AT&T Wireless 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 89

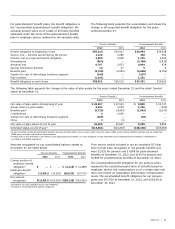

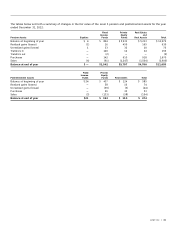

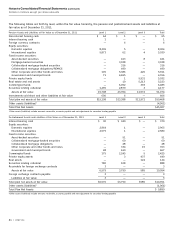

A summary of option activity as of December 31, 2012, and changes during the year then ended, is presented below (shares in

millions):

Weighted-Average

Weighted-Average Remaining Contractual Aggregate

Options Shares Exercise Price Term (Years) Intrinsic Value1

Outstanding at January 1, 2012 66 $30.62 1.99 $148

Exercised (18) —

Forfeited or expired (31) —

Outstanding at December 31, 2012 17 27.38 4.53 123

Exercisable at December 31, 2012 17 $27.37 4.51 $123

1 Aggregate intrinsic value includes only those options with intrinsic value (options where the exercise price is below the market price).

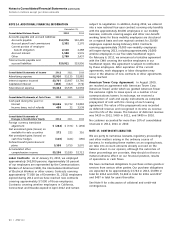

AT&T common stock. We began buying back stock under this

program in 2012 and completed the purchase of authorized

shares that year. In July 2012, the Board of Directors

authorized the repurchase of an additional 300 million

shares, under which we are currently purchasing shares.

For the year ended December 31, 2012, we had repurchased

approximately 371 million shares totaling $12,752 under

these authorizations. We expect to continue repurchasing

our common stock and plan to complete the repurchases

under the July 2012 authorization as early as mid-year.

To implement these authorizations, we use open market

repurchase programs, relying on Rule 10b5-1 of the

Securities Exchange Act of 1934 where feasible. We also use

accelerated share repurchase programs with large financial

institutions to repurchase our stock.

Authorized Shares There are 14 billion authorized common

shares of AT&T stock and 10 million authorized preferred

shares of AT&T stock. As of December 31, 2012 and 2011,

no preferred shares were outstanding.

Dividend Declarations In November 2012, the Company

declared an increase in its quarterly dividend to $0.45 per

share of common stock. In December 2011, the Company

declared a quarterly dividend of $0.44 per share of common

stock, which reflected an increase from the $0.43 quarterly

dividend declared in December 2010.

It is our policy to satisfy share option exercises using our

treasury stock. Cash received from stock option exercises was

$517 for 2012, $250 for 2011 and $55 for 2010.

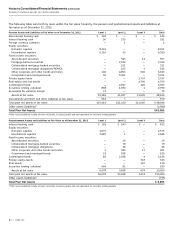

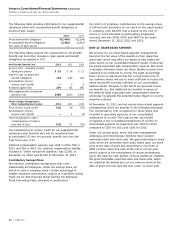

A summary of the status of our nonvested stock units as of

December 31, 2012, and changes during the year then ended

is presented as follows (shares in millions):

Weighted-Average

Nonvested Stock Units Shares Grant-Date Fair Value

Nonvested at January 1, 2012 27 $ 26.53

Granted 13 30.18

Vested (13) 25.87

Forfeited (1) 28.32

Nonvested at December 31, 2012 26 $28.55

As of December 31, 2012, there was $314 of total

unrecognized compensation cost related to nonvested share-

based payment arrangements granted. That cost is expected

to be recognized over a weighted-average period of two years.

The total fair value of shares vested during the year was $333

for 2012, compared to $360 for 2011 and $397 for 2010.

NOTE 13. STOCKHOLDERS’ EQUITY

Stock Repurchase Program From time to time, we

repurchase shares of common stock for distribution through

our employee benefit plans or in connection with certain

acquisitions. In December 2010, the Board of Directors

authorized the repurchase of up to 300 million shares of

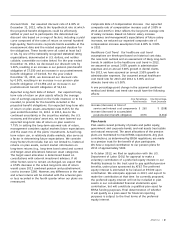

The compensation cost that we have charged against income

for our share-based payment arrangements was as follows:

2012 2011 2010

Performance stock units $397 $388 $411

Restricted stock and stock units 102 91 85

Other nonvested stock units 12 4 11

Other — 6 6

Total $511 $489 $513

period. We also grant other nonvested stock units and

award them in cash at the end of a three-year period,

subject to the achievement of certain market based

conditions. As of December 31, 2012, we were authorized

to issue up to 111 million shares of common stock (in

addition to shares that may be issued upon exercise of

outstanding options or upon vesting of performance stock

units or other nonvested stock units) to officers, employees

and directors pursuant to these various plans.