2K Sports 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At October 31, 2008, we had a U.S. federal net operating loss carryforward totaling $173,501, which

$79,959 is subject to limitation by the Internal Revenue Service, and that will begin to expire in fiscal 2026

and foreign net operating losses of $17,777 that may be carried forward indefinitely.

The total amount of undistributed earnings of foreign subsidiaries was approximately $229,800 and

$152,000 for the years ended October 31, 2008 and 2007, respectively. It is our intention to reinvest

undistributed earnings of our foreign subsidiaries and thereby indefinitely postpone their remittance.

Accordingly, no provision has been made for foreign withholding taxes or United States income taxes

which may become payable if undistributed earnings of foreign subsidiaries are paid as dividends.

We are regularly audited by domestic and foreign taxing authorities. Audits may result in tax assessments

in excess of amounts claimed and the payment of additional taxes. We believe that our tax return positions

comply with applicable tax law and that we have adequately provided for reasonably foreseeable

assessments of additional taxes. Additionally, we believe that any assessments in excess of the amounts

provided for will not have a material adverse impact on the consolidated financial statements.

On November 1, 2007, we adopted FASB Interpretation No. 48, Accounting for Uncertainty in Income

Taxes, an Interpretation of FASB Statement No. 109 (FIN 48). The cumulative effect of adopting FIN 48 was

$1,075 and was recorded to the opening balance of retained earnings in our consolidated balance sheet.

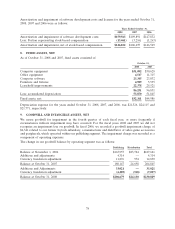

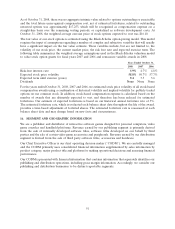

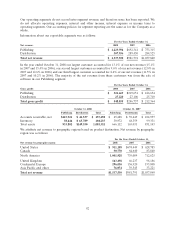

A year-over-year reconciliation of our liability for gross uncertain tax positions is as follows:

2008

Balance November 1, 2007 $18,960

Additions:

Current year tax positions 537

Prior year tax positions 2,256

Reduction of prior year tax positions (2,759)

Settlements (512)

Lapse of statue of limitations (70)

Balance at October 31, 2008 $18,412

We recognize interest and penalties related to uncertain tax positions in the provision for income taxes in

our consolidated statement of operations. The gross amount of interest and penalties accrued as of

October 31, 2008 was approximately $7,987.

Approximately $26,399 of the consolidated worldwide liability for unrecognized tax benefits recorded in

our balance sheet would affect our effective tax rate if recognized.

U.S. federal and state taxing authorities are currently examining our income tax returns for years from

fiscal 2000 through fiscal 2006. In addition, tax authorities in certain non-U.S. jurisdictions are examining

our returns affecting unrecognized tax benefits. It is possible that tax examinations will be settled prior to

October 31, 2009. If any of these tax audit settlements do occur within that period, the company would

make any necessary adjustments to the accrual for unrecognized tax benefits. Until formal resolutions are

reached between the company and the tax authorities, the determination of a possible audit settlement

range with respect to the impact on unrecognized tax benefits is not practicable. We are no longer subject

to audit for U.S. federal and state income tax returns for periods prior to fiscal 2000. With some

exceptions, we are generally no longer subject to tax examinations in non-U.S. jurisdictions for years prior

to fiscal 2001.

We believe that we have provided for any reasonably foreseeable outcomes related to our tax audits and

that any settlement will not have a material adverse effect on our consolidated financial position, cash

flows or results of operations. However, there can be no assurances as to the possible outcomes.

87