2K Sports 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We capitalize and amortize stock-based compensation awards in accordance with our software

development cost accounting policy.

Restricted Stock

Restricted stock awards granted to employees under our equity incentive plans generally vest over 3 years

from the date of grant. Certain restricted stock awards granted to key officers, senior-level employees, and

key employees in 2008 vest based on market conditions, primarily related to the performance of the price

of our common stock and internal profitability metrics.

On June 13, 2008, pursuant to an amendment to our Management Agreement, we granted 600,000 shares

of restricted stock to ZelnickMedia that vest annually over a three year period and 900,000 shares of

market based restricted stock that vest over a four year period through 2012, provided that the price of our

common stock outperforms 75% of the companies in the NASDAQ Industrial Index. For the year ended

October 31, 2008, we recorded $2,227 of stock-based compensation (a component of general and

administrative expenses) related to these grants of restricted stock.

We measure the fair value of our market based awards to employees and non-employees using the Monte

Carlo Simulation method, which takes into account assumptions such as the expected volatility on our

common stock, the risk-free interest rate based on the contractual term of the award, expected dividend

yield, vesting schedule and the probability that the market conditions of the award will be achieved.

The estimated value of market based restricted stock awards granted to employees and ZelnickMedia

during the year ended October 31, 2008 was $16.37 per share and $9.38 per share, respectively. The

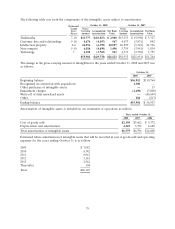

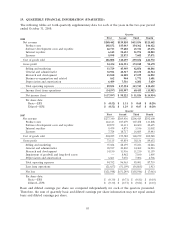

following table summarizes the weighted-average assumptions used in the Monte Carlo Simulation

valuation method:

Year Ended October 31, 2008

Employee Non-Employee

Market Based Market Based

Risk-free interest rate 3.1% 2.3%

Expected stock price volatility 51.8% 52.1%

Expected service period (years) 2.0 2.6

Dividends None None

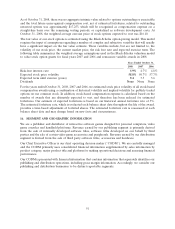

The following table summarizes the activity in non-vested restricted stock awarded to employees and

ZelnickMedia under our stock-based compensation plans:

Weighted

Average Fair

Shares Value on

(in thousands) Grant Date

Non-vested restricted stock at October 31, 2007 1,720 $18.03

Granted 2,207 25.16

Vested (723) 17.73

Forfeited (73) 18.18

Non-vested restricted stock at October 31, 2008 3,131 $23.23

As of October 31, 2008, the total future unrecognized compensation cost, net of estimated forfeitures,

related to outstanding unvested restricted stock was approximately $47,971 and will be recognized as

compensation expense on a straight-line basis over the remaining vesting period, or capitalized as software

development costs.

89