AT&T Wireless 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 73

• We fail to pay when due other debt of $400 or more that

results in acceleration of that debt (commonly referred

to as cross-acceleration) or a creditor commences

enforcement proceedings within a specified period after

a money judgment of $400 or more has become final.

• A person acquires beneficial ownership of more than

50% of AT&T common shares or more than a majority

of AT&T’s directors change in any 24-month period other

than as elected by the remaining directors (commonly

referred to as a change in control).

• Material breaches of representations or warranties in the

agreement.

• We fail to comply with the negative pledge or

debt-to-EBITDA ratio covenants under the agreement.

• We fail to comply with other covenants under the

agreement for a specified period after notice.

• We fail to make certain minimum funding payments

under the Employee Retirement Income Security Act of

1974, as amended (ERISA).

• Our bankruptcy or insolvency.

Both the Five-Year Agreement and the Four-Year Agreement

contain provisions permitting subsidiaries to be added as

additional borrowers, with or without a guarantee by AT&T Inc.

The terms of the guarantee are set forth in the agreements.

Four-Year Agreement

The obligations of the lenders under the Four-Year Agreement

to provide advances will terminate on December 11, 2016,

unless prior to that date either: (i) AT&T and, if applicable,

a Co-Borrower, reduces to $0 the commitments of the

lenders under the Agreement or (ii) certain events of default

occur. The Agreement also provides that AT&T and lenders

representing more than 50% of the facility amount may

agree to extend their commitments under the Four-Year

Agreement for two additional one-year periods beyond

the December 11, 2016 termination date, under certain

circumstances. We also can request the lenders to further

increase their commitments (i.e., raise the available credit)

up to an additional $2,000 provided no event of default

has occurred.

Five-Year Agreement

The obligations of the lenders under the Five-Year Agreement

to provide advances will terminate on December 11, 2017,

unless prior to that date either: (i) AT&T, and if applicable, a

Co-Borrower, reduce to $0 the commitments of the lenders,

or (ii) certain events of default occur. We and lenders

representing more than 50% of the facility amount may agree

to extend their commitments for two one-year periods

beyond the December 11, 2017, termination date, under

certain circumstances. We also can request the lenders to

further increase their commitments (i.e., raise the available

credit) up to an additional $2,000 provided no event of

default has occurred.

we cannot reinstate any such terminated commitments.

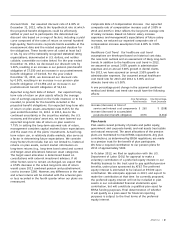

At December 31, 2012, we had no advances outstanding

under either agreement and were in compliance with all

covenants under each agreement.

Advances under both agreements would bear interest, at

AT&T’s option, either:

• at a variable annual rate equal to (1) the highest of:

(a) the base (or prime) rate of the bank affiliate of

Citibank, N.A. which is serving as administrative agent

under the Agreement, (b) 0.50% per annum above the

Federal funds rate, and (c) the London Interbank Offered

Rate (LIBOR) applicable to U.S. dollars for a period of

one month plus 1.00% per annum, plus (2) an applicable

margin, as set forth in the Agreement (Applicable

Margin); or

• at a rate equal to: (i) the LIBOR for a period of one,

two, three or six months, as applicable, plus (ii) the

Applicable Margin.

The Applicable Margin for both agreements will equal 0.565%

per annum if our unsecured long-term debt is rated at least

A+ by Standard & Poor’s (S&P) or Fitch, Inc. (Fitch) or A1 by

Moody’s Investors Service (Moody’s). The Applicable Margin

will be 0.680% per annum if our unsecured long-term debt

ratings are A or A2 and will be 0.910% per annum in the

event our unsecured long-term debt ratings are A- and A3

(or below). In the event that AT&T’s unsecured long-term

debt ratings are split by S&P, Moody’s and Fitch, then the

Applicable Margin will be determined by the highest of the

three ratings, except that in the event the lowest of such

ratings is more than one level below the highest of the

ratings then the Applicable Margin will be determined based

on the level that is one level above the lowest of such ratings.

Under each agreement AT&T will pay a facility fee of 0.060%,

0.070% or 0.090% per annum, depending on AT&T’s credit

rating, of the amount of lender commitments.

Both agreements contain a negative pledge covenant, which

requires that, if at any time AT&T or a subsidiary pledges

assets or otherwise permits a lien on its properties, advances

under the agreement will be ratably secured, subject to

specified exceptions. Both agreements also contain a financial

ratio covenant that provides that AT&T will maintain, as of

the last day of each fiscal quarter, a debt-to-EBITDA (earnings

before interest, income taxes, depreciation and amortization,

and other modifications described in the agreements) ratio

of not more than 3.0 to 1, for the four quarters then ended.

Defaults under both agreements, which would permit the

lenders to accelerate required repayment and which would

increase the Applicable Margin by 2.00% per annum, include:

• We fail to pay principal or interest, or other amounts

under the agreement beyond any grace period.