AT&T Wireless 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

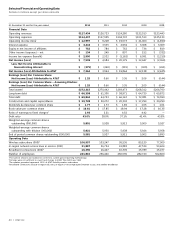

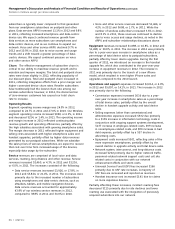

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

36 | AT&T Inc.

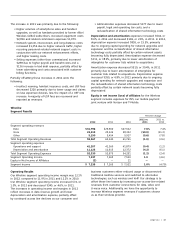

• Voice and other service revenues decreased $1,466, or

4.2%, in 2012 and $608, or 1.7%, in 2011. While the

number of wireless subscribers increased 3.6% in 2012,

and 8.1% in 2011, these revenues continued to decline

due to voice access and usage declines, as noted in the

ARPU and subscriber relationships discussions above.

Equipment revenues increased $1,088, or 16.8%, in 2012 and

$1,498, or 30.0%, in 2011. The increase in 2012 was primarily

due to a year-over-year increase in smartphone sales as a

percentage of total device sales to postpaid subscribers,

partially offset by lower device upgrades. During the first

quarter of 2012, we introduced an increase in the handset

upgrade fee, which also contributed to the year-over-year

increase in equipment revenues in 2012. The increase in

2011 was primarily due to the launch of a new iPhone

model, which resulted in even higher iPhone sales and

upgrades compared to the 2010 launch.

Operations and support expenses increased $2,014, or 4.9%,

in 2012 and $5,097, or 14.1%, in 2011. The increase in 2012

was primarily due to the following:

• Commission expenses increased $636 due to a year-

over-year increase in smartphone sales as a percentage

of total device sales, partially offset by the overall

decline in handset upgrade activity and total device

sales.

• Selling expenses (other than commissions) and

administrative expenses increased $532 due primarily

to a $181 increase in information technology costs in

conjunction with ongoing support systems development,

$137 increase in employee-related costs, $99 increase

in nonemployee-related costs, and $89 increase in bad

debt expense, partially offset by a $57 decline in

advertising costs.

• Equipment costs increased $501, reflecting sales of the

more expensive smartphones, partially offset by the

overall decline in upgrade activity and total device sales.

• Network system, interconnect, and long-distance costs

increased $202 primarily due to higher network traffic,

personnel-related network support costs and cell site

related costs in conjunction with our network

enhancement efforts and storm costs.

• Universal Service Fund (USF) fees increased $166

primarily due to USF rate increases. A majority of

USF fees are recovered and reported as revenues.

• Handset insurance cost increased $141 due to claims

on more expensive devices.

Partially offsetting these increases, incollect roaming fees

decreased $115 primarily due to rate declines and lower

roaming use associated with the integration of previously

acquired subscribers into our network.

subscribers is typically lower compared to that generated

from our smartphone subscribers on postpaid and other

plans. Data services ARPU increased 11.1% in 2012 and 9.8%

in 2011, reflecting increased smartphone and data-centric

device use. We expect continued revenue growth from

data services as more subscribers use smartphones and

data-centric devices, and as we continue to expand our

network. Voice and other service ARPU declined 9.7% in

2012 and 10.9% in 2011 due to voice access and usage

trends and a shift toward a greater percentage of data-

centric devices. We expect continued pressure on voice

and other service ARPU.

Churn The effective management of subscriber churn is

critical to our ability to maximize revenue growth and to

maintain and improve margins. The total and postpaid churn

rates were down slightly in 2012, reflecting popularity of

our discount plans. Total and postpaid churn increased in

2011, reflecting integration efforts from a prior merger and

higher connected device churn rates. Reseller subscribers

have traditionally had the lowest churn rate among our

wireless subscribers; however, in 2012, the disconnection

of zero-revenue customers has caused our total churn

rate to increase.

Operating Results

Segment operating income margin was 24.9% in 2012,

compared to 24.7% in 2011 and 27.0% in 2010. Our Wireless

segment operating income increased $990, or 6.3%, in 2012

and decreased $214, or 1.4%, in 2011. The operating income

and margin increase in 2012 reflected continuing data

revenue growth and operating efficiencies, partially offset by

the high subsidies associated with growing smartphone sales.

The margin decrease in 2011 reflected higher equipment and

selling costs associated with higher smartphone sales and

handset upgrades, partially offset by higher data revenues

generated by our postpaid subscribers. While we subsidize

the sales prices of various smartphones, we expect to recover

that cost over time from increased usage of the devices,

especially data usage by the subscriber.

Service revenues are comprised of local voice and data

services, roaming, long distance and other revenue. Service

revenues increased $2,460, or 4.3%, in 2012 and $3,216,

or 6.0%, in 2011. The increases consisted of the following:

• Data service revenues increased $3,926, or 17.8%, in

2012 and $3,824, or 21.0%, in 2011. The increases were

primarily due to the increased number of subscribers

using smartphones and data-centric devices, such as

eReaders, tablets, and mobile navigation devices.

Data service revenues accounted for approximately

43.8% of our wireless service revenues in 2012,

compared to 38.8% in 2011 and 34.0% in 2010.