2K Sports 2008 Annual Report Download - page 90

Download and view the complete annual report

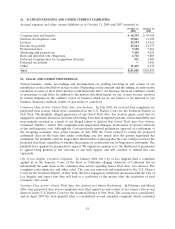

Please find page 90 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10. CREDIT AGREEMENT

In July 2007, we entered into a credit agreement with Wells Fargo which was amended and restated in

November 2007 (the ‘‘Amended Credit Agreement’’). The Amended Credit Agreement provides for

borrowings of up to $140,000 and is secured by substantially all of our assets and the equity of our

subsidiaries. The Amended Credit Agreement expires on July 3, 2012. Revolving loans under the

Amended Credit Agreement bear interest at our election of (a) 2.00% to 2.50% above a certain base rate

(8.00% at October 31, 2008), or (b) 3.25% to 3.75% above the LIBOR Rate with a minimum 4.00%

LIBOR Rate (7.25% at October 31, 2008), with the margin rate subject to the achievement of certain

average liquidity levels. We are also required to pay an annual fee on the unused available balance, ranging

from 0.25% to 0.75% based on amounts borrowed.

As of October 31, 2008 and October 31, 2007, we had borrowings outstanding of $70,000 and $18,000 and

had $28,964 and $72,000 available for borrowings, respectively. We recorded $2,827 and $964 of interest

expense and fees related to the Amended Credit Agreement for the period ended October 31, 2008 and

2007, respectively.

Availability under the Amended Credit Agreement is restricted by our domestic and United Kingdom

based accounts receivable and inventory balance. The Amended Credit Agreement also allows for the

issuance of letters of credit in an aggregate amount of up to $25,000. Outstanding letters of credit reduce

availability under the revolving line of credit. We had $11,560 and $10,000 of letters of credit outstanding

at October 31, 2008 and 2007, respectively.

The Amended Credit Agreement substantially limits us and our subsidiaries’ ability to: create, incur,

assume or be liable for indebtedness; dispose of assets outside the ordinary course; acquire, merge or

consolidate with or into another person or entity; create, incur or allow any lien on any of their respective

properties; make investments; or pay dividends or make distributions (each subject to certain limitations).

In addition, the Amended Credit Agreement provides for certain events of default such as nonpayment of

principal and interest, breaches of representations and warranties, noncompliance with covenants, acts of

insolvency, default on indebtedness held by third parties and default on certain material contracts (subject

to certain limitations and cure periods). The Amended Credit Agreement also contains a requirement that

we maintain an interest coverage ratio of more than one to one for the trailing twelve month period, if the

liquidity of our domestic operations falls below $30,000 (including available borrowings under the credit

facility), based on a 30-day average. As of October 31, 2008, we were in compliance with all covenants and

requirements outlined in the Amended Credit Agreement.

Debt issuance costs capitalized in connection with the Amended Credit Agreement totaled $2,770 and are

being amortized over the five year term of the Credit Facility. Amortization related to these costs is

included in interest expense in the consolidated statements of operations.

80