2K Sports 2008 Annual Report Download - page 59

Download and view the complete annual report

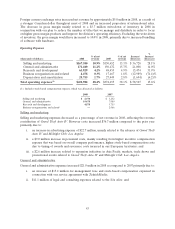

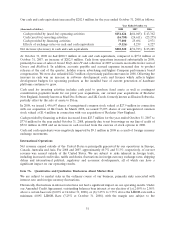

Please find page 59 of the 2008 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Provision for income taxes. Income tax expense of $10.2 million for 2007 was higher than the $0.4 million

expense for 2006 due to our ability in 2006 to carry back losses to prior years, thereby taking a tax benefit

for a portion of the net operating loss generated in 2006. No such carry back is available for our 2007 loss.

We recorded a valuation allowance of approximately $63.5 million in 2006 and increased it by $40.6 million

in 2007 based on the uncertainty of the realization of certain deferred tax assets. Our effective tax rate

differed from the federal, state and foreign statutory rates primarily due to the recording of valuation

allowances.

We are regularly audited by domestic and foreign taxing authorities. Audits may result in tax assessments

in excess of amounts claimed and the payment of additional taxes. We believe that our tax positions comply

with applicable tax law, and that we have adequately provided for reasonably foreseeable tax assessments.

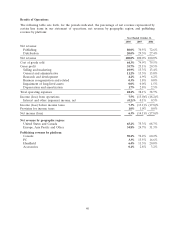

Net loss and loss per share. For the year ended October 31, 2007, net loss was $138.4 million, compared to

$184.9 million in 2006. Net loss per share for the year ended October 31, 2007 was $1.93, compared to

$2.60 in 2006. Weighted average shares outstanding were relatively flat compared to the prior period and

did not have a significant impact on our loss per share.

Liquidity and Capital Resources

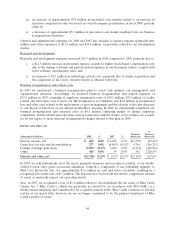

Our primary cash requirements have been to fund (i) the development, manufacturing and marketing of

our published products (ii) working capital (iii) acquisitions and (iv) capital expenditures. Historically, we

have relied on funds provided by operating activities and short and long-term borrowings to satisfy our

working capital needs.

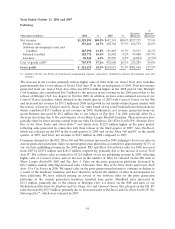

In July 2007, we entered into a credit agreement with Wells Fargo which was amended and restated in

November 2007 (the ‘‘Amended Credit Agreement’’). The Amended Credit Agreement provides for

borrowings of up to $140.0 million and is secured by substantially all of our assets and the equity of our

subsidiaries. The Amended Credit Agreement expires on July 3, 2012. Revolving loans under the

Amended Credit Agreement bear interest at our election of (a) 2.00% to 2.50% above a certain base rate

(8.00% at October 31, 2008), or (b) 3.25% to 3.75% above the LIBOR Rate with a minimum 4.00%

LIBOR Rate (7.25% at October 31, 2008). We are also required to pay an annual fee on the unused

available balance, ranging from 0.25% to 0.75% based on amounts borrowed.

Availability under the Amended Credit Agreement is restricted by our domestic and United Kingdom

based accounts receivable and inventory balance. The Amended Credit Agreement also allows for the

issuance of letters of credit in an aggregate amount of up to $25.0 million.

As of October 31, 2008 there were $70.0 million of borrowings and $29.0 million was available for

additional borrowings. We had $11.6 million of letters of credit outstanding at October 31, 2008 and were

in compliance with all covenants and requirements in the Amended Credit Agreement.

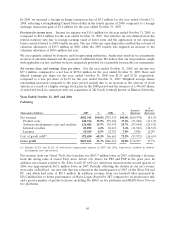

We are subject to credit risks, particularly if any of our receivables represent a limited number of

customers or are concentrated in foreign markets. If we are unable to collect our accounts receivable as

they become due, it could adversely affect our liquidity and working capital position.

Generally, we have been able to collect our accounts receivable in the ordinary course of business. We do

not hold any collateral to secure payment from customers. Effective March 1, 2008, we have purchased

trade credit insurance on the majority of our customers to mitigate accounts receivable risk.

As of October 31, 2008 and 2007, amounts due from our five largest customers comprised approximately

39.0% and 54.4% of our gross accounts receivable balance, respectively, with our significant customers

(those that individually comprised more than 10% of our gross accounts receivable balance) accounting for

11.8% and 41.9% of such balance at October 31, 2008 and 2007, respectively. We believe that the

receivable balances from these largest customers do not represent a significant credit risk based on past

collection experience, although we actively monitor each customer’s credit worthiness and economic

conditions that may impact our customers’ business and access to capital. We are monitoring the current

turmoil in the economy, the global contraction of current credit and other factors as it relates to our

customers in order to manage the risk of uncollectible accounts receivable.

49