AT&T Wireless 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

70 | AT&T Inc.

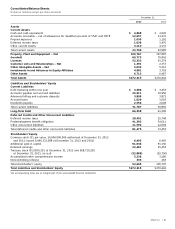

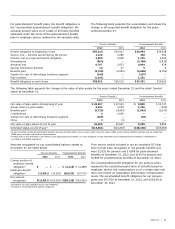

NOTE 5. PROPERTY, PLANT AND EQUIPMENT

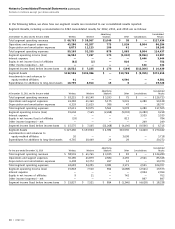

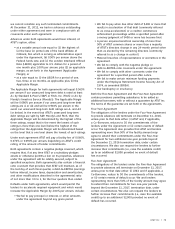

Property, plant and equipment is summarized as follows at

December 31:

Lives (years) 2012 2011

Land — $ 1,689 $ 1,689

Buildings and improvements 10-45 28,939 28,054

Central office equipment1 3-10 86,185 83,824

Cable, wiring and conduit 10-50 80,338 78,431

Other equipment 5-20 61,387 53,104

Software 3-5 7,957 10,041

Under construction — 4,412 5,136

270,907 260,279

Accumulated depreciation

and amortization 161,140 153,192

Property, plant and

equipment – net $109,767 $107,087

1Includes certain network software.

Our depreciation expense was $16,933 in 2012, $16,368 in

2011 and $16,402 in 2010. Depreciation expense included

amortization of software totaling $2,130 in 2012, $2,243 in

2011 and $2,515 in 2010.

Certain facilities and equipment used in operations are leased

under operating or capital leases. Rental expenses under

operating leases were $3,709 for 2012, $3,610 for 2011, and

$3,060 for 2010. At December 31, 2012, the future minimum

rental payments under noncancelable operating leases for

the years 2013 through 2017 were $2,706, $2,616, $2,486,

$2,337, and $2,165, with $11,755 due thereafter. Certain real

estate operating leases contain renewal options that may be

exercised. Capital leases are not significant.

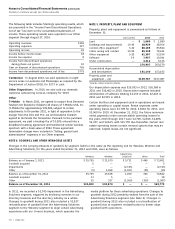

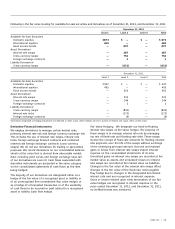

The following table includes Sterling’s operating results, which

are presented in the “Income From Discontinued Operations,

net of tax” line item on the consolidated statements of

income. These operating results were reported in our Other

segment through August 27, 2010:

Operating revenues $349

Operating expenses 327

Operating income 22

Income before income taxes 18

Income tax expense 8

Income from discontinued operations

during phase-out period 10

Gain on disposal of discontinued operations 769

Income from discontinued operations, net of tax $779

Centennial In August 2010, we sold operations in eight

service areas in Louisiana and Mississippi, as required by the

Department of Justice (DOJ), for $273 in cash.

Other Dispositions In 2010, we also sold our domestic

Japanese outsourcing services company for $109.

Other

T-Mobile In March 2011, we agreed to acquire from Deutsche

Telekom AG (Deutsche Telekom) all shares of T-Mobile USA, Inc.

(T-Mobile) for approximately $39,000, subject to certain

adjustments. In December 2011, in light of opposition to the

merger from the DOJ and FCC, we and Deutsche Telekom

agreed to terminate the transaction. Pursuant to the purchase

agreement, we paid a breakup fee of $3,000, entered into a

broadband roaming agreement and transferred certain wireless

spectrum with a book value of $962. These agreement

termination charges were included in “Selling, general and

administrative” expenses in our Other segment.

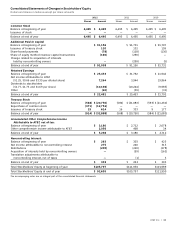

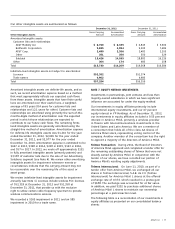

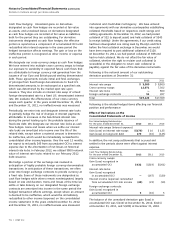

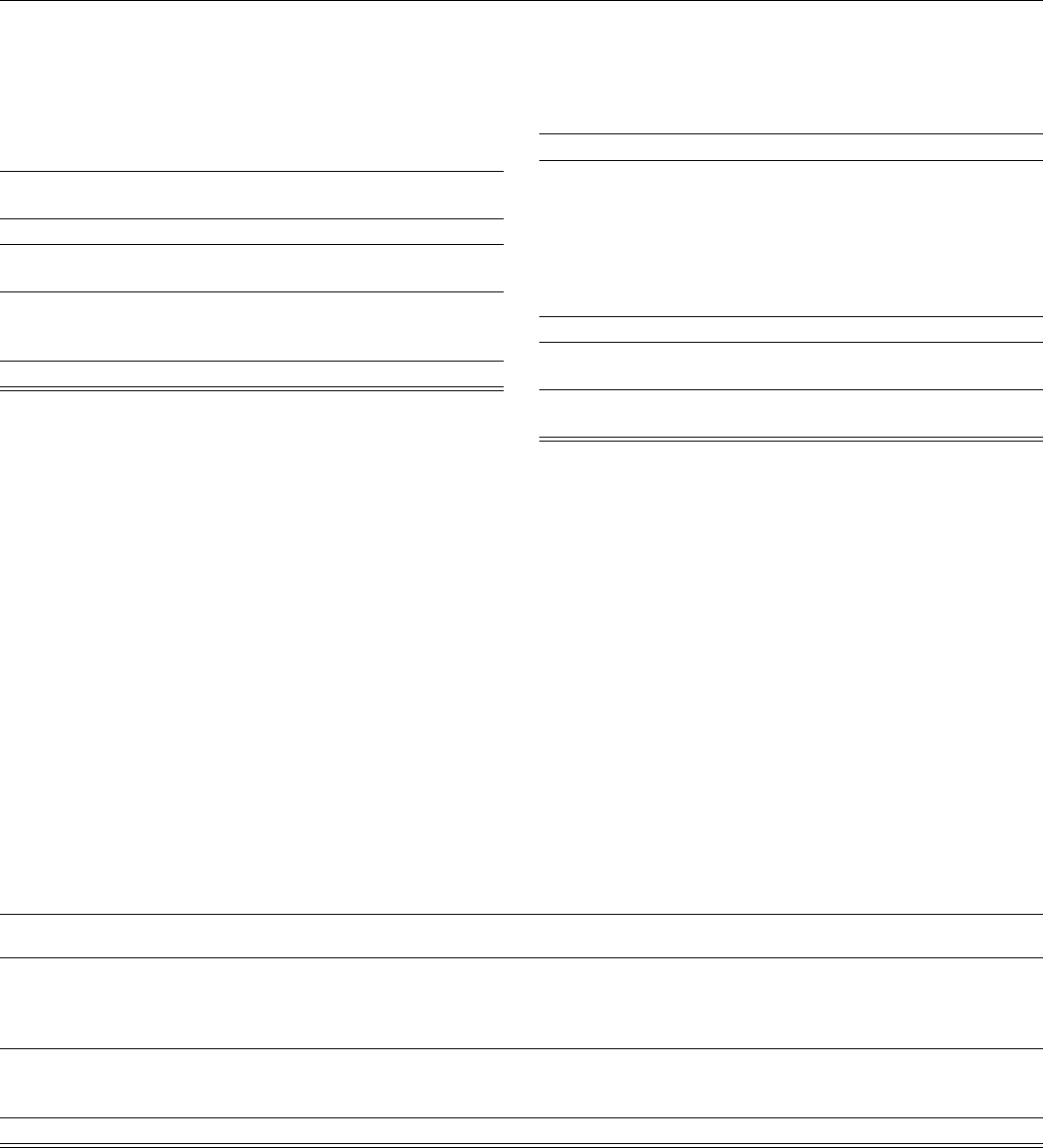

NOTE 6. GOODWILL AND OTHER INTANGIBLE ASSETS

Changes in the carrying amounts of goodwill, by segment (which is the same as the reporting unit for Wireless, Wireline and

Advertising Solutions), for the years ended December 31, 2012 and 2011, were as follows:

Advertising

Wireless Wireline Solutions Other Total

Balance as of January 1, 2011 $ 35,755 $ 31,670 $ 5,731 $ 445 $ 73,601

Goodwill acquired 5 — — — 5

Impairments — — (2,745) — (2,745)

Other (5) 1,968 (1,927) (55) (19)

Balance as of December 31, 2011 35,755 33,638 1,059 390 70,842

Goodwill acquired 13 5 — — 18

Other 35 327 (1,059) (390) (1,087)

Balance as of December 31, 2012 $35,803 $33,970 $ — $ — $69,773

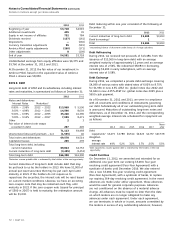

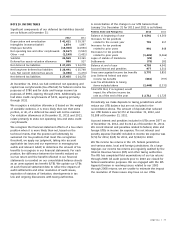

In 2011, we recorded a $2,745 impairment in the Advertising

Solutions segment, triggered by declining revenues in our

directory business and the directory industry as a whole.

Changes to goodwill during 2011 also included a $1,927

reclassification of goodwill from the Advertising Solutions

segment to the Wireline segment to align certain advertising

operations with our U-verse business, which operates the

media platform for those advertising operations. Changes to

goodwill during 2012 primarily resulted from the sale of the

Advertising Solutions segment (see Note 4). Changes in

goodwill during 2012 also included a reclassification of

goodwill due to segment reclassification to better align

goodwill with operations.