AT&T Wireless 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 41

wireless data services requires the U.S. Government to make

more spectrum available. In February 2012, Congress

authorized the FCC to conduct an “incentive auction,” to

make available for wireless broadband use certain spectrum

that is currently used by broadcast television licensees.

The FCC has initiated a proceeding to establish rules that

would govern this process. It also initiated a separate

proceeding to review its policies governing mobile spectrum

holdings and consider whether there should be limits on the

amount of spectrum a wireless service provider may possess.

We seek to ensure that we have the opportunity, through

the incentive auction and otherwise, to obtain the spectrum

we need to provide our customers with high-quality service.

While wireless communications providers’ prices and service

offerings are generally not subject to state regulation, states

sometimes attempt to regulate or legislate various aspects of

wireless services, such as in the area of consumer protection.

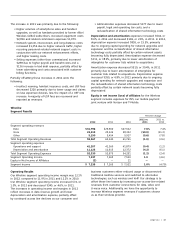

Expected Growth Areas

We expect our wireless services and wireline IP-data products

to remain the most significant growth portions of our

business and have also discussed trends affecting the

segments in which we report results for these products (see

“Wireless Segment Results” and “Wireline Segment Results”).

Over the next few years, we expect our growth to come from:

(1) our wireless service and (2) data/broadband, through

existing and new services. We expect that our previous

acquisitions will enable us to strengthen the reach and

sophistication of our network facilities, increase our large-

business customer base and enhance the opportunity to

market wireless services to that customer base. Whether, or

the extent to which, growth in these areas will offset declines

in other areas of our business is not known.

Wireless Wireless is our fastest-growing revenue stream

and we expect to deliver continued revenue growth in

the coming years. We are in a period of rapid growth in

wireless data usage and believe that there are substantial

opportunities available for next-generation converged

services that combine wireless, broadband, voice and video.

For example, we are preparing to launch our innovative home

monitoring service (Digital Life), ISIS and other car-related

security and entertainment services.

We cover most major metropolitan areas of the United States

with our Universal Mobile Telecommunications System/

High-Speed Downlink Packet Access (HSPA) and HSPA+

network technology, with HSPA+ providing 4G speeds when

combined with our upgraded backhaul. At the end of 2012,

over 90 percent of our data traffic was carried over this

enhanced backhaul. Our network provides superior mobile

broadband speeds for data and video services, as well as

operating efficiencies using the same spectrum and

infrastructure for voice and data on an IP-based platform.

Our wireless network also relies on digital transmission

technologies known as GSM, General Packet Radio Services

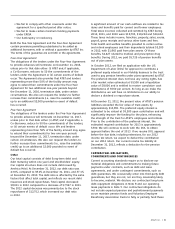

Changes in our discount rate, which are tied to changes in

the bond market and changes in the performance of equity

markets, may have significant impacts on the fair value of

pension and other postretirement plans at the end of 2013

(see “Accounting Policies and Estimates”).

OPERATING ENVIRONMENT OVERVIEW

AT&T subsidiaries operating within the United States

are subject to federal and state regulatory authorities.

AT&T subsidiaries operating outside the United States

are subject to the jurisdiction of national and supranational

regulatory authorities in the markets where service is

provided, and regulation is generally limited to operational

licensing authority for the provision of services to

enterprise customers.

In the Telecommunications Act of 1996 (Telecom Act),

Congress established a national policy framework intended to

bring the benefits of competition and investment in advanced

telecommunications facilities and services to all Americans

by opening all telecommunications markets to competition

and reducing or eliminating regulatory burdens that harm

consumer welfare. However, since the Telecom Act was

passed, the FCC and some state regulatory commissions

have maintained or expanded certain regulatory requirements

that were imposed decades ago on our traditional wireline

subsidiaries when they operated as legal monopolies.

We are pursuing, at both the state and federal levels,

additional legislative and regulatory measures to reduce

regulatory burdens that are no longer appropriate in a

competitive telecommunications market and that inhibit our

ability to compete more effectively and offer services wanted

and needed by our customers, including initiatives to

transition services from traditional networks to all IP-based

networks. At the same time, we also seek to ensure that

legacy regulations are not extended to broadband or

wireless services, which are subject to vigorous competition.

In addition, states representing a majority of our local service

access lines have adopted legislation that enables new video

entrants to acquire a single statewide or state-approved

franchise (as opposed to the need to acquire hundreds or

even thousands of municipal-approved franchises) to offer

competitive video services. We also are supporting efforts to

update and improve regulatory treatment for retail services.

Regulatory reform and passage of legislation is uncertain

and depends on many factors.

We provide wireless services in robustly competitive markets,

but those services are subject to substantial and increasing

governmental regulation. Wireless communications providers

must obtain licenses from the FCC to provide communications

services at specified spectrum frequencies within specified

geographic areas and must comply with the FCC rules and

policies governing the use of the spectrum. The FCC has

recognized that the explosive growth of bandwidth-intensive