2K Sports 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

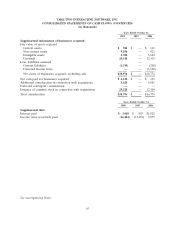

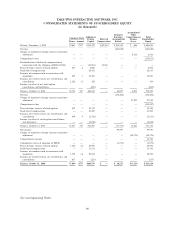

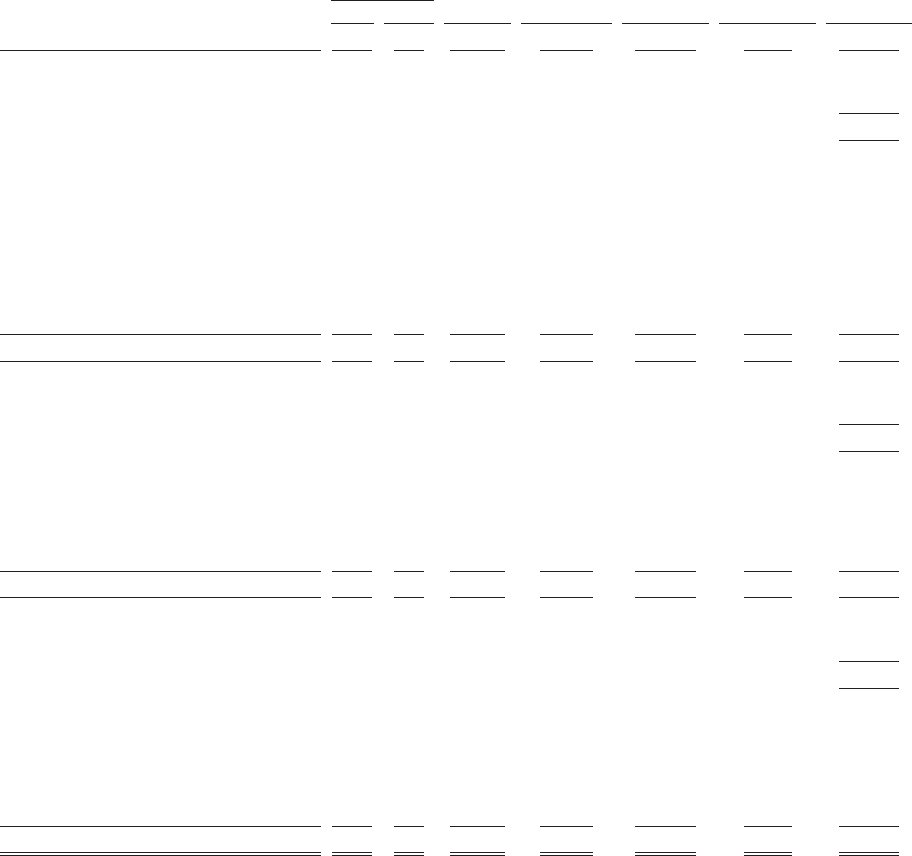

TAKE-TWO INTERACTIVE SOFTWARE, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands)

Accumulated

Retained Other

Additional Earnings Comprehensive Total

Common Stock Paid-in Deferred (Accumulated Income Stockholders’

Shares Amount Capital Compensation Deficit) (Loss) Equity

Balance, November 1, 2005 70,667 $707 $451,470 $(12,581) $ 245,548 $ 686 $ 685,830

Net loss (184,889) (184,889)

Change in cumulative foreign currency translation

adjustment — — — — — 6,216 6,216

Comprehensive loss — — — — — — (178,673)

Reclassification of deferred compensation in

connection with the adoption of SFAS 123(R) — — (12,581) 12,581 — — —

Proceeds from exercise of stock options 273 2 2,806 — — — 2,808

Stock-based compensation 28,413 28,413

Issuance of common stock in connection with

acquisition 679 7 12,493 — — — 12,500

Issuance of restricted stock, net of forfeitures and

cancellations 1,126 11 328 — — — 339

Income tax effect of net stock option

cancellations and forfeitures (825) (825)

Balance, October 31, 2006 72,745 727 482,104 — 60,659 6,902 550,392

Net loss (138,406) (138,406)

Change in cumulative foreign currency translation

adjustment — — — — — 27,959 27,959

Comprehensive loss — — — — — — (110,447)

Proceeds from exercise of stock options 679 7 10,174 — — — 10,181

Stock-based compensation — — 25,409 — — — 25,409

Issuance of restricted stock, net of forfeitures and

cancellations 849 9 (2,342) — — — (2,333)

Income tax effect of stock option cancellations

and forfeitures — — (2,048) — — — (2,048)

Balance, October 31, 2007 74,273 743 513,297 — (77,747) 34,861 471,154

Net income 97,097 97,097

Change in cumulative foreign currency translation

adjustment — — — — — (42,374) (42,374)

Comprehensive income — — — — — — 54,723

Cummulative effect of adoption of FIN48 — — — — (1,075) — (1,075)

Proceeds from exercise of stock options 1,236 12 25,950 — — — 25,962

Stock-based compensation — — 35,341 — — — 35,341

Issuance of common stock in connection with

acquisition 1,550 16 29,212 — — — 29,228

Issuance of restricted stock, net of forfeitures and

cancellations 635 6 (221) — — — (215)

Balance, October 31, 2008 77,694 $777 $603,579 $ — $ 18,275 $ (7,513) $ 615,118

See accompanying Notes.

66