2K Sports 2008 Annual Report Download - page 62

Download and view the complete annual report

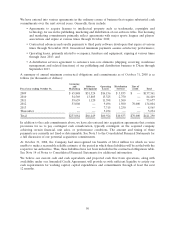

Please find page 62 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.achievement of certain average liquidity levels. Changes in market rates may impact our future interest

expense. For instance, if the LIBOR rate were to increase one percentage point (1.0%), our expected

annual interest expense would change by approximately $0.7 million based on our outstanding loan

balance as of October 31, 2008. A decrease in the LIBOR rate would not have a material impact on

interest expense because of the 4.00% minimum LIBOR rate prescribed under our Amended Credit

Agreement.

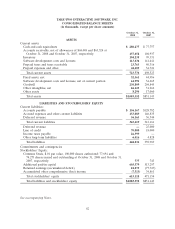

We transact business in foreign currencies and are exposed to risks resulting from fluctuations in foreign

currency exchange rates. Accounts relating to foreign operations are translated into United States dollars

using prevailing exchange rates at the relevant quarter end. Translation adjustments are included as a

separate component of stockholders’ equity. For the year ended October 31, 2008, our foreign currency

translation adjustment loss was approximately $42.4 million.

For the year ended October 31, 2008, 40.7% of the Company’s revenue was generated outside the United

States. Using sensitivity analysis, a hypothetical 10% increase in the value of the U.S. dollar against all

currencies would decrease revenues by 4.1%, while a hypothetical 10% decrease in the value of the U.S.

dollar against all currencies would increase revenues by 4.1%. In the opinion of management, a substantial

portion of this fluctuation would be offset by expenses incurred in local currency.

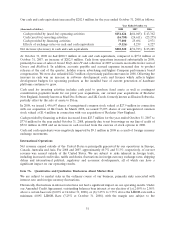

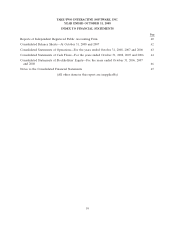

Item 8. Financial Statements and Supplementary Data

The financial statements and supplementary data appear in a separate section of this report following

Part IV. We provide details of our valuation and qualifying accounts in ‘‘Note 18—Supplementary

Financial Information’’ to the consolidated financial statements. All schedules have been omitted since the

information required to be submitted has been included on the consolidated financial statements or notes

thereto or has been omitted as not applicable or not required.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Based on an evaluation under the supervision and with the participation of management, our principal

executive officer and principal financial officer have concluded that our disclosure controls and procedures

as defined in rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended

(‘‘Exchange Act’’) were effective as of the end of the period covered by this report to ensure that

information required to be disclosed by us in reports that we file or submit under the Exchange Act is

(i) recorded, processed, summarized and reported within the time periods specified in the Securities and

Exchange Commission rules and forms and (ii) accumulated and communicated to our management,

including our principal executive officer and principal financial officer, as appropriate to allow timely

decisions regarding required disclosure.

Inherent Limitations Over Internal Controls

Our internal control over financial reporting is designed to provide reasonable assurance regarding the

reliability of financial reporting and the preparation of financial statements for external purposes in

accordance with generally accepted accounting principles. Our internal control over financial reporting

includes those policies and procedures that:

(i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the

transactions and dispositions of our assets;

52