2K Sports 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15. STOCK-BASED COMPENSATION

Our stock-based compensation plans are broad-based, long-term retention programs intended to attract

and retain talented employees and align stockholder and employee interests. For similar reasons, we also

granted non-employee equity awards, which are subject to variable accounting, to ZelnickMedia in

connection with their contract to provide executive management services to us. We began replacing stock

option awards with restricted stock awards in 2007. We issue shares to employees on the date the restricted

stock is granted and therefore shares granted have voting rights and are considered issued and outstanding.

In April 2008, our stockholders approved an increase to the number of shares available for grant under the

Incentive Stock Plan from 4,500,000 to 6,500,000. The Incentive Stock Plan is administered by the

Compensation Committee of the Board of Directors and allows for awards of restricted stock, deferred

stock and other stock-based awards of our common stock to employees and non-employees. As of

October 31, 2008, there were approximately 1,090,000 shares available for issuance under the Incentive

Stock Plan.

In June 2002, our stockholders approved our 2002 Stock Option Plan, as previously adopted by our Board

of Directors (the ‘‘2002 Plan’’), pursuant to which officers, directors, employees and consultants may

receive stock options to purchase shares of our common stock. In June 2005, our stockholders approved an

increase in the aggregate amount of shares issuable under the 2002 Plan from 9,000,000 shares to

11,000,000 shares. As of October 31, 2008, there were approximately 1,150,000 shares available for

issuance under the 2002 Plan.

In January 1997, our stockholders approved our 1997 Stock Option Plan, as amended, as previously

adopted by our Board of Directors (the ‘‘1997 Plan’’), pursuant to which officers, directors, employees and

consultants may receive options to purchase up to an aggregate of 6,500,000 shares (9,750,000 shares after

stock split in April 2005) of our common stock. As of October 31, 2008, there were no shares of common

stock available for issuance under the 1997 Plan.

Subject to the provisions of the plans, the Board of Directors or any Committee appointed by the Board of

Directors, has the authority to determine the individuals to whom the stock options or other awards are to

be granted, the number of shares to be covered by each option or other award, the option price, the type of

option, the option period, restrictions, if any, on the exercise of the option or other award, the terms for

the payment of the option price and other terms and conditions of the option or other award.

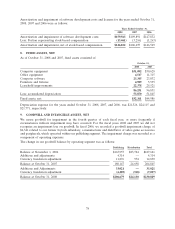

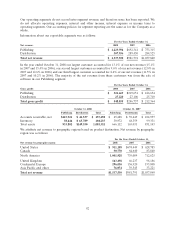

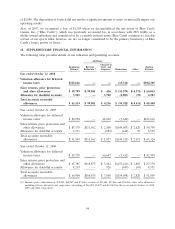

The following table summarizes stock-based compensation expense resulting from stock options and

restricted stock included in our Consolidated Statements of Operations:

Years Ended October 31,

2008 2007 2006

Cost of goods sold $13,461 $ 3,216 $ 1,263

Selling and marketing 2,370 1,232 1,256

General and administrative 19,678 7,080 13,277

Research and development 4,878 3,735 6,135

Business reorganization and related —2,066 —

Stock-based compensation expense 40,387 17,329 21,931

Capitalized stock-based compensation expense 8,215 9,983 8,084

Total stock-based compensation expense, net of income tax benefit $48,602 $27,312 $30,015

During the years ended October 31, 2008 and 2007, we recorded $13,481 and $1,283 of stock-based

compensation expense for non-employee awards, respectively. We did not record any stock-based

compensation expense for non-employee awards for the year ended 2006.

88