AT&T Wireless 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 67

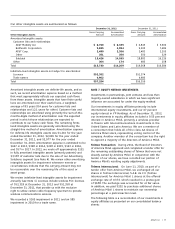

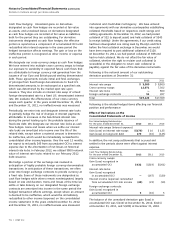

The Wireless segment uses our nationwide network to provide

consumer and business customers with wireless voice and

advanced data communications services. This segment

includes our portion of the results from our mobile payment

joint venture marketed as the Isis Mobile WalletTM (ISIS), which

is accounted for as an equity investment.

The Wireline segment uses our regional, national and global

network to provide consumer and business customers with

landline voice and data communications services, AT&T

U-verse® high-speed broadband, video and voice services and

managed networking to business customers. Additionally,

we receive commissions on sales of satellite television

services offered through our agency arrangements.

The Wireline segment results have been reclassified to

exclude the operating results of the home monitoring

business moved to our Other segment and to include the

operating results of customer information services, which

were previously reported in our Other segment’s results.

The Advertising Solutions segment included our directory

operations, which published Yellow and White Pages directories

and sold directory advertising and Internet-based advertising

and local search through May 8, 2012 (see Note 4).

The Other segment includes our portion of the results from

our international equity investments, our 47 percent equity

interest in YP Holdings, and costs to support corporate-driven

activities and operations. Also included in the Other segment

are impacts of corporate-wide decisions for which the

individual operating segments are not being evaluated.

The Other segment results have been reclassified to exclude

the operating results of customer information services,

which are now reported in our Wireline segment’s results.

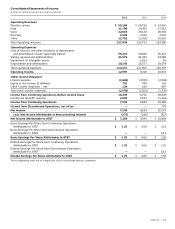

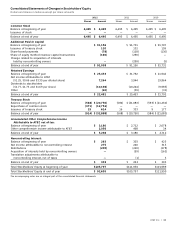

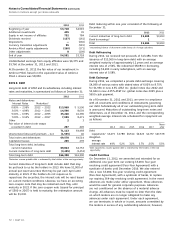

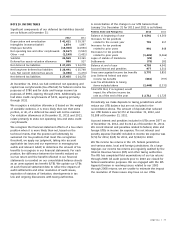

At December 31, 2012, 2011 and 2010, we had issued and

outstanding options to purchase approximately 17 million,

66 million, and 130 million shares of AT&T common stock.

The exercise prices of 3 million, 40 million, and 100 million

shares in 2012, 2011, and 2010 were above the average

market price of AT&T stock for the respective periods.

Accordingly, we did not include these amounts in determining

the dilutive potential common shares. At December 31, 2012,

the exercise prices of 14 million vested stock options were

below market price.

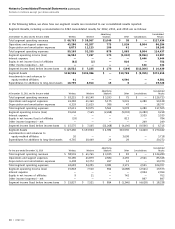

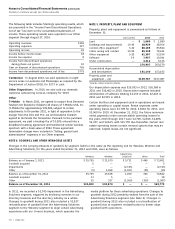

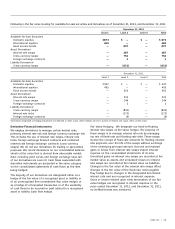

NOTE 3. SEGMENT INFORMATION

Our segments are strategic business units that offer

different products and services over various technology

platforms and are managed accordingly. We analyze our

operating segments based on segment income before

income taxes. We make our capital allocation decisions

based on our strategic direction of the business, needs of

the network (wireless or wireline) providing services and

other assets needed to provide emerging services to our

customers. Actuarial gains and losses from pension and

other postemployment benefits, interest expense and

other income (expense) – net, are managed only on a

total company basis and are, accordingly, reflected only

in consolidated results. Therefore, these items are not

included in each segment’s reportable results. The customers

and long-lived assets of our reportable segments are

predominantly in the United States. At December 31, 2012,

we had three reportable segments: (1) Wireless, (2) Wireline

and (3) Other. Our operating results prior to May 9, 2012,

also included Advertising Solutions, which was a reportable

segment. On May 8, 2012, we completed the sale of our

Advertising Solutions segment and received a 47 percent

equity interest in the new entity YP Holdings LLC

(YP Holdings) (see Note 4).