AT&T Wireless 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 49

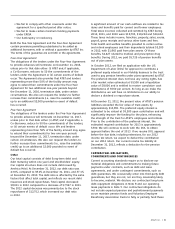

weighted maturity of approximately 12 years and an average

interest rate of 2.54%. We redeemed $8,083 in borrowing,

including $6,200 in early redemptions, with an average

interest rate of 5.58%. Debt issued included:

• $1,000 of 0.875% global notes due 2015.

• $1,000 of 1.6% global notes due 2017.

• $1,000 of 3% global notes due 2022.

• £1,250 of 4.875% global notes due 2044 (equivalent

to $1,979 when issued).

• $1,150 of 1.7% global notes due 2017.

• $850 of 3% global notes due 2022.

• €1,000 of 1.875% global notes due 2020 (equivalent

to $1,290 when issued).

• $1,000 of 0.8% global notes due 2015.

• $1,500 of 1.4% global notes due 2017.

• $1,500 of 2.625% global notes due 2022.

• €1,000 of 3.55% global notes due 2032 (equivalent

to $1,300 when issued).

During 2012, cash paid to redeem debt totaled $8,733 and

consisted of $650 for a debt exchange and the following

repayments:

• $1,835 in repayments of long-term debt with a

weighted-average interest rate of 5.40%.

• $2,500 for the early redemption of the AT&T Inc. 4.95%

global notes originally due in November 2013.

• $1,500 for the early redemption of the AT&T Inc. 6.7%

notes originally due in November 2013.

• $1,200 for the early redemption of the AT&T Inc. 6.375%

notes originally due in November 2056.

• $1,000 for the early redemption of the AT&T Inc. 4.85%

global notes originally due in February 2014.

• $48 in repayments of capitalized leases.

During 2012, we completed a private debt exchange covering

$4,099 of various notes with stated rates of 6.00% to 8.75%

for $1,956 in new 4.3% AT&T Inc. global notes due 2042 and

$3,044 in new 4.35% AT&T Inc. global notes due 2045 plus a

$650 cash payment.

On February 12, 2013, we issued $1,000 of 0.900%

global notes due 2016 and $1,250 of floating rate notes

due in 2016. The floating rate for the note is based upon

the three-month London Interbank Offered Rate (LIBOR),

reset quarterly, plus 38.5 basis points.

At December 31, 2012, we had $3,486 of debt maturing

within one year, substantially all of which was long-term debt

maturities. Debt maturing within one year includes the

following notes that may be put back to us by the holders:

• $1,000 of annual put reset securities issued by BellSouth

Corporation that may be put back to us each April until

maturity in 2021.

• An accreting zero-coupon note that may be redeemed

each May until maturity in 2022. If the zero-coupon note

(issued for principal of $500 in 2007) is held to maturity,

the redemption amount will be $1,030.

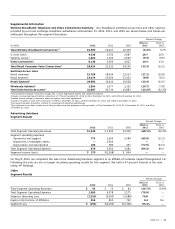

Cash Used in or Provided by Investing Activities

During 2012, cash used in investing activities consisted

primarily of:

• $19,465 in capital expenditures, excluding interest

during construction.

• $263 in interest during construction.

• $691 purchase of spectrum licenses.

During 2012, cash provided by investing activities consisted

primarily of:

• $740 from the sale of our Advertising Solutions segment.

• $65 from the sale of securities, net of investments.

Virtually all of our capital expenditures are spent on our

wireless and wireline networks, our U-verse services and

support systems for our communications services. Capital

expenditures, excluding interest during construction, decreased

$645 from 2011 and decreased $544 when including interest

during construction. Capital spending in our Wireless segment,

excluding capitalized interest during construction, represented

55% of our total spending and increased 10% in 2012.

The Wireline segment, which includes U-verse services,

represented 45% of the total capital expenditures, excluding

interest during construction, and decreased 15% in 2012.

Wireless expenditures were primarily used for network capacity

expansion, integration and upgrades to our HSPA network

and the deployment of LTE equipment.

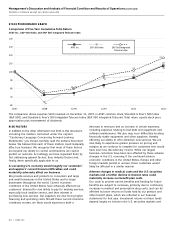

We expect that our capital expenditures during 2013 will

be in the $21,000 range. This amount may change if the

regulatory environment becomes more unfavorable for

investment. We expect increases in our Wireless segment and

stable investments in our Wireline segment. The amount of

capital investment is influenced by demand for services and

products, continued growth and regulatory considerations.

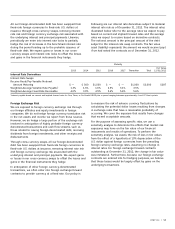

Cash Used in or Provided by Financing Activities

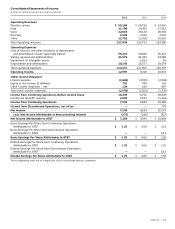

We paid dividends of $10,241 in 2012, $10,172 in 2011, and

$9,916 in 2010, primarily reflecting dividend rate increases

and partially offset by the decline in shares outstanding due

to our repurchases during 2012. In November 2012, our

Board of Directors approved a 2.3% increase in the quarterly

dividend from $0.44 to $0.45 per share. This follows a 2.3%

dividend increase approved by our Board in December 2011.

Dividends declared by our Board of Directors totaled $1.77

per share in 2012, $1.73 per share in 2011, and $1.69 per

share in 2010. Our dividend policy considers the expectations

and requirements of stockholders, internal requirements of

AT&T and long-term growth opportunities. It is our intent to

provide the financial flexibility to allow our Board of Directors

to consider dividend growth and to recommend an increase

in dividends to be paid in future periods. All dividends remain

subject to declaration by our Board of Directors.

In 2012, in response to lower market interest rates, we

undertook several activities related to our long-term debt.

During 2012, we received net proceeds of $13,486 from the

issuance of $13,569 in long-term debt with an average