AT&T Wireless 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 69

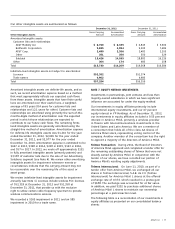

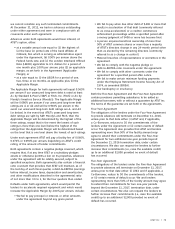

Atlantic Tele-Network On January 22, 2013, we announced

an agreement to acquire Atlantic Tele-Network’s (ATNI) U.S.

retail wireless operations for $780 in cash, which covers

approximately 4.6 million people in primarily rural areas

across six states – Georgia, Idaho, Illinois, North Carolina,

Ohio and South Carolina. The acquisition includes spectrum

in the 700 MHz, 850 MHz and 1900 MHz bands and is largely

complementary to our existing network. The transaction is

subject to regulatory approval and we expect it to close in

the second half of 2013.

Purchase of Spectrum from Verizon On January 25, 2013,

we agreed to acquire spectrum in the 700 MHz B band from

Verizon Wireless for $1,900 in cash and the assignment of

AWS spectrum in five markets. This transaction is subject to

regulatory approval and we expect it to close in the second

half of 2013.

Dispositions

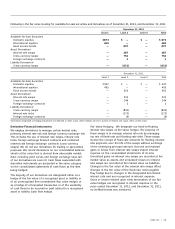

Advertising Solutions On May 8, 2012, we completed the

sale of our Advertising Solutions segment to an affiliate of

Cerberus Capital Management, L.P. for approximately $740 in

cash after closing adjustments, a $200 note and a 47 percent

equity interest in the new entity, YP Holdings. Our operating

results include the results of the Advertising Solutions

segment through May 8.

Tender of Telmex Shares In August 2011, the Board of

Directors of América Móvil, S.A. de C.V. (América Móvil)

approved a tender offer for the remaining outstanding shares

of Télefonos de México, S.A. de C.V. (Telmex) that were not

already owned by América Móvil. We tendered all of our

shares of Telmex for $1,197 of cash. Telmex was accounted

for as an equity method investment (see Note 7).

Sale of Sterling Operations In May 2010, we entered into

an agreement to sell our Sterling Commerce Inc. (Sterling)

subsidiary and changed our reporting for Sterling to

discontinued operations. In August 2010, we completed the

sale and received net proceeds of approximately $1,400.

During the second quarter of 2010, we accounted for Sterling

as a discontinued operation. We determined that the cash

inflows under a transition services agreement and our cash

outflows under an enterprise license agreement did not

constitute significant continuing involvement with Sterling’s

operations after the sale.

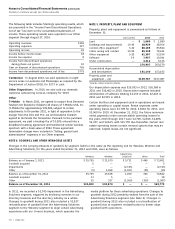

NOTE 4. ACQUISITIONS, DISPOSITIONS AND OTHER ADJUSTMENTS

Acquisitions

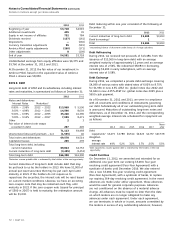

Spectrum Acquisitions During 2012, we acquired $855 of

wireless spectrum from various companies. During 2011, we

acquired $33 of wireless spectrum from various companies,

not including the Qualcomm spectrum purchase discussed

in the following paragraph.

Qualcomm Spectrum Purchase In December 2011, we

completed our purchase of spectrum licenses in the Lower

700 MHz frequency band from Qualcomm Incorporated for

approximately $1,925 in cash. The spectrum covers more than

300 million people total nationwide, including 12 MHz of

Lower 700 MHz D and E block spectrum covering more than

70 million people in five of the top 15 metropolitan areas and

6 MHz of Lower 700 MHz D block spectrum covering more

than 230 million people across the rest of the United States.

We plan to deploy this spectrum as supplemental downlink

capacity, using carrier aggregation technology once

compatible handsets and network equipment are developed.

Wireless Properties Transactions In June 2010, we

acquired certain wireless properties, including FCC licenses

and network assets, from Verizon Wireless for $2,376 in cash.

The assets primarily represent former Alltel Wireless assets

and served approximately 1.6 million subscribers in 79 service

areas across 18 states.

Centennial In December 2010, we completed our acquisition

accounting of Centennial Communications Corporation

(Centennial), which included net assets of $1,518 in goodwill,

$655 in FCC licenses, and $449 in customer lists and other

intangible assets.

Purchase of Wireless Partnership Minority Interest In

July 2011, we completed the acquisition of Convergys

Corporation’s minority interests in the Cincinnati SMSA

Limited Partnership and an associated cell tower holding

company for approximately $320 in cash.

Subsequent and Pending Acquisitions

Subsequent Spectrum Acquisitions On January 24, 2013,

we completed the acquisition of NextWave Wireless Inc.

(NextWave), which holds wireless licenses in the Wireless

Communication Services and Advanced Wireless Service

(AWS) bands. We acquired all the equity and purchased a

portion of the debt of NextWave for $600. In addition, certain

of NextWave’s assets were distributed to the holders of its

debt in redemption of the remainder of that debt. During

January 2013, we have also closed approximately $400 of

other wireless spectrum acquisitions from various companies.