AT&T Wireless 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

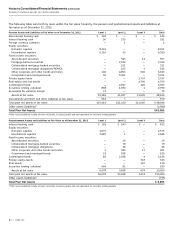

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

82 | AT&T Inc.

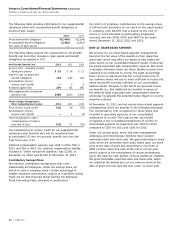

Asset and benefit obligation forecasting studies are

conducted periodically, generally every two to three years,

or when significant changes have occurred in market

conditions, benefits, participant demographics or funded

status. Decisions regarding investment policy are made

with an understanding of the effect of asset allocation on

funded status, future contributions and projected expenses.

The current asset allocation policy and risk level for the

pension plan and VEBA assets are based on a study

completed and approved during 2011.

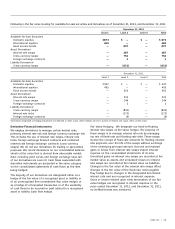

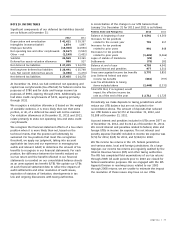

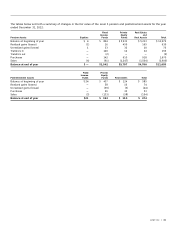

The plans’ weighted-average asset targets and actual

allocations as a percentage of plan assets, including the

notional exposure of future contracts by asset categories

at December 31, are as follows:

We maintain VEBA trusts to partially fund postretirement

benefits; however, there are no ERISA or regulatory

requirements that these postretirement benefit plans

be funded annually.

The principal investment objectives are to ensure the

availability of funds to pay pension and postretirement

benefits as they become due under a broad range of future

economic scenarios, to maximize long-term investment

return with an acceptable level of risk based on our pension

and postretirement obligations, and to be broadly diversified

across and within the capital markets to insulate asset

values against adverse experience in any one market.

Each asset class has broadly diversified characteristics.

Substantial biases toward any particular investing style or

type of security are sought to be avoided by managing

the aggregation of all accounts with portfolio benchmarks.

Pension Assets Postretirement (VEBA) Assets

Target 2012 2011 Target 2012 2011

Equity securities:

Domestic 25% – 35% 26% 24% 32% – 42% 37% 39%

International 10% – 20% 16 15 28% – 38% 33 31

Fixed income securities 30% – 40% 34 34 19% – 29% 24 21

Real assets 6% – 16% 11 11 0% – 6% 1 1

Private equity 4% – 14% 13 13 0% – 9% 4 5

Other 0% – 5% — 3 0% – 7% 1 3

Total 100% 100% 100% 100%

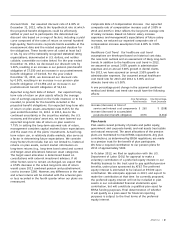

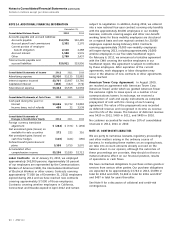

the bid price or the average of the bid and asked price on

the last business day of the year from published sources

where available and, if not available, from other sources

considered reliable. Depending on the types and contractual

terms of OTC derivatives, fair value is measured using

valuation techniques, such as the Black-Scholes option

pricing model, simulation models or a combination of

various models.

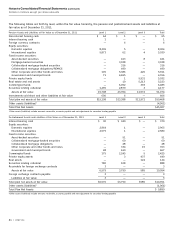

Common/collective trust funds, pooled separate accounts,

and other commingled (103-12) investment entities are

valued at quoted redemption values that represent the net

asset values of units held at year-end which management

has determined approximates fair value.

Alternative investments, including investments in private

equity, real estate, natural resources (included in real assets),

mezzanine and distressed debt (included in partnerships/joint

ventures), limited partnership interest, fixed income securities

and hedge funds do not have readily available market values.

These estimated fair values may differ significantly from the

At December 31, 2012, AT&T securities represented less than

0.5% of assets held by our pension plans and VEBA trusts.

Investment Valuation

Investments are stated at fair value. Fair value is the price

that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants

at the measurement date. See “Fair Value Measurements”

for further discussion.

Investments in securities traded on a national securities

exchange are valued at the last reported sales price on the

last business day of the year. If no sale was reported on

that date, they are valued at the last reported bid price.

Investments in securities not traded on a national securities

exchange are valued using pricing models, quoted prices of

securities with similar characteristics or discounted cash

flows. Shares of registered investment companies are valued

based on quoted market prices, which represent the net

asset value of shares held at year-end. Over-the-counter

(OTC) securities and government obligations are valued at