AT&T Wireless 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 | AT&T Inc.

Notes to Consolidated Financial Statements

Dollars in millions except per share amounts

Cash and Cash Equivalents Cash and cash equivalents

include all highly-liquid investments with original maturities

of three months or less. The carrying amounts approximate

fair value. At December 31, 2012, we held $482 in cash and

$4,386 in money market funds and other cash equivalents.

Revenue Recognition Revenues derived from wireless,

local telephone, long distance, data and video services

are recognized when services are provided. This is based

upon either usage (e.g., minutes of traffic/bytes of data

processed), period of time (e.g., monthly service fees) or

other established fee schedules. Our wireless service

revenues are billed either in advance, arrears or are prepaid.

We record an estimated revenue reduction for future

adjustments to customer accounts, other than bad debt

expense, at the time revenue is recognized based on

historical experience. Service revenues also include billings

to our customers for various regulatory fees imposed on

us by governmental authorities. Cash incentives given to

customers are recorded as a reduction of revenue.

When required as part of providing service, revenues and

associated expenses related to nonrefundable, upfront service

activation and setup fees are deferred and recognized over

the associated service contract period or customer life.

Associated expenses are deferred only to the extent of such

deferred revenue. For contracts that involve the bundling of

services, revenue is allocated to the services based on their

relative selling price, subject to the requirement that revenue

recognized is limited to the amounts already received from

the customer that are not contingent upon the delivery

of additional products or services to the customer in the

future. We record the sale of equipment to customers as

gross revenue when we are the primary obligor in the

arrangement, when title is passed and when the products are

accepted by customers. For agreements involving the resale

of third-party services in which we are not considered the

primary obligor of the arrangement, we record the revenue

net of the associated costs incurred. For contracts in which

we provide customers with an indefeasible right to use

network capacity, we recognize revenue ratably over the

stated life of the agreement.

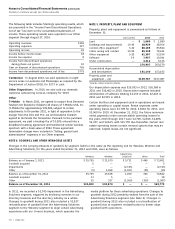

Traffic Compensation Expense We use various estimates

and assumptions to determine the amount of traffic

compensation expenses recognized during any reporting

period. Switched traffic compensation costs are accrued

utilizing estimated rates and volumes by product, formulated

from historical data and adjusted for known rate changes.

Such estimates are adjusted monthly to reflect newly available

information, such as rate changes and new contractual

agreements. Bills reflecting actual incurred information are

generally not received within three months subsequent to the

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation Throughout this document, AT&T Inc. is

referred to as “AT&T,” “we” or the “Company.” The consolidated

financial statements include the accounts of the Company and

our majority-owned subsidiaries and affiliates. Our subsidiaries

and affiliates operate in the communications services industry

both domestically and internationally, providing wireless

communications services, local exchange services, long-

distance services, data/broadband and Internet services, video

services, telecommunications equipment, managed networking

and wholesale services. During 2012, we sold our Advertising

Solutions segment (see Note 4).

All significant intercompany transactions are eliminated in

the consolidation process. Investments in partnerships and

less than majority-owned subsidiaries where we have

significant influence are accounted for under the equity

method. Earnings from certain foreign equity investments

accounted for using the equity method are included for

periods ended within up to one month of our year end

(see Note 7). We also record our proportionate share of

our equity method investees’ other comprehensive income

(OCI) items, including actuarial gains and losses on pension

and other postretirement benefit obligations.

The preparation of financial statements in conformity with

U.S. generally accepted accounting principles (GAAP)

requires management to make estimates and assumptions

that affect the amounts reported in the financial statements

and accompanying notes, including estimates of probable

losses and expenses. Actual results could differ from those

estimates. We have reclassified and reallocated certain

amounts in prior-period financial statements to conform to

the current period’s presentation, including a reclassification

and realignment of certain operating expenses based on

an enhanced activity-based expense tracking system.

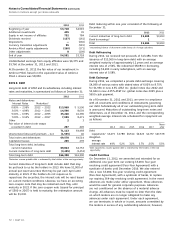

Income Taxes We provide deferred income taxes for

temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and

the computed tax basis of those assets and liabilities.

We provide valuation allowances against the deferred tax

assets for which the realization is uncertain. We review

these items regularly in light of changes in federal and

state tax laws and changes in our business.

We report, on a net basis, taxes imposed by governmental

authorities on revenue-producing transactions between us

and our customers in our consolidated statements of income.