AT&T Wireless 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 51

A significant amount of our cash outflows are related to tax

items and benefits paid for current and former employees.

Total taxes incurred, collected and remitted by AT&T during

2012, 2011, and 2010 were $19,703, $19,224 and $24,614.

These taxes include income, franchise, property, sales, excise,

payroll, gross receipts and various other taxes and fees.

Total health and welfare benefits provided to certain active

and retired employees and their dependents totaled $5,300

in 2012, with $1,842 paid from plan assets. Of those

benefits, $4,427 related to medical and prescription drug

benefits. During 2012, we paid $5,729 of pension benefits

out of plan assets.

In October 2012, we filed an application with the U.S.

Department of Labor (DOL) for approval to contribute a

preferred equity interest in our Mobility business to the trust

used to pay pension benefits under plans sponsored by AT&T.

The preferred interest does not have any voting rights, has

a fair market value estimated at $9,500 and a liquidation

value of $8,000 and is entitled to receive cumulative cash

distributions of $560 per annum. So long as we make the

distributions, we will have no limitations on our ability to

declare a dividend or repurchase shares.

At December 31, 2012, the present value of AT&T’s pension

liabilities exceeded the fair value of trust assets by

approximately $13,851. The preferred equity interest is

estimated to be valued at $9,500 upon contribution and will

significantly improve the funding for the plans, enhancing

the strength of the trust for AT&T’s employees and retirees.

Prior to the contribution of the preferred interest, the

estimated required contribution for 2013 is approximately

$300. We will continue to work with the DOL to obtain

approval before the end of 2013. If we receive DOL approval

before the due date, including extensions, for our 2012

income tax return, we expect to deduct the contribution

on our 2012 return. Our current income tax liability at

December 31, 2012, reflects a deduction for the pension

contribution.

CONTRACTUAL OBLIGATIONS,

COMMITMENTS AND CONTINGENCIES

Current accounting standards require us to disclose our

material obligations and commitments to making future

payments under contracts, such as debt and lease

agreements, and under contingent commitments, such as

debt guarantees. We occasionally enter into third-party debt

guarantees, but they are not, nor are they reasonably likely

to become, material. We disclose our contractual long-term

debt repayment obligations in Note 8 and our operating

lease payments in Note 5. Our contractual obligations do

not include expected pension and postretirement payments

as we maintain pension funds and Voluntary Employee

Beneficiary Association trusts to fully or partially fund these

• We fail to comply with other covenants under the

agreement for a specified period after notice.

• We fail to make certain minimum funding payments

under ERISA.

• Our bankruptcy or insolvency.

Both the Five-Year Agreement and the Four-Year Agreement

contain provisions permitting subsidiaries to be added as

additional borrowers, with or without a guarantee by AT&T Inc.

The terms of the guarantee are set forth in the agreements.

Four-Year Agreement

The obligations of the lenders under the Four-Year Agreement

to provide advances will terminate on December 11, 2016,

unless prior to that date either: (i) AT&T and, if applicable,

a Co-Borrower, reduces to $0 the commitments of the

lenders under the Agreement or (ii) certain events of default

occur. The Agreement also provides that AT&T and lenders

representing more than 50% of the facility amount may

agree to extend their commitments under the Four-Year

Agreement for two additional one-year periods beyond

the December 11, 2016, termination date, under certain

circumstances. We also can request the lenders to further

increase their commitments (i.e., raise the available credit)

up to an additional $2,000 provided no event of default

has occurred.

Five-Year Agreement

The obligations of the lenders under the Five-Year Agreement

to provide advances will terminate on December 11, 2017,

unless prior to that date either: (i) AT&T, and if applicable, a

Co-Borrower, reduce to $0 the commitments of the lenders,

or (ii) certain events of default occur. We and lenders

representing more than 50% of the facility amount may agree

to extend their commitments for two one-year periods

beyond the December 11, 2017, termination date, under

certain circumstances. We also can request the lenders to

further increase their commitments (i.e., raise the available

credit) up to an additional $2,000 provided no event of

default has occurred.

Other

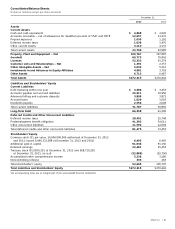

Our total capital consists of debt (long-term debt and

debt maturing within one year) and stockholders’ equity.

Our capital structure does not include debt issued by

América Móvil. At December 31, 2012, our debt ratio was

43.0%, compared to 38.0% at December 31, 2011, and 37.1%

at December 31, 2010. The debt ratio is affected by the same

factors that affect total capital, and reflects our recent debt

issuances and stock repurchases. Total capital decreased

$8,011 in 2012 compared to a decrease of $7,567 in 2011.

The 2012 capital decrease was primarily due to the stock

repurchases of $12,752, which increased our debt ratio

in 2012.