AT&T Wireless 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

74 | AT&T Inc.

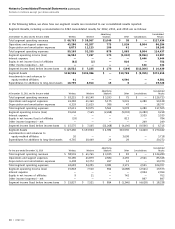

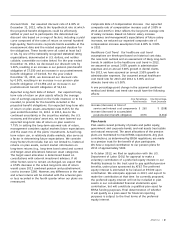

Investment Securities

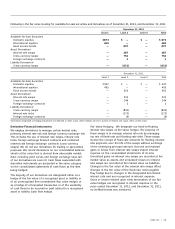

Our investment securities include equities, fixed income

bonds and other securities. A substantial portion of the fair

values of our available-for-sale securities were estimated

based on quoted market prices. Investments in securities not

traded on a national securities exchange are valued using

pricing models, quoted prices of securities with similar

characteristics or discounted cash flows. Realized gains and

losses on securities are included in “Other income (expense)

– net” in the consolidated statements of income using the

specific identification method. Unrealized gains and losses,

net of tax, on available-for-sale securities are recorded in

accumulated OCI. Unrealized losses that are considered other

than temporary are recorded in “Other income (expense) –

net” with the corresponding reduction to the carrying basis

of the investment. Fixed income investments of $86 have

maturities of less than one year, $280 within one to three

years, $210 within three to five years, and $261 for five or

more years, which approximate fair value.

Our short-term investments (including money market

securities) and customer deposits are recorded at amortized

cost, and the respective carrying amounts approximate

fair values.

Our investment securities maturing within one year are

recorded in “Other current assets,” and instruments with

maturities of more than one year are recorded in “Other

Assets” on the consolidated balance sheets.

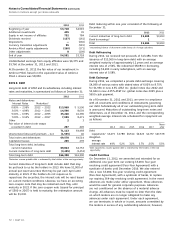

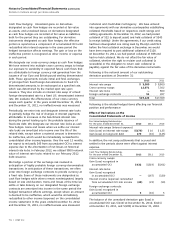

The fair value measurements level of an asset or liability within

the fair value hierarchy is based on the lowest level of any

input that is significant to the fair value measurement. Valuation

techniques used should maximize the use of observable inputs

and minimize the use of unobservable inputs.

The valuation methodologies described above may produce a

fair value calculation that may not be indicative of future net

realizable value or reflective of future fair values. We believe

our valuation methods are appropriate and consistent with

other market participants. The use of different methodologies

or assumptions to determine the fair value of certain financial

instruments could result in a different fair value measurement

at the reporting date. There have been no changes in the

methodologies used since December 31, 2011.

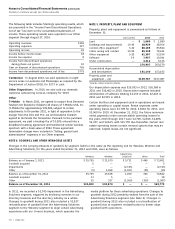

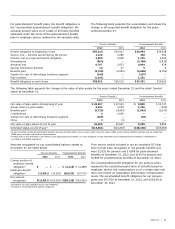

Long-Term Debt and Other Financial Instruments

The carrying amounts and estimated fair values of our

long-term debt, including current maturities and other

financial instruments, are summarized as follows:

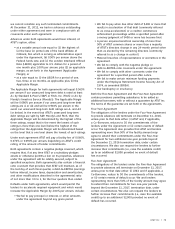

December 31, 2012 December 31, 2011

Carrying Fair Carrying Fair

Amount Value Amount Value

Notes and debentures $69,578 $81,310 $64,514 $73,738

Bank borrowings 1 1 — —

Investment securities 2,218 2,218 2,092 2,092

The carrying value of debt with an original maturity of less

than one year approximates market value. The fair value

measurement used for notes and debentures are considered

Level 2.

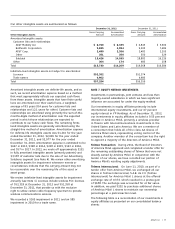

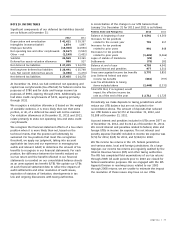

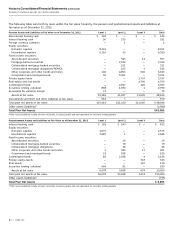

NOTE 9. FAIR VALUE MEASUREMENTS AND DISCLOSURE

The Fair Value Measurement and Disclosure framework provides a three-tiered fair value hierarchy that gives highest priority

to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority

to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are described below:

LEVEL 1 Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active

markets that we have the ability to access.

LEVEL 2 Inputs to the valuation methodology include:

• Quoted prices for similar assets and liabilities in active markets.

• Quoted prices for identical or similar assets or liabilities in inactive markets.

• Inputs other than quoted market prices that are observable for the asset or liability.

• Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

LEVEL 3 Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

• Fair value is often based on developed models in which there are few, if any, external observations.