2K Sports 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

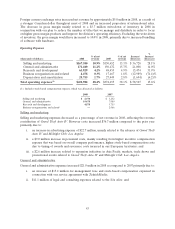

Research and development

Research and development expenses decreased $15.8 million in 2007 compared to 2006 primarily due to:

i. approximately $3.5 million of severance expense recorded in 2006 relating to the termination of

research and development employees resulting from studio closures; and

ii. $12.3 million higher software capitalization costs as a result of increased development work in

progress for technologically feasible current generation platform titles.

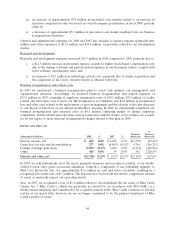

Business reorganization and related costs

Business reorganization and related expenses were $17.5 million in 2007. There were no business

reorganization expenses incurred in 2006. Business reorganization and related expenses in 2007 include

employee termination costs of $10.1 million, primarily as a result of severance for former management and

consolidating our international operations. In 2007 we recorded $2.9 million of facility related and

relocation costs for our 2K headquarters move to California. In total, we spent $4.4 million on professional

fees and other costs related to the replacement of prior management and the election of five new directors

to our Board of Directors at our annual stockholders’ meeting (rather than the six incumbent directors

nominated and recommended by our incumbent Board of Directors), $2.0 million of which was investment

banking fees incurred by prior management to consider the possibility of presenting alternative proposals

to our stockholders, including a potential sale of the Company.

Impairment of long-lived assets

In 2006, we recorded an impairment charge of $8.1 million related to goodwill and fixed assets at our

Joytech subsidiary, a manufacturer and distributor of video game accessories, which operates within our

publishing segment. The impairment charges reflected a decline in the fair value of Joytech’s business

resulting from increased competition and a decline in the price and sales volume of prior generation

accessories due to weaker market conditions and the ongoing transition to current generation platforms.

Additional impairment charges of approximately $7.5 million were related to the write-off of certain

trademarks, acquired intangibles, investments and fixed assets. These write-offs were based on

management’s assessment of the future value of these assets, including future business prospects and

estimated cash flows to be derived from these assets.

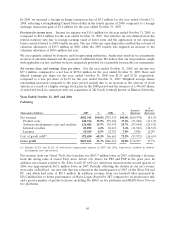

Interest and other, net

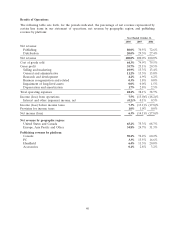

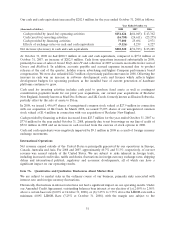

%

Increase/ Increase/

(thousands of dollars) 2007 % 2006 % (decrease) (decrease)

Interest income, net $ 2,274 0.2% $2,664 0.3% $ (390) (14.6)%

Loss on sale and deconsolidation (4,469) (0.5)% — 0.0% (4,469) N/M

Foreign exchange gain (loss) 1,644 0.2% 2,176 0.2% (532) (24.4)%

Other 34 0.0% 20 0.0% 14 70.0%

Interest and other, net $ (517) (0.1)% $4,860 0.5% $(5,377) (110.6)%

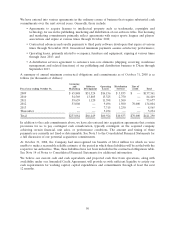

In September 2007, we sold substantially all of the assets, primarily inventory and accounts receivable, of

our wholly-owned Joytech video game accessories subsidiary, formerly a component of our publishing

segment, for approximately $3.6 million in cash. The disposition of Joytech did not involve a significant

amount of assets or materially impact our operating results. We recognized a $3.1 million loss on the sale

of our Joytech business.

In the fourth quarter of 2007, we recognized a loss of $1.4 million when we deconsolidated the net assets of

Blue Castle Games, Inc., which was previously accounted for, in accordance with FIN 46(R), as a wholly-

owned subsidiary and considered to be a variable interest entity. Blue Castle continues to develop certain

of our sports titles; however, we are no longer considered to be the primary beneficiary of Blue Castle’s

future profits or losses.

48