AT&T Wireless 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

84 | AT&T Inc.

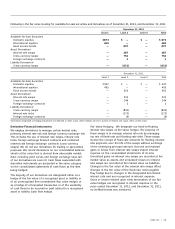

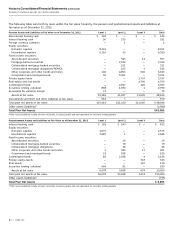

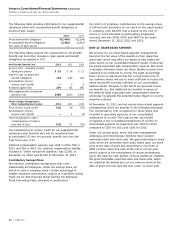

The following table sets forth by level, within the fair value hierarchy, the pension and postretirement assets and liabilities at

fair value as of December 31, 2012:

Pension Assets and Liabilities at Fair Value as of December 31, 2012 Level 1 Level 2 Level 3 Total

Non-interest bearing cash $ 144 $ — $ — $ 144

Interest bearing cash 56 235 — 291

Foreign currency contracts — 1 — 1

Equity securities:

Domestic equities 8,291 — — 8,291

International equities 6,361 29 — 6,390

Fixed income securities:

Asset-backed securities — 543 14 557

Mortgage-backed securities — 2,324 — 2,324

Collateralized mortgage-backed securities — 311 — 311

Collateralized mortgage obligations/REMICS — 523 1 524

Other Corporate and other bonds and notes 140 4,903 600 5,643

Government and municipal bonds 50 5,301 — 5,351

Private equity funds — — 5,797 5,797

Real estate and real assets — — 4,766 4,766

Commingled funds — 4,927 426 5,353

Securities lending collateral 868 1,930 1 2,799

Receivable for variation margin 72 — — 72

Assets at fair value 15,982 21,027 11,605 48,614

Investments sold short and other liabilities at fair value 563 7 — 570

Total plan net assets at fair value $15,419 $21,020 $11,605 $ 48,044

Other assets (liabilities)1 (2,984)

Total Plan Net Assets $45,060

1Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.

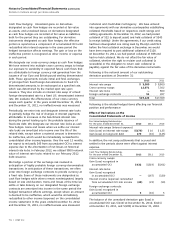

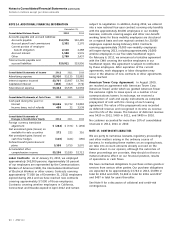

Postretirement Assets and Liabilities at Fair Value as of December 31, 2012 Level 1 Level 2 Level 3 Total

Interest bearing cash $ 169 $ 243 $ — $ 412

Equity securities:

Domestic equities 2,575 — — 2,575

International equities 2,685 1 — 2,686

Fixed income securities:

Asset-backed securities — 29 — 29

Collateralized mortgage-backed securities — 79 — 79

Collateralized mortgage obligations — 46 — 46

Other Corporate and other bonds and notes 1 383 17 401

Government and municipal bonds 22 598 — 620

Commingled funds 82 2,038 4 2,124

Private equity assets — — 343 343

Real assets — — 110 110

Securities lending collateral 544 81 — 625

Assets at fair value 6,078 3,498 474 10,050

Total plan net assets at fair value $6,078 $3,498 $474 $10,050

Other assets (liabilities)1 (755)

Total Plan Net Assets $ 9,295

1Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.