2K Sports 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.non-refundable advance payments made for research and development activities until the related goods

are delivered or the related services are performed. EITF 07-03 is effective for interim or annual reporting

periods in fiscal years beginning after December 15, 2007 (November 1, 2008 for the Company), and

requires prospective application for new contracts entered into after the effective date. We do not expect

that the adoption of EITF 07-03 will have a material effect on our consolidated financial position, cash

flows or results of operations.

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations (‘‘SFAS 141(R)’’). This

Statement provides greater consistency in the accounting and financial reporting of business combinations.

It requires the acquiring entity in a business combination to recognize all assets acquired and liabilities

assumed in the transaction, establishes the acquisition-date fair value as the measurement objective for all

assets acquired and liabilities assumed, and requires the acquirer to disclose the nature and financial effect

of the business combination. SFAS 141(R) is effective for all fiscal years beginning after December 15,

2008 (November 1, 2009 for the Company) and interim periods within those years, with earlier adoption

prohibited. We are evaluating the impact that the adoption of SFAS 141(R) will have on our consolidated

financial position, cash flows or results of operations.

In April 2008, the FASB issued FSP FAS 142-3, Determination of the Useful Life of Intangible Assets (‘‘FSP

FAS 142-3’’). FSP FAS 142-3 amends the factors an entity should consider in developing renewal or

extension assumptions used in determining the useful life of recognized intangible assets under SFAS

No. 142, Goodwill and Other Intangible Assets. This guidance for determining the useful life of a recognized

intangible asset applies prospectively to intangible assets acquired individually or with a group of other

assets in either an asset acquisition or business combination. FSP FAS 142-3 is effective for fiscal years, and

interim periods within those fiscal years, beginning after December 15, 2008 (November 1, 2009 for the

Company), and early adoption is prohibited. We do not expect that the adoption of FSP FAS 142-3 will

have a material effect on our consolidated financial position, cash flows or results of operations.

In June 2008, the FASB issued Staff Position EITF 03-6-1, Determining Whether Instruments Granted in

Share-Based Payment Transactions Are Participating Securities (‘‘FSP EITF 03-6-1’’), which is effective for

financial statements issued for fiscal years beginning after December 15, 2008. FSP EITF 03-6-1 clarifies

that share-based payment awards that entitle holders to receive nonforfeitable dividends before they vest

will be considered participating securities and included in the basic earnings per share calculation. The

Company is assessing the impact of adoption of FSP EITF 03-6-1 on its results of operations.

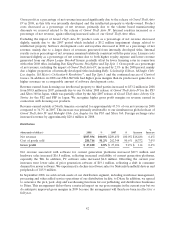

Fluctuations in Operating Results and Seasonality

We have experienced fluctuations in quarterly and annual operating results as a result of: the timing of the

introduction of new titles; variations in sales of titles developed for particular platforms; market

acceptance of our titles; development and promotional expenses relating to the introduction of new titles,

sequels or enhancements of existing titles; projected and actual changes in platforms; the timing and

success of title introductions by our competitors; product returns; changes in pricing policies by us and our

competitors; the size and timing of acquisitions; the timing of orders from major customers; order

cancellations; and delays in product shipment. Sales of our products are also seasonal, with peak shipments

typically occurring in the fourth calendar quarter (our fourth and first fiscal quarters) as a result of

increased demand for titles during the holiday season. Quarterly and annual comparisons of operating

results are not necessarily indicative of future operating results.

39