AT&T Wireless 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. | 35

continuing to invest significant capital in expanding our

network capacity, our capacity constraints could affect the

quality of existing voice and data services and our ability to

launch new, advanced wireless broadband services, unless we

are able to obtain more spectrum. Any long-term spectrum

solution will require that the Federal Communications

Commission (FCC) make new or existing spectrum available

to the wireless industry to meet the expanding needs of our

subscribers. We will continue to attempt to address spectrum

and capacity constraints on a market-by-market basis.

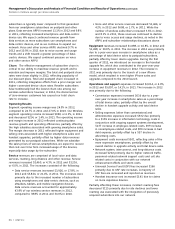

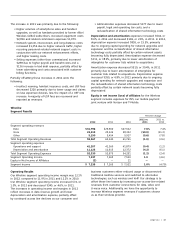

Wireless Metrics

Subscriber Additions As of December 31, 2012, we served

107 million wireless subscribers, an increase of 3.6% from

2011. We continue to see a declining rate of growth in the

industry’s subscriber base compared to prior years, as

reflected in a 13.0% decrease in gross subscriber additions

(gross additions) in 2012 after a 4.3% increase in 2011.

Gross additions in 2012 and 2011 reflected higher activations

of postpaid smartphones and sales of tablets and other

data-centric devices compared to prior years.

Lower net subscriber additions (net additions) in 2012 were

primarily attributable to lower net connected device and

reseller additions when compared to the prior year, which

reflected higher churn rates for customers not using such

devices (zero-revenue customers). Lower net prepaid

additions in 2012 reflected a decrease in net prepaid tablet

additions, as the introduction of our Mobile Share plans

has accelerated a shift from prepaid to postpaid tablet

subscribers. A relatively flat rate of growth in net postpaid

additions in 2012 and decline in 2011 reflected slowing

growth in the industry’s subscriber base. Lower net postpaid

additions in 2011, compared to 2010, also reflected higher

postpaid churn attributable in part to integration efforts

connected to a prior merger.

Average service revenue per user (ARPU) – Postpaid

increased 1.9% in 2012 and 1.8% in 2011, driven by increases

in data services ARPU of 13.9% in 2012 and 15.3% in 2011,

reflecting greater use of smartphones and data-centric

devices by our subscribers.

The growth in postpaid data services ARPU in 2012 and 2011

was partially offset by a 5.7% decrease in postpaid voice and

other service ARPU in 2012 and a 5.3% decrease in 2011.

Voice and other service ARPU declined due to lower access

and airtime charges, triggered in part by postpaid subscribers

on our discount plans, and lower roaming revenues.

ARPU – Total declined 1.6% in 2012 and 3.8% in 2011,

reflecting growth in connected device, tablet and reseller

subscribers. Connected devices and other data-centric

devices, such as tablets, have lower-priced data-only plans

compared with our postpaid smartphone plans, which have

voice and data features. Accordingly, ARPU for these

industry, most of our subscribers’ phones are designed to

work only with our wireless technology, requiring subscribers

who desire to move to a new carrier with a different

technology to purchase a new device. From time to time, we

offer and have offered attractive handsets on an exclusive

basis. As these exclusivity arrangements expire, we expect to

continue to offer such handsets (based on historical industry

practice), and we believe our service plan offerings will help

to retain our subscribers by providing incentives not to

migrate to a different carrier. We do not expect exclusivity

terminations to have a material impact on our Wireless

segment income, consolidated operating margin or our cash

flows from operations.

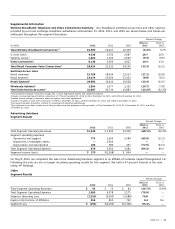

Our postpaid subscribers typically sign a two-year contract,

which includes discounted handsets and early termination

fees. As of December 31, 2012, about 90% of our postpaid

smartphone subscribers are on FamilyTalk® plans (family

plans), Mobile Share plans or business discount plans

(discount plans), which provide for service on multiple devices

at discounted rates, and such subscribers tend to have higher

retention and lower churn rates. During the first quarter of

2011, we introduced our Mobile to Any Mobile feature, which

enables our new and existing subscribers on these and other

qualifying plans to make unlimited mobile calls to any mobile

number in the United States, subject to certain conditions.

We also offer data plans at different price levels (usage-

based data plans) to attract a wide variety of subscribers

and to differentiate us from our competitors. Our postpaid

subscribers on data plans increased 11.4% year over year.

A growing percentage of our postpaid smartphone

subscribers are on usage-based data plans, with 67.4%

(or 31.7 million subscribers) on these plans as of

December 31, 2012, up from 56.0% (or 22.1 million

subscribers) as of December 31, 2011, and 31.2% (or

9.1 million subscribers) as of December 31, 2010. More than

75% of subscribers on tiered data plans have chosen the

higher-tiered plans. In August 2012, we launched new

Mobile Share data plans (which allow postpaid subscribers

to share data at discounted prices among devices covered

by their plan), and sales results have been strong, with

approximately 25% of Mobile Share subscribers choosing

plans of 10 gigabytes or higher. Such offerings are intended

to encourage existing subscribers to upgrade their current

services and/or add connected devices, attract subscribers

from other providers, and minimize subscriber churn.

As of December 31, 2012, 54.7% of our postpaid smartphone

subscribers use a 4G-capable device (i.e., a device that

would operate on our HSPA+ or LTE network). Due to

substantial increases in the demand for wireless service

in the United States, AT&T is facing significant spectrum

and capacity constraints on its wireless network in certain

markets. We expect such constraints to increase and expand

to additional markets in the coming years. While we are