AT&T Wireless 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

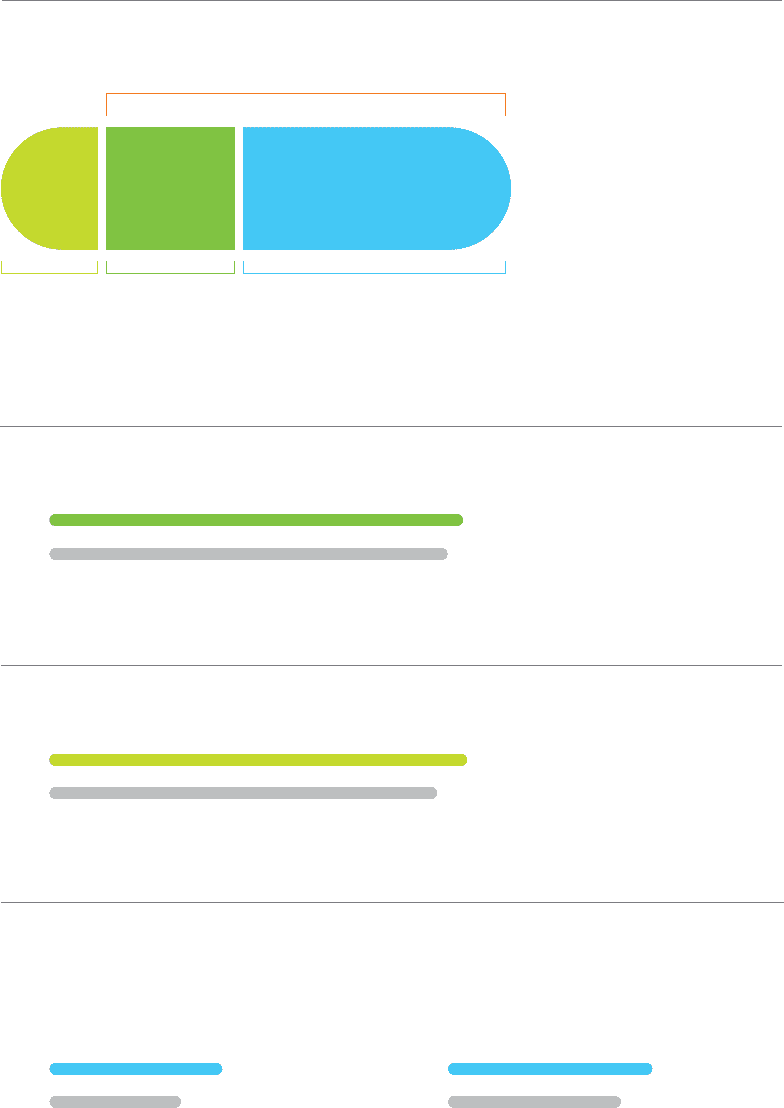

STRONG EARNINGS GROWTH

Excluding significant items, 2012 full-year EPS grew 8.5 percent year over year.

$2.31 Reported $1.25

$2.13 Reported $0.66

$126.4B Reported $127.4B

$123.4B Reported $126.7B

REVENUE GROWTH

Excluding Advertising Solutions, AT&T’s full-year 2012 revenues grew 2.4 percent versus 2011.

2012

2012

2011

2011

RECORD CASH GENERATION

AT&T generated best-ever cash from operations and free cash flow in 2012, which let us

return a record $23 billion in cash to shareowners, including dividends and share buybacks.

Free cash flow is cash from operations minus capital expenditures.

Free Cash Flow Cash from Operations

$19.4B $39.2B

$14.5B $34.7B

2012 2012

2011 2011

CONTINUED MOMENTUM IN GROWTH DRIVERS

For full-year 2012, excluding our divested Advertising Solutions business unit, 81 percent of

AT&T’s $126.4 billion in revenues came from our key growth drivers, which grew nearly 6 percent.

2012 FINANCIAL HIGHLIGHTS

Wireline Data/

Managed IT Services

Voice/

Other Wireless

53%

81%

28%

19%

of total revenues grew

nearly 6% year over year