2K Sports 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

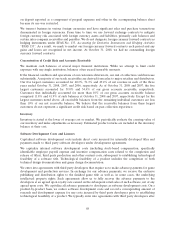

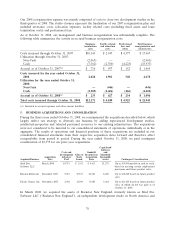

Amortization and impairment of software development costs and licenses for the years ended October 31,

2008, 2007 and 2006 were as follows:

Years Ended October 31,

2008 2007 2006

Amortization and impairment of software development costs $159,563 $109,891 $147,832

Less: Portion representing stock-based compensation (13,461) (3,216) (1,263)

Amortization and impairment, net of stock-based compensation $146,102 $106,675 $146,569

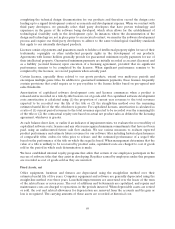

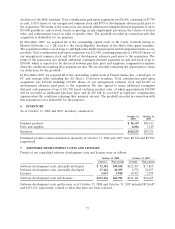

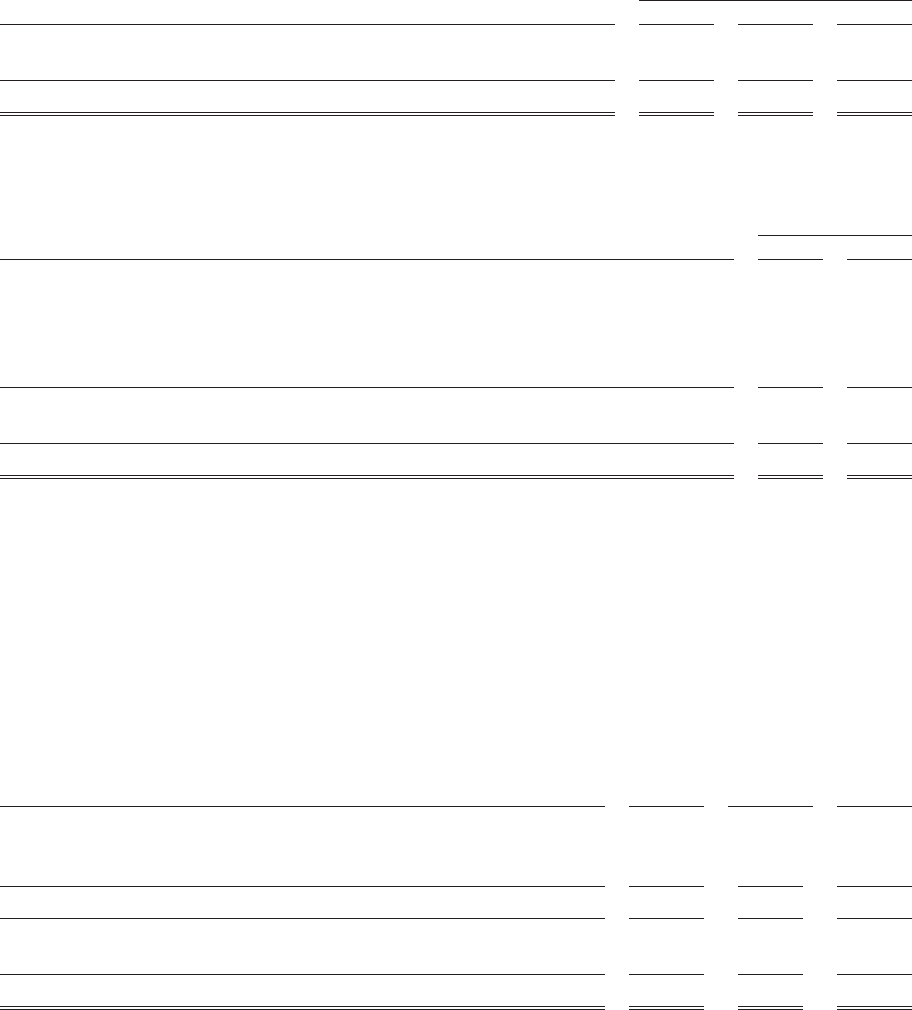

8. FIXED ASSETS, NET

As of October 31, 2008 and 2007, fixed assets consisted of:

October 31,

2008 2007

Computer equipment $31,002 $30,628

Office equipment 4,517 11,315

Computer software 23,345 23,832

Furniture and fixtures 4,989 5,535

Leasehold improvements 22,378 25,521

86,231 96,831

Less: accumulated depreciation 53,870 51,845

Fixed assets, net $32,361 $44,986

Depreciation expense for the years ended October 31, 2008, 2007, and 2006, was $21,526, $24,115 and

$21,771, respectively.

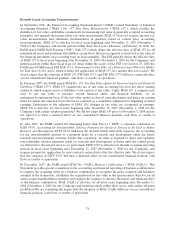

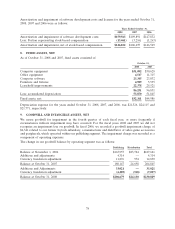

9. GOODWILL AND INTANGIBLE ASSETS, NET

We assess goodwill for impairment in the fourth quarter of each fiscal year, or more frequently if

circumstances indicate impairment may have occurred. For the fiscal years 2008 and 2007 we did not

recognize an impairment loss on goodwill. In fiscal 2006, we recorded a goodwill impairment charge of

$6,341 related to our former Joytech subsidiary, a manufacturer and distributor of video game accessories

and peripherals, which operated within our publishing segment. The impairment charge was recorded as a

component of operating expenses.

The change in our goodwill balance by operating segment was as follows:

Publishing Distribution Total

Balance at November 1, 2006 $163,957 $23,724 $187,681

Additions and adjustments 4,314 — 4,314

Currency translation adjustment 11,876 974 12,850

Balance at October 31, 2007 180,147 24,698 204,845

Additions and Adjustments 33,021 — 33,021

Currency translation adjustment (6,489) (568) (7,057)

Balance at October 31, 2008 $206,679 $24,130 $230,809

78