercarrier compensation (ICC) rules, which govern payments

between carriers for the exchange of traffic. The order adopts

rules to address immediately certain practices that artificially

increase ICC payments, as well as other practices to avoid

such payments. The order also establishes a new ICC regime

that will result in the elimination of virtually all terminating

switched access charges and reciprocal compensation

payments over a six-year transition. In the order, the FCC

and Enhanced Data rates for GSM Evolution (EDGE) for data

communications. As of December 31, 2012, we served

107 million subscribers. We have also begun transitioning

our network to next generation LTE technology and expect

this network to cover approximately 300 million people in the

United States and to be largely complete by the end of 2014.

We continue to expand the number of locations, including

airports and cafés, where customers can access broadband

Internet connections using wireless fidelity (local radio

frequency commonly referred to as Wi-Fi) technology.

As the wireless industry continues to mature, we believe that

future wireless growth will increasingly depend on our ability

to offer innovative data services and a wireless network that

has sufficient spectrum and capacity to support these

innovations and make them available to more subscribers.

We are facing significant spectrum and capacity constraints

on our wireless network in certain markets. We expect such

constraints to increase and expand to additional markets

in the coming years. While we are continuing to invest

significant capital in expanding our network capacity, our

capacity constraints could affect the quality of existing voice

and data services and our ability to launch new, advanced

wireless broadband services, unless we are able to obtain

more spectrum. Any long-term spectrum solution will require

that the FCC make new or existing spectrum available to

the wireless industry to meet the expanding needs of our

subscribers. We will continue to attempt to address spectrum

and capacity constraints on a market-by-market basis. To that

end, we signed nearly 50 deals to acquire spectrum during

2012 (some pending regulatory review). Much of the recently

acquired spectrum came from an innovative solution in which

we obtained FCC approval to use WCS spectrum for mobile

broadband for the first time.

U-verse Services During 2012, we continued to expand our

offerings of U-verse High Speed Internet and TV services.

As of December 31, 2012, we are marketing U-verse services

to approximately 24.5 million customer locations (locations

eligible to receive U-verse service). As of December 31, 2012,

we had 8.0 million total U-verse subscribers (high-speed

Internet and video), including 7.7 million Internet and

4.5 million video subscribers (subscribers to both services

are only counted once in the total). As part of Project VIP

(see “Other Business Matters”), we plan to expand our

U-verse services to approximately 8.5 million additional

customer locations.

We believe that our U-verse TV service is a “video service”

under the Federal Communications Act. However, some cable

providers and municipalities have claimed that certain IP

services should be treated as a traditional cable service and

therefore subject to the applicable state and local cable

regulation. Certain municipalities have delayed our requests

to offer this service or have refused us permission to use our