2K Sports 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

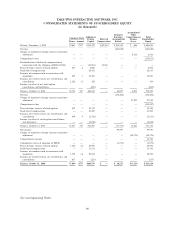

TAKE-TWO INTERACTIVE SOFTWARE, INC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except share and per share amounts)

1. BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

Take-Two Interactive Software, Inc. (the ‘‘Company,’’ ‘‘we,’’ ‘‘us,’’ or similar pronouns) was incorporated in

the state of Delaware in 1993. We are a leading global publisher, developer and distributor of interactive

entertainment software, hardware and accessories. Our publishing segment, which consists of Rockstar

Games, 2K Games, 2K Sports and 2K Play, develops, markets and publishes software titles for the

following leading gaming and entertainment hardware platforms:

Sony Microsoft Nintendo

PLAYSTATION↦ 3 Xbox 360↦WiiTM

PlayStation↦ 2DS↩

PSP↦ (PlayStation↦ Portable)

We also develop and publish software titles for the PC. Our distribution segment, which primarily consists

of our Jack of All Games subsidiary, distributes our products as well as third party software, hardware and

accessories to retail outlets primarily in North America.

The consolidated financial statements include the financial statements of the Company and its wholly-

owned subsidiaries and of entities for which the Company is deemed to be the primary beneficiary as

defined in FASB Interpretation No. 46(R) (‘‘FIN 46’’), ‘‘Consolidation of Variable Interest Entities.’’ All

material inter-company balances and transactions have been eliminated in consolidation.

Reclassifications

Certain amounts in the financial statements of the prior years have been reclassified to conform to the

current year presentation for comparative purposes.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the dates

of the financial statements and the reported amounts of net revenue and expenses during the reporting

periods. The most significant estimates and assumptions relate to the recoverability of software

development costs, licenses and intangibles, valuation of inventories, realization of deferred income taxes,

the adequacy of allowances for sales returns, price concessions and doubtful accounts, accrued liabilities,

the service period for deferred net revenue, the valuation of stock-based transactions and assumptions

used in our goodwill impairment test. These estimates generally involve complex issues and require us to

make judgments, involve analysis of historical and prediction of future trends, and are subject to change

from period to period. Actual amounts could differ significantly from these estimates.

Financial Instruments

The carrying amounts of our financial instruments, including cash and cash equivalents, accounts

receivable, accounts payable and accrued liabilities, approximate fair value because of their short

maturities. We consider all highly liquid instruments purchased with original maturities of three months or

less to be cash equivalents. At October 31, 2008 and 2007 we had $3,199 and $3,538, respectively, of cash

67