AT&T Wireless 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

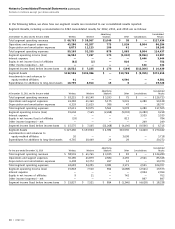

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

66 | AT&T Inc.

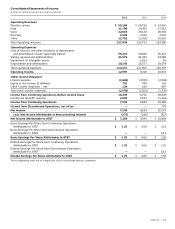

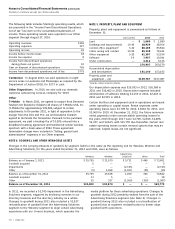

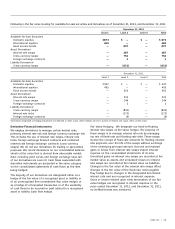

NOTE 2. EARNINGS PER SHARE

A reconciliation of the numerators and denominators of

basic earnings per share and diluted earnings per share for

income from continuing operations for the years ended

December 31, 2012, 2011 and 2010, are shown in the

table below:

Year Ended December 31, 2012 2011 2010

Numerators

Numerator for basic earnings

per share:

Income from continuing

operations $7,539 $4,184 $19,400

Income attributable to

noncontrolling interest (275) (240) (315)

Income from continuing

operations attributable to AT&T 7,264 3,944 19,085

Dilutive potential common shares:

Other share-based payment 12 11 11

Numerator for diluted earnings

per share $7,276 $3,955 $19,096

Denominators (000,000)

Denominator for basic earnings

per share:

Weighted-average number of

common shares outstanding 5,801 5,928 5,913

Dilutive potential common

shares:

Stock options 3 4 3

Other share-based payment

(in shares) 17 18 22

Denominator for diluted

earnings per share 5,821 5,950 5,938

Basic earnings per share

from continuing operations

attributable to AT&T $ 1.25 $ 0.66 $ 3.23

Basic earnings per share from

discontinued operations

attributable to AT&T — — 0.13

Basic earnings per share

attributable to AT&T $ 1.25 $ 0.66 $ 3.36

Diluted earnings per share

from continuing operations

attributable to AT&T $ 1.25 $ 0.66 $ 3.22

Diluted earnings per share from

discontinued operations

attributable to AT&T — — 0.13

Diluted earnings per share

attributable to AT&T $ 1.25 $ 0.66 $ 3.35

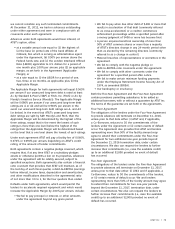

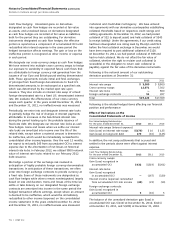

a discounted cash flow approach on a presumed royalty rate

derived from the revenues related to the brand name. The fair

value measurements used are considered Level 3 under the

Fair Value Measurement and Disclosure framework (see Note 9).

Intangible assets that have finite useful lives are amortized

over their useful lives (see Note 6). Customer lists and

relationships are amortized using primarily the sum-of-the-

months-digits method of amortization over the expected

period in which those relationships are expected to

contribute to our future cash flows. The remaining finite-lived

intangible assets are generally amortized using the straight-

line method of amortization.

Advertising Costs We expense advertising costs for

advertising products and services or for promoting our

corporate image as we incur them (see Note 14).

Foreign Currency Translation We are exposed to foreign

currency exchange risk through our foreign affiliates and

equity investments in foreign companies. Our foreign

subsidiaries and foreign investments generally report their

earnings in their local currencies. We translate our share of

their foreign assets and liabilities at exchange rates in effect

at the balance sheet dates. We translate our share of their

revenues and expenses using average rates during the

year. The resulting foreign currency translation adjustments

are recorded as a separate component of accumulated

other comprehensive income (accumulated OCI) in the

accompanying consolidated balance sheets. We do not hedge

foreign currency translation risk in the net assets and income

we report from these sources. However, we do hedge a

portion of the foreign currency exchange risk involved in

anticipation of highly probable foreign currency-denominated

transactions, which we explain further in our discussion of our

methods of managing our foreign currency risk (see Note 9).

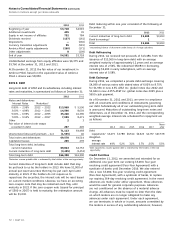

Employee Separations We established obligations for

expected termination benefits provided under existing plans

to former or inactive employees after employment but

before retirement. At December 31, 2012, we had severance

accruals of $120 and at December 31, 2011, we had

severance accruals of $335. The decline was primarily due

to payments during the year.

Pension and Other Postretirement Benefits See Note 11

for a comprehensive discussion of our pension and

postretirement benefit expense, including a discussion of

the actuarial assumptions and our policy for recognizing

the associated gains and losses.