AT&T Wireless 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 | AT&T Inc.

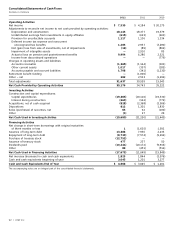

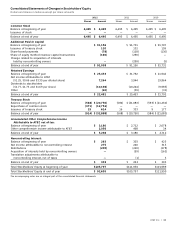

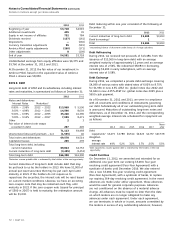

Consolidated Statements of Cash Flows

Dollars in millions

2012 2011 2010

Operating Activities

Net income $ 7,539 $ 4,184 $ 20,179

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization 18,143 18,377 19,379

Undistributed earnings from investments in equity affiliates (615) (623) (603)

Provision for uncollectible accounts 1,117 1,136 1,334

Deferred income tax expense and noncurrent

unrecognized tax benefits 1,285 2,937 (3,280)

Net (gain) loss from sale of investments, net of impairments (19) (89) (802)

Impairment of intangible assets — 2,910 85

Actuarial loss on pension and postretirement benefits 9,994 6,280 2,521

Income from discontinued operations — — (779)

Changes in operating assets and liabilities:

Accounts receivable (1,365) (1,164) (101)

Other current assets 1,017 (397) (185)

Accounts payable and accrued liabilities 1,798 (341) (1,230)

Retirement benefit funding — (1,000) —

Other − net 282 2,533 (1,296)

Total adjustments 31,637 30,559 15,043

Net Cash Provided by Operating Activities 39,176 34,743 35,222

Investing Activities

Construction and capital expenditures:

Capital expenditures (19,465) (20,110) (19,530)

Interest during construction (263) (162) (772)

Acquisitions, net of cash acquired (828) (2,368) (2,906)

Dispositions 812 1,301 1,830

Sales (purchases) of securities, net 65 62 (100)

Other (1) 27 29

Net Cash Used in Investing Activities (19,680) (21,250) (21,449)

Financing Activities

Net change in short-term borrowings with original maturities

of three months or less 1 (1,625) 1,592

Issuance of long-term debt 13,486 7,936 2,235

Repayment of long-term debt (8,733) (7,574) (9,294)

Purchase of treasury stock (12,752) — —

Issuance of treasury stock 477 237 50

Dividends paid (10,241) (10,172) (9,916)

Other 89 (451) (516)

Net Cash Used in Financing Activities (17,673) (11,649) (15,849)

Net increase (decrease) in cash and cash equivalents 1,823 1,844 (2,076)

Cash and cash equivalents beginning of year 3,045 1,201 3,277

Cash and Cash Equivalents End of Year $ 4,868 $ 3,045 $ 1,201

The accompanying notes are an integral part of the consolidated financial statements.