2K Sports 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stock Options

As of October 31, 2008 and 2007, there were outstanding stock options granted under our stock option

plans to purchase in the aggregate 4,347,000 and 5,818,000 shares of our common stock, respectively,

vesting at various times from 2008 to 2010 and expiring at various times from 2008 to 2017. Options

granted generally vest over a period of three to four years and expire within a period of five to ten years.

As of October 31, 2007, there were non-plan stock options outstanding for an aggregate of 96,000 shares of

our common stock. There were no non-plan stock options outstanding at October 31, 2008.

Pursuant to the Management Agreement, in August 2007, we issued stock options to ZelnickMedia to

acquire 2,009,075 shares of our common stock at an exercise price of $14.74 per share, which vest over

36 months and expire 10 years from the date of grant. Each month, we remeasure the fair value of the

unvested portion of such options and record compensation expense for the difference between total earned

compensation at the end of the period, and total earned compensation at the beginning of the period. As a

result, changes in the price of our common stock impacts compensation expense or benefit recognized

from period to period. For the years ended October 31, 2008 and 2007, we recorded $11,254 and $1,283,

respectively, of stock-based compensation (a component of general and administrative expenses) related to

this option grant.

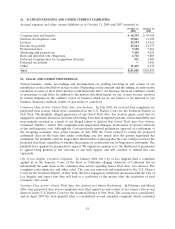

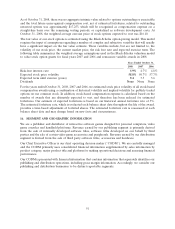

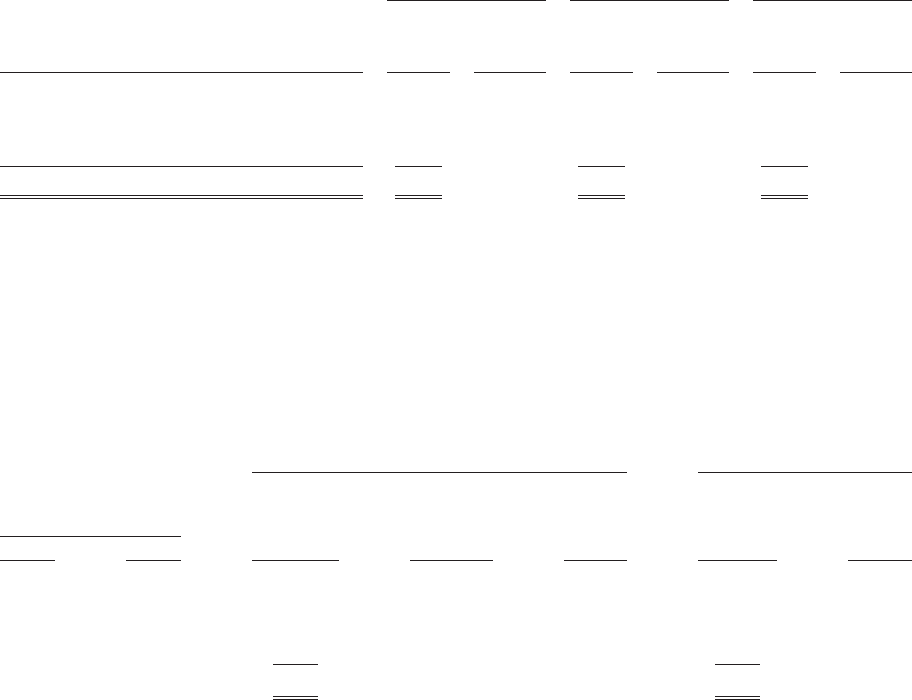

The following table summarizes the activity in options awarded to employees and ZelnickMedia under our

option plans and also includes non-plan options:

2008 2007 2006

Weighted Weighted Weighted

Average Average Average

Exercise Exercise Exercise

(options in thousands) Options Price Options Price Options Price

Outstanding at beginning of year 5,914 $19.72 5,802 $20.70 7,495 $20.47

Granted ——2,465 15.53 397 13.53

Exercised (1,236) 21.00 (679) 15.39 (306) 10.75

Forfeited (331) 19.36 (1,674) 18.70 (1,784) 19.83

Outstanding at end of year 4,347 $18.92 5,914 $19.72 5,802 $20.70

Exercisable at year-end 2,588 $20.84 2,750 $22.06 3,627 $19.92

Weighted average fair value of options

granted during the year $— $11.45 $ 6.27

Remaining weighted average contractual life

of options exercisable (years) 3.8 2.2 2.3

The total estimated fair value of shares vested during fiscal years 2008, 2007 and 2006 was $19,376; $13,777

and $26,718, respectively.

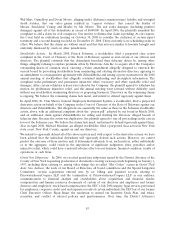

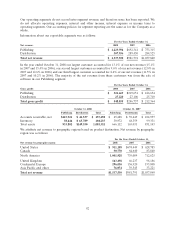

The following summarizes information about stock options outstanding and exercisable at October 31,

2008 (options in thousands):

Options Outstanding Options Exercisable

Weighted

Average Weighted Weighted

Number of Remaining Average Number of Average

Exercise Price Ranges Options Contractual Exercise Options Exercise

From To Outstanding Life Price Exercisable Price

$10.42 $15.39 2,136 8.5 $14.51 842 $14.45

15.50 20.68 566 2.4 19.03 327 19.33

20.70 24.51 495 1.8 22.61 269 23.02

25.10 26.59 1,150 1.4 25.44 1,150 25.44

4,347 5.1 18.92 2,588 20.84

90