2K Sports 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.completing the technical design documentation for our products and therefore record the design costs

leading up to a signed development contract as research and development expense. When we contract with

third party developers, we generally select third party developers that have proven technology and

experience in the genre of the software being developed, which often allows for the establishment of

technological feasibility early in the development cycle. In instances where the documentation of the

design and technology are not in place prior to an executed contract, we monitor the software development

process and require our third party developers to adhere to the same technological feasibility standards

that apply to our internally developed products.

Licenses consist of payments and guarantees made to holders of intellectual property rights for use of their

trademarks, copyrights or other intellectual property rights in the development of our products.

Agreements with license holders generally provide for guaranteed minimum royalty payments for use of

their intellectual property. Guaranteed minimum payments are initially recorded as an asset (licenses) and

as a liability (accrued licenses) upon execution of a licensing agreement, provided that no significant

performance remains to be completed by the licensor. When significant performance remains to be

completed by the licensor, we record payments when actually paid.

Certain licenses, especially those related to our sports products, extend over multi-year periods and

encompass multiple game titles. In addition to guaranteed minimum payments, these licenses frequently

contain provisions that could require us to pay royalties to the license holder based on pre-agreed unit

sales thresholds.

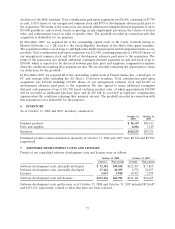

Amortization of capitalized software development costs and licenses commences when a product is

released and is recorded on a title-by-title basis in cost of goods sold. For capitalized software development

costs amortization is calculated using (1) the proportion of current year revenues to the total revenues

expected to be recorded over the life of the title or (2) the straight-line method over the remaining

estimated useful life of the title, whichever is greater. For capitalized licenses, amortization is calculated as

a ratio of (1) current period revenues to the total revenues expected to be recorded over the remaining life

of the title or (2) the contractual royalty rate based on actual net product sales as defined in the licensing

agreement, whichever is greater.

At each balance sheet date, or earlier if an indicator of impairment exists, we evaluate the recoverability of

capitalized software costs, licenses and any other unrecognized minimum commitments that have not been

paid, using an undiscounted future cash flow analysis. We use various measures to evaluate expected

product performance and estimate future revenues for our software titles including historical performance

of comparable titles; orders for titles prior to release; and the estimated performance of a sequel title

based on the performance of the title on which the sequel is based. When management determines that the

value of a title is unlikely to be recovered by product sales, capitalized costs are charged to cost of goods

sold in the period in which such determination is made.

We have established internal royalty programs that allow that certain of our employees participate in the

success of software titles that they assist in developing. Royalties earned by employees under this program

are recorded as cost of goods sold as they are incurred.

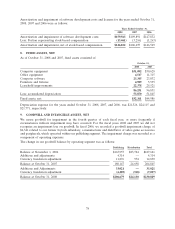

Fixed Assets, net

Office equipment, furniture and fixtures are depreciated using the straight-line method over their

estimated useful life of five years. Computer equipment and software are generally depreciated using the

straight-line method over three years. Leasehold improvements are amortized over the lesser of the term

of the related lease or seven years. The cost of additions and betterments are capitalized, and repairs and

maintenance costs are charged to operations, in the periods incurred. When depreciable assets are retired

or sold, the cost and related allowances for depreciation are removed from the accounts and the gain or

loss is recognized. The carrying amounts of these assets are recorded at historical cost.

69